Is overbought the right price now?

Is overbought the right price now?

Just a week ago, there were literally thousands of articles saying: "Well, of course we had a sell-off, the markets were so overbought it was bound to happen." Yet here we are, a week later and now they are saying what a great buying opportunity this is. Seriously? We're now only 5% below the "obviously overbought" market top. What changed in the past 7 days?

The market has gone nuts since August, rising from S&P 2,400 to 2,872, which is a 20% run in 5 months. Markets don't go up 20% a year, let alone in 5 months. Hell, they hardly even go up 20% in two years and, of course, the logic is TAX CUTS – which seems to justify everything but let's consider that very few companies drop more than 20% to the bottom line (14.6% is the average) and that they are taxed on their profits, not their income so, even if the taxes were as much as the profits (they are about 20% of profits on average) and the taxes were eliminated ENTIRELY, then the companies would only make 14.6% more money.

That is, of course, not the case and there is nothing in Q1's earnings or guidance to give any indication that the new tax law will have a serious effect on forward earnings – mainly because US Corporations never paid 20% taxes in the first place (about 13.5% on average). So, if they actually paid the new 20% rate, it would be a tax INCREASE for those companies who routinely park their cash overseas or pay tens of millions of Dollars to accounting firms and Investment Banks to avoid paying Billions in taxes (Apple alone is bringing back over $200Bn they had stashed overseas).

Trump is taking credit for repatriating funds from overseas but what he's really doing is giving companies a tax incentive (15%) for bringing back money they earned under the Obama Administration (because he was mean and would have taxed them) and for not paying their taxes under Obama's budgets. In fact, Trump is REWARDING the corporations for hiding money from Democrats and letting future CEOs know that any time a Democrat tries to tax them – they are free to flaunt the law until a Republican is back in power to forgive them.

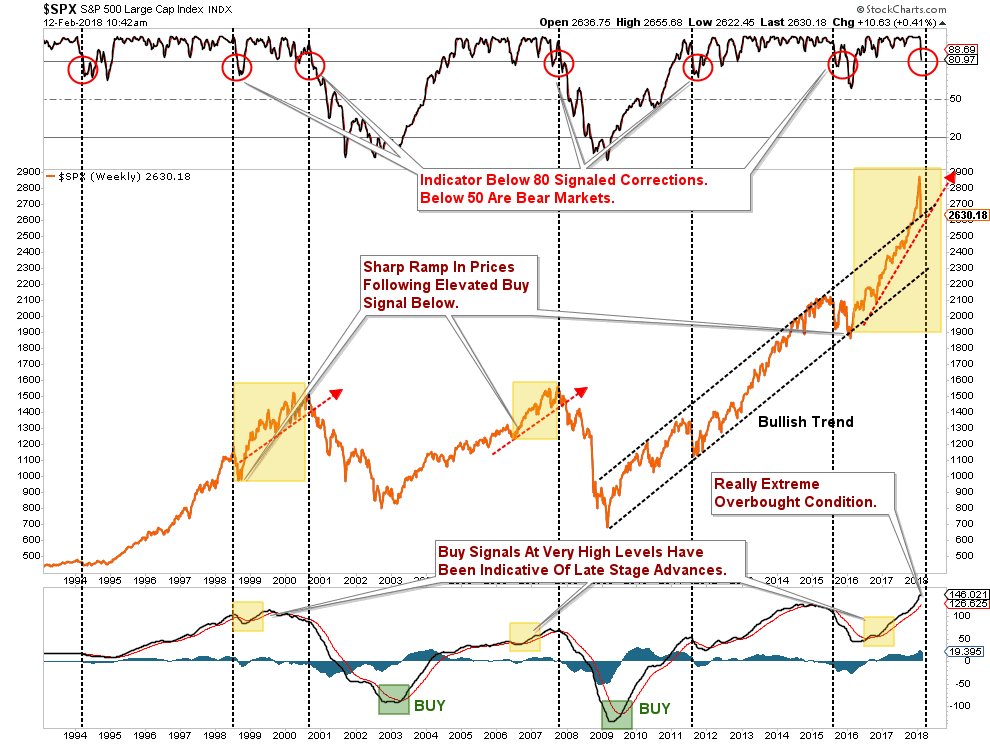

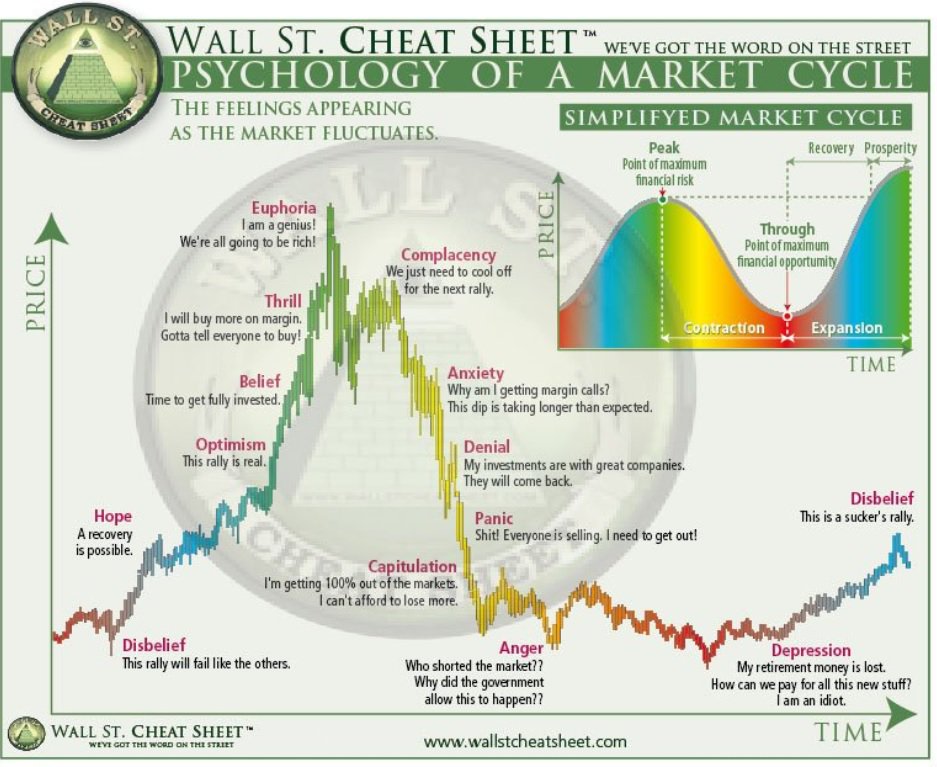

Trump is also taking credit for the market rally, though the last couple of weeks finally got him to shut up about it. As you can see from the chart on the left, which has been around for 100 years, there's nothing going on here that hasn't happened before and we had a late-stage parobilic move up, people got really excited and thought it would go on forever and now we had a sharp pullback and people are piling back in and here we are – at the spot labeled "Complacency" – making all the same mistakes we made just two weeks ago!

Trump is also taking credit for the market rally, though the last couple of weeks finally got him to shut up about it. As you can see from the chart on the left, which has been around for 100 years, there's nothing going on here that hasn't happened before and we had a late-stage parobilic move up, people got really excited and thought it would go on forever and now we had a sharp pullback and people are piling back in and here we are – at the spot labeled "Complacency" – making all the same mistakes we made just two weeks ago!

As I noted in yesterday's Report, we amped up our hedges into the weekend and, this morning, I put out a note to our Members saying:

/YM is 25,300, that's my favorite short and we have /ES 2,740, /NQ 6,845 and /TF1,545 and my stop-outs are if we get over 2,750, 6,850 or 1,550 but, otherwise, I want to accumulate /YM shorts.

The reason I'm skeptical of the rally is that we've bounced back on 1/3 the volume at which we sold off and forming a weak base is why we were shorting the market in the first place a few weaks ago. Apparently, traders have learned nothing at all this month and we're right back to the madness of the Dow moving up 1,500 points on ridiculously low volume. This is simply a lack of sellers at the moment and God help us all if they come back! Here's the recent S&P ETF (SPY) volume:

Date Open High Low Close* Adj Close** Volume Feb 15, 2018 271.57 273.04 268.77 273.03 273.03 103,991,400 Feb 14, 2018 264.31 270.00 264.30 269.59 269.59 120,735,700 Feb 13, 2018 263.97 266.62 263.31 266.00 266.00 81,223,600 Feb 12, 2018 263.83 267.01 261.66 265.34 265.34 143,736,000 Feb 09, 2018 260.80 263.61 252.92 261.50 261.50 283,565,300 Feb 08, 2018 268.01 268.17 257.59 257.63 257.63 246,449,500 Feb 07, 2018 268.50 272.36 267.58 267.67 267.67 167,376,100 Feb 06, 2018 259.94 269.70 258.70 269.13 269.13 355,026,800 Feb 05, 2018 273.45 275.85 263.31 263.93 263.93 294,681,800 Feb 02, 2018 280.08 280.23 275.41 275.45 275.45 173,174,800 Feb 01, 2018 281.07 283.06 280.68 281.58 281.58 90,102,500 Jan 31, 2018 282.73 283.30 280.68 281.90 281.90 108,364,800

That's 1.5Bn shares on the way down from 275 (the low was put in on the 9th) and 480M on the way up – that's simply not at all good! If you build a building with 1.5Bn bricks and someone knocks it down and then you rebuild the building with 480M bricks – is the build more or less sturdy now? Like bricks, inflows form the foundation for price supports and, without them – you are looking at a house of cards.

That's 1.5Bn shares on the way down from 275 (the low was put in on the 9th) and 480M on the way up – that's simply not at all good! If you build a building with 1.5Bn bricks and someone knocks it down and then you rebuild the building with 480M bricks – is the build more or less sturdy now? Like bricks, inflows form the foundation for price supports and, without them – you are looking at a house of cards.

Don't get me wrong, we were buying stocks right along with you as they went on sale because who knows if we'll see these prices again BUT we also put more money into our hedges so we're now better protected for the next drop and, if we don't get one, then we will do very well in our long positions (see yesterday's review of our Money Talk Portfolio).

For example, I was reviewing our Options Opportunity Portfolio (OOP) yesterday and, as of 1pm, it was at $97,587 but, thanks to the ridiculous afternoon rally, the same exact positions popped to $103,550 into the close. That's simply ridiculous, gaining $5,963 (6%) in 3 hours and, as I made many great speeches about earlier this year (and last) – it's logically unsustainable or everyone will be a Billionaire making those kinds of gains – and where would all this money be coming from?

Perhaps we will all be Billionaires if inflation keeps moving up. Most people in Zimbabwe were Trillionaires when their currency collapsed, as were Germans after World War I and we have just the kind of burgeoning Fascist Regime to pull it off in the US as well! Import prices were up 0.4% in January, setting a 5% annual pace and, ex-Agriculture, which has been weak, it was 0.9% – very Weimar indeed! The Germans were brought down by war debts which caused huge deficits and rising interest was the nail in their coffins as the cost of servicing the debt became unbearable – pretty much what I was saying is happening to the US in Tuesday's Report…

Also inflationary, Housing starts popped higher to 1.33M and that's good for the broad economy but very inflationary and still nowehere near our normal level of about 1.6M per year (think about how long it takes to replace 110M homes, not to mention population growth). Overall, it would be a plus but now when you are running up $7Tn in debt to stimulate the economy. At 3% interest, that's $210Bn a year in interest alone – enough give each home-buyer $150,000.

Also inflationary, Housing starts popped higher to 1.33M and that's good for the broad economy but very inflationary and still nowehere near our normal level of about 1.6M per year (think about how long it takes to replace 110M homes, not to mention population growth). Overall, it would be a plus but now when you are running up $7Tn in debt to stimulate the economy. At 3% interest, that's $210Bn a year in interest alone – enough give each home-buyer $150,000.

So think about that, what would be a smarter stimulus, spending $7Tn to give tax cuts to people who don't need it and stomp all over the World with our armies or tell anyone who wants to buy a new home they can have $150,000 in cash? You don't even have to give them the cash, just give them low-interest loans that make the mortages more affordable and you'll fuel housing growth. Perhaps, since we're saving $6.8Tn AND $210Bn per year in interest expenses, we could also mandate that new homes come with solar panels, which will take pressure off the electric grid that needs $2Tn worth of repairs and that too would save the new homeowners money and would lower the demand for energy and reduce the cost for all of us.

Yes, there are sensible ways to govern but you wouldn't know it from the pack of bozos we have in office now. Do you want to stop Russia from interfering in the election? Give all registered voters "VoteCoins™", blockchain tokens that they can then send to the candidates of their choice, fully traceable and verifiable and you'd have the added benefit of instant election results with no messy ballot and recount issues. Give us just $1Bn and my team and I can have the system running in time for the November elections.

Yes, there are sensible ways to govern but you wouldn't know it from the pack of bozos we have in office now. Do you want to stop Russia from interfering in the election? Give all registered voters "VoteCoins™", blockchain tokens that they can then send to the candidates of their choice, fully traceable and verifiable and you'd have the added benefit of instant election results with no messy ballot and recount issues. Give us just $1Bn and my team and I can have the system running in time for the November elections.

There, what else needs fixing?

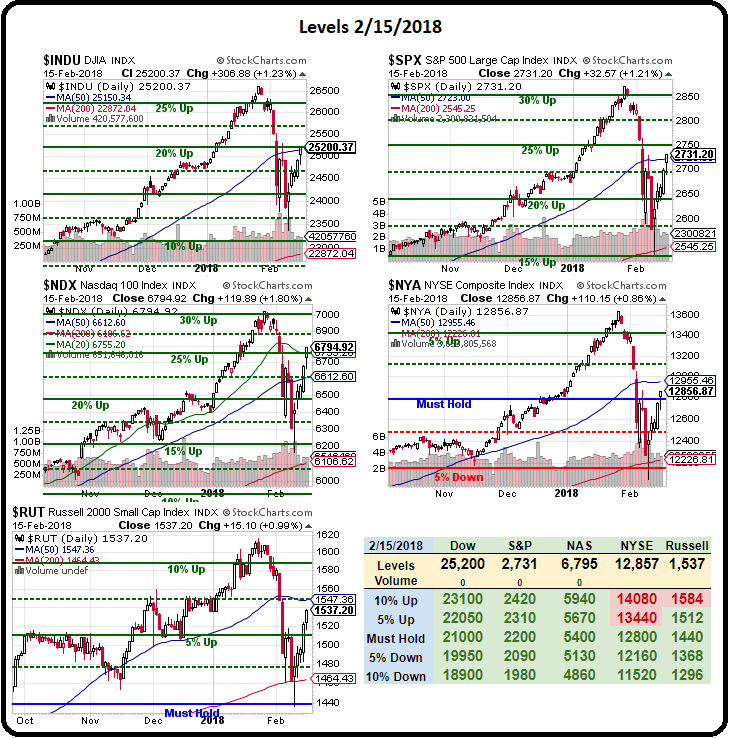

We'll see if the indexes are going to be "fixed" today. As I'm writing this (9am), we're up about $500 per contract on our /YM shorts already as we cross below the 25,200 line and now that's our stop to lock in $500 and make sure we can afford our Egg McMuffins. Now we're playing for a sushi lunch! The critical lines to watch are those 50-day moving averages which, as you can see on our Big Chart, are Dow 25,150, S&P 2,723, Nasdaq 6,612, NYSE 12,955 and Russell 1,547:

As of this morning, the NYSE and Russell (our broadest indexes) are below the lines, Dow and S&P are on the lines and the Nasdaq is off in LaLa Land – as it often is – especially after Apple (AAPL) has a good day. Now that we're a bit lower in the Futures, we can cash in our gains on the Dow (/YM) at 25,150 (up $750 per contract) and /TF at 1,535 (up $500 per contract) and swtich to the Nasdaq shorts (/NQ) at 6,798.50 with a tight stop over 6,800. Since they remain the highest over the line, they have the farthers to fall if everyone is giving up their 50 dmas today.

Meanwhile, nothing beats a good hedge but the time to add those was yesterday, when the market was going up – we got great prices yesterday because we took sensible precautions while others were throwing caution to the wind.

That's why we're going to have a great, non-stressful Holiday Weekend – no mattter how far we fall today.

Have a great weekend,

– Phil

I will be giving a 4-hour "Master Class" on Hedging, Options Trading Strategies, Portfolio Management and Fundamental Analysis at the opening of the New York Traders Expo on Sunday, Feb 25th at 9am at the Marriott Marquis – so register now if you'd like to hear a lot more about these strategies and get our latest trade ideas.