So far, so predictable.

And that's the way we like our markets, right? It was two weeks ago (2/6) that we prediced the market would bounce back from 2,550 to at least 2,650 (strong bounce) for the week and then, on 2/9, we broadened our lines and came up with the following predicted range for the S&P (/ES) Futures using our fabulous 5% Rule™:

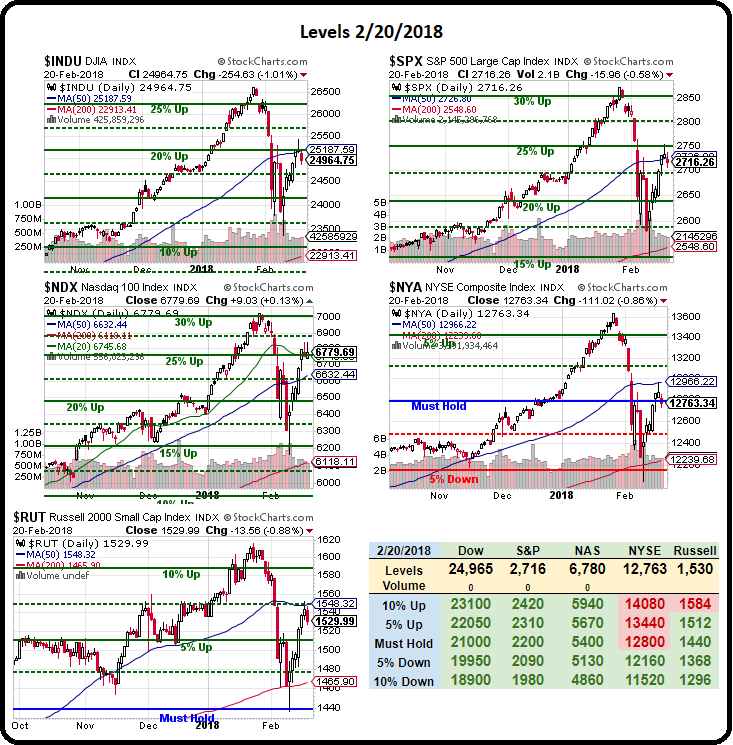

Here's how those lines are holding up two weeks later:

We're testing the top of the bounce range but remember that range tops out still only 40% back to the 30% line, which doesn't even register on the chart anymore as the trading range has narrowed – as we predicted – at the lower levels. As I said in yesterday's Morning Report, evidence suggests that 20% line may be the top of the range for rest of the year, not the bottom or even the middle and we will need to look down to the 10% line, at 2,420, for proper support after the next correction. Hopefully, we'll consolidate around there for a proper move up later in the year (assuming things hold up in the economy).

This isn't about TA (I HATE TA), the 5% Rule is just a mathemetical representation of the Fundamental Value of the S&P 500 and we simply use the chart to illustrate it. Stocks can go a very long time 10% overvalued and even grow into that valuation without a correction but 20% over-valued is strething it and, as we're seeing this earnings season, we set the high-flyers up for big punishments when they miss. Here's the Big Picture on our other indexes from our Big Chart:

Those 50 and 200 dmas are the only TA I do pay attention to because those represent the average that a large sampling of investors have been willing to pay for a stock (or index) and, as you can see, we're still miles over the 200-day moving averages for our indexes so, the question is, what changed in the last 50 days to justify a 10% bump in the indexes? I guess you can kind of say the taxes but, as we noted in yesterday's Report – those are only going to add 5% to earnings at best and, if that's it – then we're still a good 5% too high and we should be looking down, not up, to see where the market is heading next.

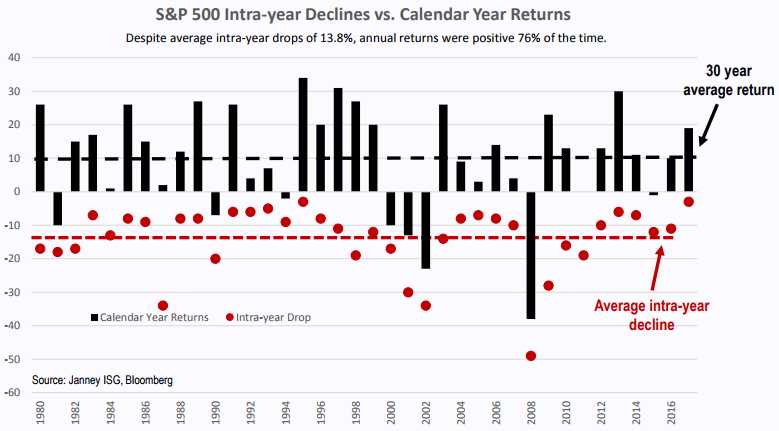

There's nothing bad about a correction, corrections let you buy stocks for reasonable prices. It's like never buying jeans again because they went on sale – that makes no sense. Corrections are as natural as sales are in stores and this one in the stock market is long overdue. A correction is only a problem when you don't plan for one: When you overplay a bullish hand, when you fail to hedge, when you fail to keep cash on the sidelines – that's when you fear a correction. Otherwise – it's simply an opportunity!

We finished last year at 2,675 so, in the bigger picture, the drop to 2,550 was only down 125 points (5%) for the year, not even touching the average 13.8% decline. It only seemed like a big drop as the S&P had moved 200 points higher BEFORE falling 125 points below the baseline. Now, at 2,706, we're still net postive for the year – so we haven't even had our real correction yet and why should this year be so exceptional that is has no correction? If you can't easily answer that – you should probably consider a good hedge!

Meanwhile, we'll see if we can take out those strong bounce lines and, just as importantly, those 50 dmas at 25,188 on the Dow, 2,727 on the S&P (also the strong bounce line), 6,632 on the Nasdaq, 12,966 on the NYSE and 1,548 on the Russell. Until 3 of those 5 are over the line – there's nothing to be bullish about anymore so than you would be bullish about a ball you dropped that has bounce back to your knee making the next bounce back to your hands – that's not the way physics works and, without the application of additional force (money flows) – that's not the way the markets work either!

The Fed releases minutes at 2pm and that might boost the markets as they've generally been operating in fear of more hikes recently and I very much doubt there will be indications of more than 4 hikes in the minutes.

We'll be doing a Live Trading Webinar at 1pm, EST so we'll be able to react live to the Fed – come join us this afternoon.

Also, I will be giving a 4-hour "Master Class" on Hedging, Options Trading Strategies, Portfolio Management and Fundamental Analysis at the opening of the New York Traders Expo this Sunday, Feb 25th at 9am at the Marriott Marquis – so register now if you'd like to hear a lot more about our strategies as well as get a look at our Top Trade Ideas for 2018.