One Final Puff

Courtesy of Michael Batnick

There are half as many listed U.S. companies as there were twenty years ago, which is a topic that’s been widely covered this year. (Barron’s, Wall Street Journal, Bloomberg, MarketWatch). I thought this topic was pretty much beaten into the ground until came across an excellent piece from Vanguard.

There are half as many listed U.S. companies as there were twenty years ago, which is a topic that’s been widely covered this year. (Barron’s, Wall Street Journal, Bloomberg, MarketWatch). I thought this topic was pretty much beaten into the ground until came across an excellent piece from Vanguard.

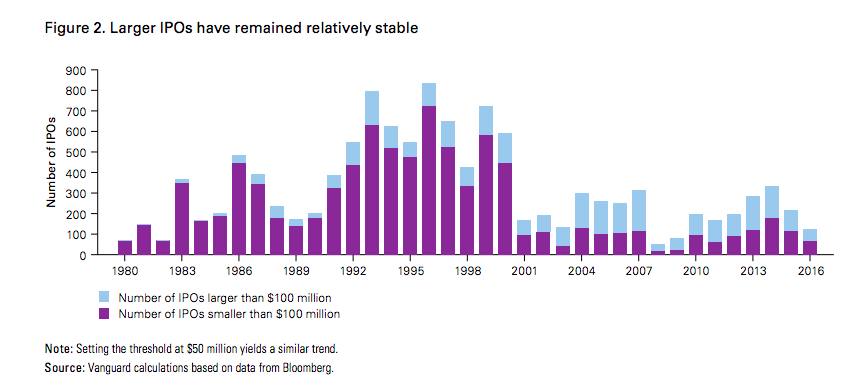

Small IPOs have crashed thanks to tighter regulations, the scrutiny young public companies face, and most importantly, a burgeoning private market. Here’s Vanguard on IPOs over the last four decades (emphasis mine):

Figure 2 shows the number of IPOs according to company size. Smaller firms, defined as those with gross IPO proceeds under $100 million—which essentially makes them micro-cap companies—fell precipitously following the tech bubble. The disappearance of small- and micro-firm IPOs was the main reason the total number of stocks declined between 1996 and 2016

The chart below shows what happens to stocks three years following their IPO. Here’s Vanguard, again, emphasis mine.

Even after going public via an IPO, most companies remain small relative to other publicly listed companies. Figure 4a shows that only a very small percentage of companies grow to become small-, mid-, or large-cap. The overwhelming majority of companies either remain micro-cap or delist.

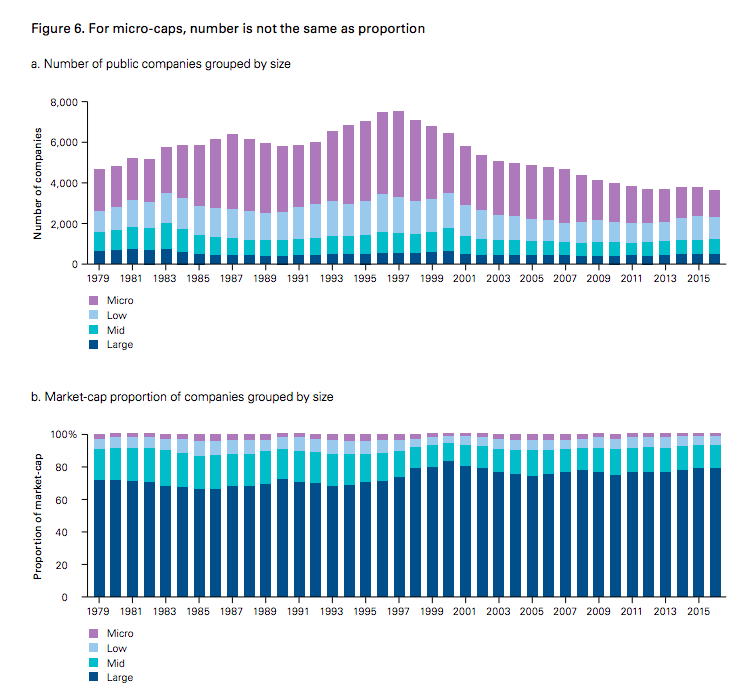

The total number of micro-caps has been in decline since the end of the dot com bubble, however, figure 6b shows that micro-caps’ proportion of the overall market has been quite stable, at around 1.5% of total U.S. market capitalization.

There are less tiny companies going public than there used to, and that’s really all there is to it. I don’t see this as a positive or negative story, just an interesting set of data that can now, thanks to Vanguard, be put to rest.

Source: