Wheeee!

Wheeee!

This is getting to be fun, right? It certainly is for our Members as we shorted the Nasdaq at 7,000 on Tuesday morning and, for those who missed that, we laid out a strategy for shorting the Dow in yesterday's Morning Report at 25,500, which paid $2,500 per contract and the S&P at 2,750, which also paid $2,500 per contract so – you're welcome! Now we'll see if the rest of our prophesy plays out:

"…if the S&P can't hold that 2,750 line – next stop is 2,735 and below that is DOOM!!!"

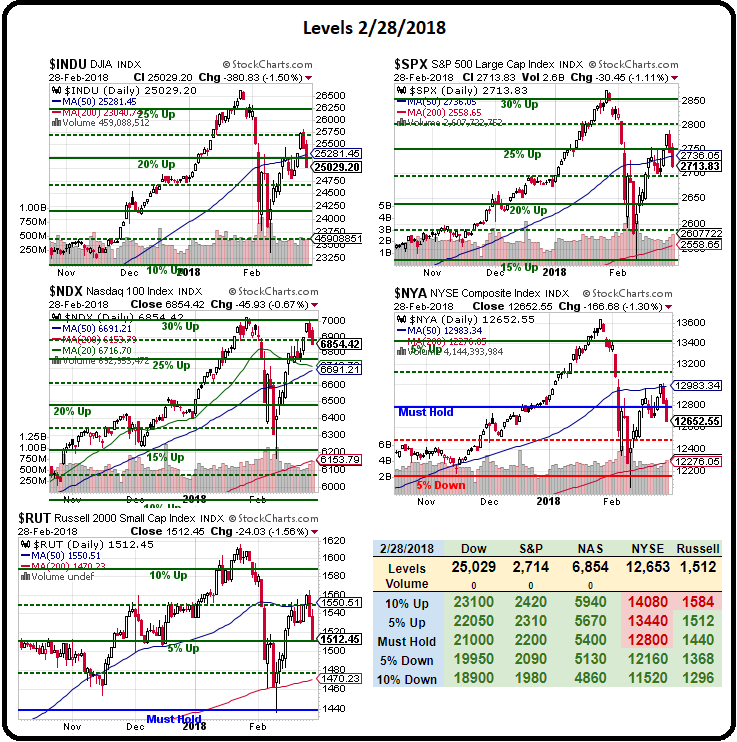

DOOM!!! in this case is the 200-day moving average, all the way down at 2,557 but there should be interim support at 2,640, which is the 20% line on the Big Chart so we'll take short profits there and look for a bounce. We're certainly not going to be bullish again until those 50-day moving averages are retaken (see yesterday's notes) and keep that in mind for next time when we urge caution.

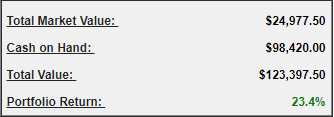

As we expected, our Short-Term Portfolio, which was $116,777.50 yesterday morning, jumped to $123,397.50 for a gain of $6,620 as our DIA June $255 puts moved back into the money and SQQQ climbed back over $15 but those trades "only" provide $100,000 and $40,000 worth of protection, respecitively, so it's time to consider the next layer of hedges – just in case this drop doesn't stop at the previous lows.

As we expected, our Short-Term Portfolio, which was $116,777.50 yesterday morning, jumped to $123,397.50 for a gain of $6,620 as our DIA June $255 puts moved back into the money and SQQQ climbed back over $15 but those trades "only" provide $100,000 and $40,000 worth of protection, respecitively, so it's time to consider the next layer of hedges – just in case this drop doesn't stop at the previous lows.

One thing we can do with DIA that doesn't cost much is to add a more speculative spread. Our June $255 puts were at the money when we bought them and we sold 1/2 as many June $230 puts, capping our gains a bit but what if we added the Sept $240 ($8.50)/225 ($5.50) bear put spread for $3. 20 more of those is just $6,000 and gives us $60,000 worth of proetcion if the Dow drops 20% and, more importantly, it let's us take a profit on the $255 puts off the table (when we decide to) and then becomes a cover for the short June $230 puts in case we're wrong and the Dow continues lower.

That's how we layer our hedges. We plan in advance to dimantle our original hedge so we can take advantage of a change in direction – like we did last month when we flipped bullish on the 10% drop. This time, we may not be as quick to flip though.

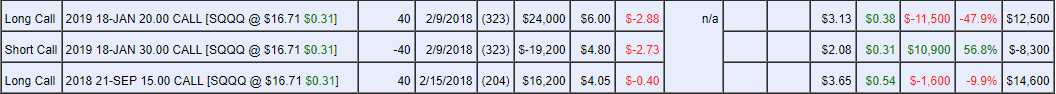

We already added 40 naked long Nasdaq Ultra-Short (SQQQ) Sept $15 calls as the Nasdaq blasted higher 2 weeks ago and they are now slightly in the money at $3.65 and we should be able to sell the $20 calls for $3 today and that will free up $12,000 we can use for another hedge while still giving us $20,000 worth of additional protection and, as a bonus, with the Jan spread acting as a hedge, we'll be able to take profits on the Sept $15 calls when we need to and leave the new short $20s covered by the Jan $20/30 spread. That's how one little change can flip our whole portfolio from bearish to bullish any time!

The Nasdaq is still our most overbought index, led back to highs by Apple's (AAPL) 16% run over the past two weeks. AAPL is about 17% of the Nasdaq by weight so, by itself, it accounted for almost 3% of the Nadadaq's 11% recovery. Now, we think AAPL deserves every penny of that $180 valuation but not so much Amazon (AMZN) at $1,512, Netflix (NFLX) at $291 and certainly not Tesla (TSLA) at $350 – those are some examples of Nasdaq stocks that could drop 20% and still take 100 years or more to pay back the money they are asking you to put into a share of their stock!

As I've been saying for years now: Money, like Richard Gere, has nowhere else to go, so it's been forced into equities – pushing valuations up to extreme levels. That doesn't mean, as the pundits like to say, that equities are the best place to be – just like standing outside your college dorm in the snow in your PJs isn't the best place to be when someone pulls the fire alarm at 2am – it's simply that you just have nowhere else to go – so you go there!

Lost in the shuffle last week, Goldman Sachs (GS) said stocks could drop 25% if rates rose to 4.5% but it was the first thing I said to our Members on Tuesday – as well as a warning I gave to seminar attendees at the Trader Expo on Monday:

"Good morning!

"Not sure what the markets are excited about. Powell's written testimony seems to keep the Fed on a tightening path and NO ONE is talking about Goldman's call that the market will drop 25% when rates hit 4.5% but I bet GS's HNW clients are looking to lighten up as we test the highs again.

"Notice on the Big Chart the Nas is about 3.75% ahead of the Dow, RUT and S&P in recovering so watch out for any weakness on them to cause the rubber band that connects them to snap the Nas back down."

The 10-year note is at 3% now and the Fed is expected to roll out 4 1/4-point rate hikes in 2018 so maybe 4% by the end of the year – if there are no outside factors that force our rate higher – like a loss of appetite for US T-Bills just as we're ramping up our borrowing to insane levels due to idiotic economic policies while maybe something like the trial of a sitting President is playing out on the World Stage. Not too far-fetched, is it?

The 10-year note is at 3% now and the Fed is expected to roll out 4 1/4-point rate hikes in 2018 so maybe 4% by the end of the year – if there are no outside factors that force our rate higher – like a loss of appetite for US T-Bills just as we're ramping up our borrowing to insane levels due to idiotic economic policies while maybe something like the trial of a sitting President is playing out on the World Stage. Not too far-fetched, is it?

Trump's 4th Press Secretary (Hope Hicks) quit last night, right after sitting down with the Special Prosecutor and that doesn't seem good for Team Trump, who are very busy gearing up for a Trade War with China that can throw the entire global economy into chaos. Who says politcs don't matter in the markets?

Around the World, yields on unstable US Government Debt are at the highest levels in 4 years and that drives up the cost of insuring US Government debt, which then makes buying our bonds much less attractive to foreign investors (and it's also a sign that people are using faith in our ability to repay the loans, of course). In fact, yields on 2-year TBills are 275 basis points (15%) higher than they are on 2-year German notes (still -0.52%) but the German notes are still a better deal as it costs 300 more basis points (3%) to insure the US debt against default.

So rates are not entirely under the Fed's control and their move to push rates to 3.75-4% in 2018 are simply a starting point for where we might end up if the Dollar gets weaker or our Government looks more unstable (just a tweet away!). Already, the data from fund-tracker EPFR Global showed that average weekly purchases of U.S. bonds by non-U.S. investors have dwindled by nearly a third to $9Bn so far this month, compared with more than $13Bn last year.

As we expected, PCE came in at 0.4% this morning and Personal Income kept pace, also bumping up 0.4% while personal spending remained calm, at 0.2%. This is inflationary in a stagnant spending environment – what used to be called Stagflation – back when we had such things as naturally-moving markets. Durable goods were down 3.7% on Tuesday and Pending Home Sales were down 4.7% yesterday – and people wonder why the market dipped?

Be careful out there!