What a wild ride the Dollar is having!

Technically, so far, it's just a weak bounce off the (hopefully) floor at 88 but it's been a week of wild trading in US Dollars as first Treasury Secretary Steve Mnuchin talks the Dollar down (see "Record High Wednesday – Diving Dollar Boosts Equity Markets") and then his boss, Trump, completely negates what he says and promises a stronger Dollar.

You can see the very quick reaction we got yesterday but then traders remembered it was Donald Trump who promised a stronger Dollar – and it began to sell off again. Meanwhile, we're long on the Dollar (/DX) here as we think the Fed will indicate they are on a path to tighten further while Draghi and Abe continue to prevaricate. That's what currency values are all about – your currency relative to someone elses. The Dollar index itself is measured against a basket of other major currencies – there's no absolute value to the Dollar at all (kind of like BitCoin!).

We'll see what happens this morning as Trump is giving his Davos speech (8am, EST) and the theme is "America is Open For Business" touting our resurgent economy and, of course, low taxes and lack of regulations. In fact, just this morning, Trump named BPs lawyer and noted climate foe, Jeffery Clark to head up the DOJ's Environmental Unit and, as the linked article has to note – "No, this is not a headline from The Onion"). At least Clark has experience (though it's in destroying the environment, not protecting it).

To show how serious he is about trade, Trump's appointment for Deputy Chief of US Trade, G. Payne Griffin, just graduated American University in 2014 with a Bachelors Degree in Economics but, don't worry folks – he was an Eagle Scout, so things should be great. Hopefully he'll work out better than 24 year-old Drug Czar, Taylor Weyeneth, who just had to resign because he lied on his resume.

Speaking of the envrionment (enjoy it while it lasts!), Weather.com put together a fantastic article on climate change called "50 States, 50 Stories" which should be read by everyone in America (don't worry, it's has lots of pictures). It's not all depressing – some of the stories are about what people are doing to fix the environment but it's a nice, deep dive into the issue around the country.

Meanwhile, the President can talk up our economy all he wants to but those pesky facts are still out there. This morning we just got the Q4 GDP report and it missed by 13% at 2.6% vs 3% expected and that means Trump is certainly missing his 3% GDP claim for the year. In fact, the average for Trump's first year in office is now 2.52%, so I guess he can still round it up to 3%. It's certainly not good that GDP has fallen off almost 20% from Q3's high of 3.2% – that's contrary to the economic narrative for sure and really not too supportive of record high markets.

That means our index shorts (see yesterday's Morning Report) are back on in the Futures and we do have S&P (/ES) 2,850 this morning and Nasdaq (/NQ) 7,000 along with Dow (26,425) and Russell (/TF) 1,610 but, as with yesterday, we favor shorting the S&P and the Nasdaq as they cross below with very tight stops over the lines. The once-again weak Dollar is supporting the indexes for now but it's not likely to last (China and Japan won't put up with it past this level).

That means our index shorts (see yesterday's Morning Report) are back on in the Futures and we do have S&P (/ES) 2,850 this morning and Nasdaq (/NQ) 7,000 along with Dow (26,425) and Russell (/TF) 1,610 but, as with yesterday, we favor shorting the S&P and the Nasdaq as they cross below with very tight stops over the lines. The once-again weak Dollar is supporting the indexes for now but it's not likely to last (China and Japan won't put up with it past this level).

We're not shy about going back to the well and this is just another one of those ways the rich get richer in ways the poor don't even have access to (Futures accounts). We discussed our hedges earlier in the week and I would strongly suggest not going into the weekend without any as it may occur to some people that a declining GDP might not support a 12.5% rise in the S&P since the beginning of Q4.

Keep in mind that Q4's GDP was actually BOOSTED by the euphoria over the tax cuts and consumers went out and borrowed their asses off in Q4, raising debt levels to record highs. Now they are sitting down with their accountants and finding out just how little they are saving in taxes (unless they are in the Top 1%, in which case things are fantastic). Q4 spending was also boosted by $500Bn worth of huricane repairs and Trump can't warm the Earth fast enough to repeat that stimulus in Q1.

Consumer spending jumped 3.8% in Q4, the most in 4 years but again, a lot of it was durable goods – replacing storm-damaged items and the consumers did that on credit-cards, which means they'll have less money to spend in 2018. PCE Inflation hit 2.8%, and the Core Inflation is at the Fed's 2% target with record low unemployment so, despite the disappointing performance – the Fed has no reason not to go ahead and tighten as planned.

Consumer spending jumped 3.8% in Q4, the most in 4 years but again, a lot of it was durable goods – replacing storm-damaged items and the consumers did that on credit-cards, which means they'll have less money to spend in 2018. PCE Inflation hit 2.8%, and the Core Inflation is at the Fed's 2% target with record low unemployment so, despite the disappointing performance – the Fed has no reason not to go ahead and tighten as planned.

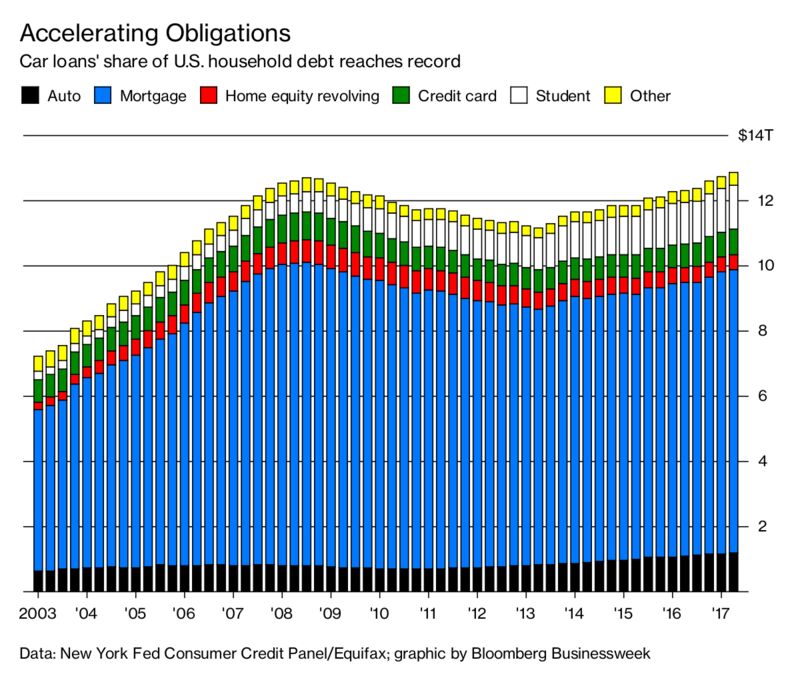

With household debt topping $13Tn (65% of our GDP), we're past the point that collapsed the economy in 2008 with roughly the same Mortgage Debt ($10Tn) and most notably a massive $1Tn increase in Student Loan Debt as college costs have spiraled completely out of control. Bernie was going to make it free but Trump has let it ride with the average cost of a 4-year college in the US now over $25,000 per year – just the tuition!

Consumers with a lot of debt and rising interest tend to cut back on spending at some point, so we'll have to take some of these Q4 earnings reports with a grain of salt as far as extrapolating too far into the future that this stimulated spending will continue.

Have a great weekend,

– Phil