I'm participating in the Live Trading Challenge this morning.

After giving a 4-hour seminar yesterday morning, today I'm going head to head with other speakers to see who can make the most money in one hour of trading. If you lose $10,000 you're out but, other than that, there aren't too many rules. I know I can lose $10,000 (that's easy!), it's the random hour thing that bothers me.

As you know, though we do like to have fun playing the Futures, I'm a long-term Fundamental Investor at heart and the most important thing I teach people about day-trading, especially the Futures – is knowing when not to play. We like to see a good set-up and have news AND strong resistance lines to back up our play and, when we have them, I call them out – but certainly not on demand on 9:30 on a Monday morning – so we'll see how it goes.

As I will be the sole Fundamentalist, I'm intending to grab stocks that are likely to move in the morning so, looking at the morning's news, we have:

- No medals for NBC's Olympic ratings (CMCSA)

- Record weekend for 'Black Panther' (DIS, IMAX)

- Morgan Stanley gets bullish on bonds (Idiots)

- GE to restate two years of earnings (Yikes!)

Overriding all that is the Fed's Bullard speaking at 8:30 and he has been reliably doveish recently, boosting the markets but the Futures are already up 166 points on the Dow 25,500 with the S&P (/ES) testing 2,760 and Russell (/TF) is back at our shorting line at 1,555 so I'll be a lot happier shorting than going long – but who knows where we'll be at 9:30 (3 hours from now)?

On the earnings, none of those companies really interest me but we'll still see if there's some kind of overreaction we can play against. I heard a good rumor that Liquid Metal (LQMT) is going to be working with Apple (AAPL) on an IWatch, which would be and incredible boost for a penny stock we already love (my kids own 10,000 shares each at 0.13), so I might add some of those if they aren't too high at the bell.

To hammer home the point of how these trades work, we reviewed the trade ideas we had for people who attended our seminars at the last 3 Trader's Expos (2015 – 2017) and they were:

- Buy 100 AAPL at $114.84 ($11,484)

- Sell 1 Jan 2017 $100 puts for $9.25 ($925)

- Sell 1 Jan 2017 $115 calls for $15.20 ($1,520)

We know that went well, AAPL was miles over the conservative target and the trade returned $11,500 from a $9,039 entry but we also collected $384 in dividends for net $11,884 which was up $2,845 (31%) in 16 months (an August 4th show in 2015) – not bad for a conservative play.

- Buy 10,000 HOV at $1.71 ($17,100)

- Sell 100 Jan 2017 $2 calls for 0.45 ($4,500)

- Sell 100 Jan 2017 $1.50 puts for 0.35 ($3,500)

That trade netted in for $9,100 and paid $15,000 back as Hovnanian (HOV) was well over $2 last Jan. The stock is back around $1.70 but they don't have leaps anymore – possibly because we exploited them for a fantastic $5,900 profit 64% in the same 16 months.

So, for new plays using a similar strategy, we went with:

- Buy 100 shares of AAPL for $175.50 ($17,500)

- Sell 1 2020 $140 puts for $9 ($900)

- Sell 1 2020 $180 call for $24 ($2,400)

That puts you into 100 shares of AAPL at net $142.50 ($14,200) with an obligation to buy 100 more if AAPL is below $140 so the "risk" is owning 200 shares of AAPL for $141.25 – which is 19.5% below the current price. When your worst-case scenario is owning 200 shares of AAPL at a 20% discount – it's a good trade!

To the upside, if you are called away at $180 that's $18,000 so $3,800 profit (26.7%) plus 7 anticipated 0.63 dividends for another $441 (3.1%) so we're just under 31% overall for 22 months and, if we're lucky, we'll see a special dividend from AAPL as they repatriate their cash.

- Buy 2,000 CLF for $7.49 ($14,980)

- Sell 20 2020 $5 calls for $3.85 ($7,700)

- Sell 20 2020 $5 puts for 0.90 ($1,800)

Here we're in for net $5,480 and, if called away at $5 (33% below the current price), we'll get $10,000 back for a $4,520 (82.5%) gain in 20 months – so you can see why we gave HOV the heave-ho for Cleveland Cliffs (CLF). Then we moved on to looking at our more advanced strategies:

- Sell 20 FCX Jan 2018 $5 puts for $2.16 ($4,320)

That was it. At the time Freeport-McMoRan (FCX) was down at $6.92 and there were rumors they wouldn't survive but we thought they would and took advantage of the net $2.84 entry that required just 0.52 ($1,040) in margin. Gains, of course, were 100% as the short puts recently expired worthless with FCX at $15 at the time.

As a new trade, we went back to our original Trade of the Year on L Brands (LB) as they still have a decent entry at $48.71 so we put together the following play:

Finally, using our "7 Steps to Making 30-40% Annual Returns", we used one of each style to add new trade ideas for GE (GE) and HanesBrands (HBI):

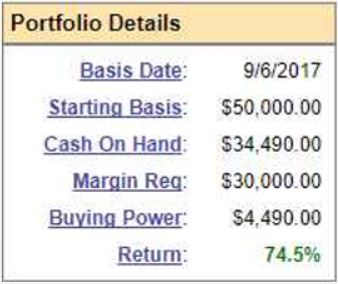

- Buy 1,000 shares of GE for $14.49 ($14,490)

- Sell 10 2020 $18 calls for $1.50 ($1,500)

- Sell 10 2020 $15 puts for $2.50 ($2,500)

At $18 or better, we get $18,000 back plus $480 in dividends against our net $10,490 entry for a profit of $7,990 (76%) over 20 months and, now that the scary earnings have been restated (see article above) I think GE will begin marching back up – and with easier comps to beat too!

- Buy 10 HBI 2020 $15 calls for $6 ($6,000)

- Sell 10 HBI 2020 $23 calls for $2.20 ($2,200)

- Sell 10 HBI 2020 $20 puts for $3.35 ($3,350)

Though we are obligated to buy 1,000 more shares at $20 if HBI goes lower, the first 1,000 shares worth of calls are netting us in for just $450 so, even if assigned, we'll be in just 1,000 shares for net $20.45, which is about the current price. When it came time (Thanksgiving) to officially announce our Trade of the Year, we used HBI instead of LB because it was cheaper at the time. If this trade returns it's planned $7,000 for a $6,550 (1,455%) profit in 20 months – you'll probably agree with the choice!

If you want trade ideas like these every day – come join us at www.philstockworld.com!