24,000!

24,000!

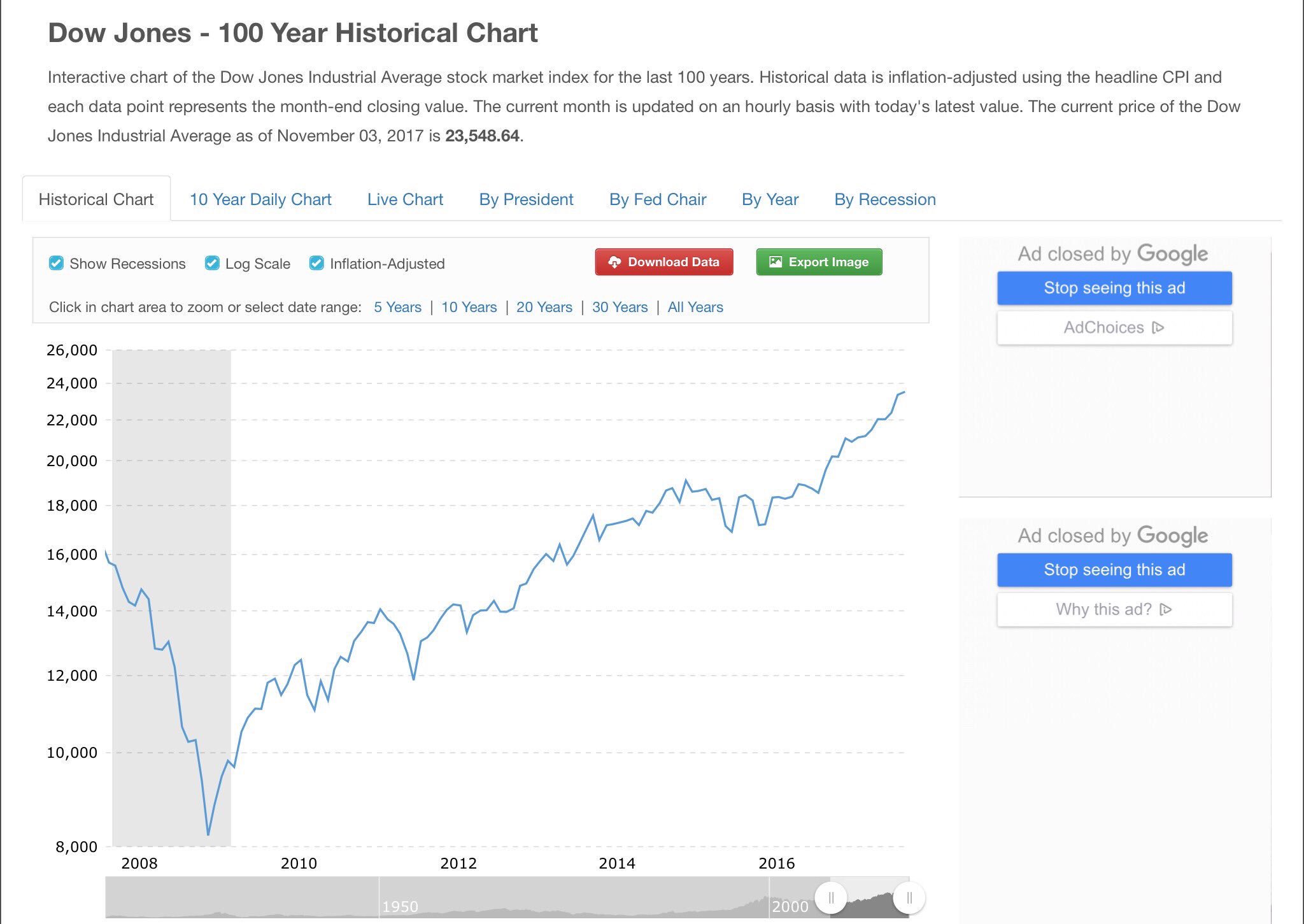

It was only September when we broke back over 22,000 so about 10% gained in 3 months added to the 10% gained the previous 8 months puts us up 20% for the year. On the Dow Jones Industrial Average, that means our 30 Dow stocks have gained $1.2 TRILLION in market cap to what is now just shy of $7.5 TRILLION for just 30 of the S&P 500 companies. Keep in mind that the entire $18.5Tn United States GDP gained just 3.3% last year and that's only $610Bn so, even if the 30 Dow companies had gotten 100% of the entire country's growth – they'd still be shy $600Bn.

But, as I mentioned yesterday, it's not just the Dow 30 that are growing insanely – the entire S&P 500 is up 25% since Trump's election and you can credit the President if you want but, as I said, 3.3% GDP growth is $610Bn and our Top 500 companies (including the Dow 30) are now worth $24 TRILLION – up $5Tn in 12 months so we are, in effect, paying 8 times the actual economic growth for the stocks and that's assuming ALL of the growth goes to those 500 companies (and none for you, your family, local businesses, etc).

You think that can't happen to your equities but they are up for the same no rational reason that BitCoin was and, even worse than BitCoin, the markets are up on very low volumes, which means there is very little support once the selling begins. For example, in the past 5 days, less than 300M shares of the S&P ETF (SPY) were traded while in the down week of Aug 17th to the 23rd, 443M shares were traded and even that is nothing compared to last December 12-16, when 624M shares were traded. What do you think happens when the number of sellers completely overwhelms the number of buyers? Those of you who were around in 2008 don't need to be reminded.

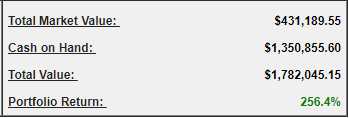

If you remember, in yesterday's PSW Report, we discussed how ridiculous it was that our Long-Term Portfolio had jumped $51,171 in less than two weeks to $1,749,543 – a 3% gain. It's still less than two weeks but just 24 hours later and our bullish Long-Term positions finished the day yesterday at $1,796,342, up a RIDICULOUS $46,799 (2.6%) for the DAY! The title of yesterday's Report was "Record High Wednedsay – We Will All Be Billionaires" – it looks like that may happen a lot soone than we thought at this rate!

If you remember, in yesterday's PSW Report, we discussed how ridiculous it was that our Long-Term Portfolio had jumped $51,171 in less than two weeks to $1,749,543 – a 3% gain. It's still less than two weeks but just 24 hours later and our bullish Long-Term positions finished the day yesterday at $1,796,342, up a RIDICULOUS $46,799 (2.6%) for the DAY! The title of yesterday's Report was "Record High Wednedsay – We Will All Be Billionaires" – it looks like that may happen a lot soone than we thought at this rate!

Keep in mind that we did not touch the positions – that's just how much they gained for the day. When we reviewed them in our Live Trading Webinar in the afternoon, they were "only" up about $30,000 – the late-day push put the cherry on top of the gains while we watched. This is WRONG people – you are not supposed to make money this easily because, when you do – money loses it's meaning (and value). I know it seems odd to complain about making great profits but I'm essentially a Socialist (yes, Socialists are allowed to make money trading stocks!) and I'm VERY WORRIED about the damage this is doing to our long-term economy.

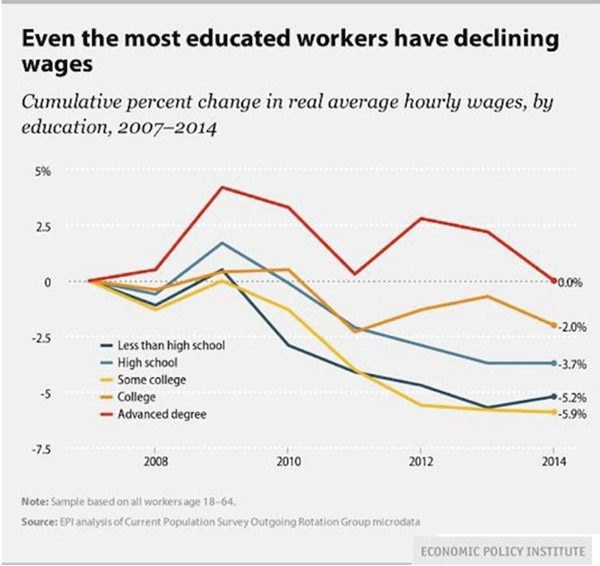

When people pay 8 times the actual economic growth for stocks (and it's more like 20x if you spread the growth out evenly) and putting a notional $5Tn into just the S&P 500 – it's not coming from the $600Bn in growth, is it? It means other things are being valued less while the market is being valued more and that is NOT good for the actual economy or the humans that work in it. Labor is one of those things that is poorly valued, with wages on a huge downswing over the past decade.

When people pay 8 times the actual economic growth for stocks (and it's more like 20x if you spread the growth out evenly) and putting a notional $5Tn into just the S&P 500 – it's not coming from the $600Bn in growth, is it? It means other things are being valued less while the market is being valued more and that is NOT good for the actual economy or the humans that work in it. Labor is one of those things that is poorly valued, with wages on a huge downswing over the past decade.

Fortunately for those of us in the Top 1%, wages make up little or none of our incomes. We make money by investing in the market and that is essentially a license to print money – the money we're NOT paying to the bottom 99% in wages.

Well, to say we're NOT paying the bottom 99% is sugar-coating things – we are in fact TAKING the money from the bottom 99%, who have lost an average of 3% of their incomes in the past decade as well as their benefits, government supports, retirement programs, health care assistance, etc. In other words, whatever we can do to claw back the money we were forced to give you by bleeding-heart liberals and labor negotiaters (ie communists and mobsters), we are now taking back and shifting the wealth back to where we like it to be.

We're even going to take away your free Internet access, raise your healthcare expenses, cut your Social Security and Medicare Benefits as well as dozens of other Government programes in order to give ourselves a big, fat tax cut next year. Oh, and by the way, you're going to borrow $1.5 TRILLION to pay for it – thanks! We deserve it, of course. After all, I did sit here and talk about what stocks looked good and you had to go to your computer and move some of your money around to buy the stock and then we made $46,799 in a day. I know I'm exhaused – how about you?

Society cannot function like this – you know that it can't. This is a path that will lead to disaster yet why should we change it when it's making us so rich? We should change it because we are building these gains on a house of cards that, like the TV show "House of Cards", can suddenly end if just one thing goes wrong. Or like BitCoin, which is down another $200 (2%) while I write this. It's dragging our GreenCoins down with it (see yesterday's notes), now 0.000182 (-16%) and that makes it an even better bargain if you use them at our guaranteed 0.00044 exchange rate for Annual PSW Memberships (no other discounts apply!) in December – which is TOMORROW! The future is now…

Society cannot function like this – you know that it can't. This is a path that will lead to disaster yet why should we change it when it's making us so rich? We should change it because we are building these gains on a house of cards that, like the TV show "House of Cards", can suddenly end if just one thing goes wrong. Or like BitCoin, which is down another $200 (2%) while I write this. It's dragging our GreenCoins down with it (see yesterday's notes), now 0.000182 (-16%) and that makes it an even better bargain if you use them at our guaranteed 0.00044 exchange rate for Annual PSW Memberships (no other discounts apply!) in December – which is TOMORROW! The future is now…

We will be concentrating this morning on improving our hedges. A good rule of thumb is to put 25-33% of your gains into hedges (that pays 3:1) to lock in the gains we make on the way up. Sometimes we get lucky and get paid on the dip and then the market recovers and we don't need the cash from the hedges to fix our longs. That's actually what's been happening for years, which is why our Short-Term Portfolio, which is used to protect our Long-Term Portfolio, has actually outgained it over the past 4 years. Yes, we've made money on the dips – but we've never needed the money as the market always recovers. So far.

The record-high Dow has pushed the Dow's Ultra-Short ETF (DXD) down to $9.31 and it should open even lower this morning as the Dow has a 125-point pre-market gain. Why? Why not? In any case, if we want to lock in this month's $100,000 gain through the holidays, we can buy the following spread:

- Buy 200 DXD April $8 calls for $1.30 ($26,000)

- Sell 200 DXD April $11 calls for 0.30 ($6,000)

- Sell 10 AAPL 2020 $140 puts for $10 ($10,000)

That's a net of $10,000 on the $60,000 spread so there's $50,000 upside potential (500% on cash) if DXD hits $11, which would take about a 10% drop in the Dow since it's a 2x short ETF. Since DXD is currently at $9.30, the trade is $26,000 in the money to start so, even if the Dow simply doesn't go lower – it's a great profit. You can use any stock you REALLY want to own for the bullish offset – we certainly don't mind buying 1,000 shares of AAPL at a 20% discount but any stock you'd like to own cheaply can be used – including our Trade of the Year Ideas (see Tuesday's Report).

Hedging can help you sleep a lot better at night and we're risking very little cash for a lot of protection.

Please, be careful out there.