Wheeeee!

Wheeeee!

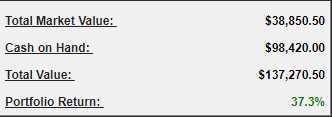

This market is non-stop fun, isn't it? It sure is for our Short-Term Portfolio, the same one we discussed adding more shorts to yesterday morning because the market was once again in a downward spiral gained a lovely $13,873 for the day and is now up $37,270.50 (37.2%) for the year. Unfortunately, our bullish, Long-Term Portfolio Positions fell back to $515,411, up just $15,411 for the year (3.1%) but that's the whole point of our paired portfolio strategy – we use the STP to hedge the LTP and lock in profits on the way up.

Even better, when there is a sharp sell-off, we still have tons of cash and we're already well-hedged so we're ready to go shopping. In fact, the reason the LTP took a 7% hit on this sell-off is because we added a lot of bullish positions last time the maket fell (only 30 days ago), so we're actually less hedged than we were last time, when we had fewer longs and just as many hedges (in anticipation of buying on the dip).

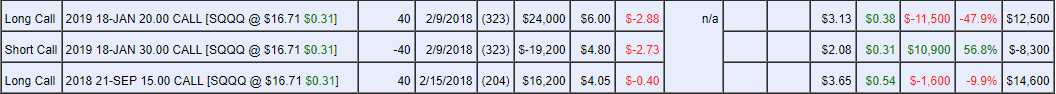

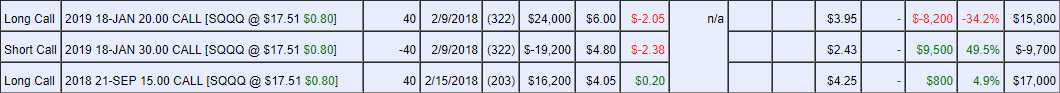

Hedges are insurance and YOU WILL LOSE MONEY when the market goes up – it's like life insurance – you don't WANT to die but, if you do, at least you get paid. We don't WANT our hedges to pay off but, when they do, they save our portfolios – which is the whole point. Yesterday we showed you one of the primary hedges in our STP, which was the following bullish spread on the Ultra-Short Nasdaq ETF (SQQQ):

We're still waiting to sell the Sept $3 calls for $3 or better (maybe this morning) but already we had a nice move yesterday, with the net $18,800 trade (as of yesterday, we paid $21,000) has popped to net $23,100 so the spread we showed you yesterday morning and told you was our primary hedge jumped $4,300 (23%) as the Nasdaq dropped 1.6% – THAT is how you use leverage effectively!

Keep in mind this spead pays $100,000 if SQQQ is over $30 when the calls expire and we paid $21,000 for that protection against our $500,000 long portfolio so we can afford to take a tremendous hit on our longs before our net balance is impacted and that helps us ride out these little dips and even take advantage of them. Obviously, if the market is up, or even flat, we expect to make far more than $21,000 on our longs to pay for the hedge. As a rule of thumb, we try to put 1/4 to 1/3 of our profits into the hedges to lock in our gains (depending on how worried we are).

This morning, I put out a tweet to flip long for the bounce off the indexes but already (7:50) the weak bounces (20% of the drop is 20 points in this case) failed and we're out of those trades and, of course, our hedges are still doing their thing. We take the longs to lock in the profits on the hedges if it's pre-market – as we can't close the positions if the market makes a snap recovery (see yesterday's Report for more notes on that strategy).

This morning, I put out a tweet to flip long for the bounce off the indexes but already (7:50) the weak bounces (20% of the drop is 20 points in this case) failed and we're out of those trades and, of course, our hedges are still doing their thing. We take the longs to lock in the profits on the hedges if it's pre-market – as we can't close the positions if the market makes a snap recovery (see yesterday's Report for more notes on that strategy).

Unfortunately (because I'm usually right), I also said in that tweet:

DAX down 2.3% so really nasty and Nasdaq testing 6,700 already, which is that death cross of the 20 and 50 dma and DOOM!!! if we fail it. Oh, who's kidding, we're about to fail it!

So DOOM!!!! on a Friday, DOOM!!! I say…

Actually, we might bounce here if Trump can keep his mouth shut long enough for them to spin his comments less insanely.

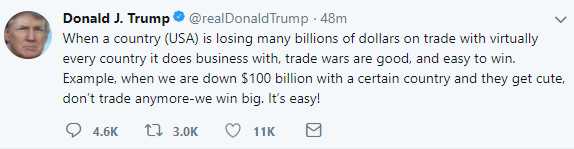

Those insane comments I was speaking about were his 5:50 am tweet (mine was 6:53) saying (and I WISH I were making this up "trade wars are good" and, oops, that's out of context because you could argue that's not insane, just stupid but he added "and easy to win" to push his comment firmly into the insane camp – as anyone who has taken an economics class since 1930 can tell you! Or, as I summarized:

Those insane comments I was speaking about were his 5:50 am tweet (mine was 6:53) saying (and I WISH I were making this up "trade wars are good" and, oops, that's out of context because you could argue that's not insane, just stupid but he added "and easy to win" to push his comment firmly into the insane camp – as anyone who has taken an economics class since 1930 can tell you! Or, as I summarized:

"Easy to win" – what a moron! For one thing, the things we import that give us a trade deficit are oil and metals we can't survive without, like rare earths from China. It would be one thing if we stopped using oil but what Trump is doing is like fixing the blood deficit for someone who needs a transfusion by refusing to accept blood. A win on the balance sheet isn't necessarily a win for the economy – and certainly not for the people.

Oil is, in fact $356Bn of our $566Bn trade deficit, so about 63% (2/3) of it right there and we wouldn't need to import 1/3 of that if Trump hadn't changed the laws and allowed our refiners to EXPORT refined gasoline so they buy more oil and export gasoline which, of course, hits the US consumers both ways by INCREASING the price of oil (more "demand") and INCREASING the price of gasoline (less US supply). In short, Trump and the GOP have completely screwed the American public by reversing the long-standing policy against exporting gasoline. Who has been helped by this? Oil campaign donors and, of course, Vladimir Putin, a man with $75Bn of personal worth – most of which is in oil companies.

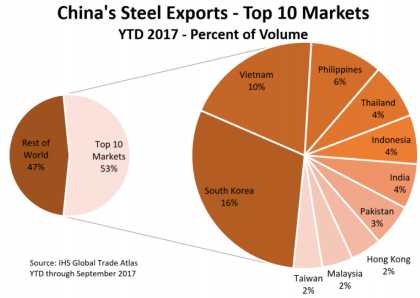

So Trump and the GOP pass a law that blows up the deficit and then they say they have to fix the defict by punishing another country Putin wants to stick it to – China. Of course, China could care less because the United States is China's 26th largest customer, not even rating a mention on this pie chart, which is what we used to call a "fact" that is easily checked before throwing the entire economy into chaos.

So Trump and the GOP pass a law that blows up the deficit and then they say they have to fix the defict by punishing another country Putin wants to stick it to – China. Of course, China could care less because the United States is China's 26th largest customer, not even rating a mention on this pie chart, which is what we used to call a "fact" that is easily checked before throwing the entire economy into chaos.

China sends more than twice as much steel to Taiwan – a country they don't even officially recognize – than they do to the United States!

Even arch-Conservative and Trump cheerleader, Larry Kudlow is pointing out on CNBC that there are less than 200,000 jobs in steel and aluminum in the United States but there are over 5,000,000 jobs that depend on cheap steel in their manufacturing and, of course, there are 320M American Consumers who will see prices spike for all sorts of things – and that's before we even get the inevitable retaliation as Trump's tarriffs are targeting ALL countries – which is patently ridiculous and a violation of dozens of existing trade agreements.

Of course, there's our salvation, Trump's powers are not unlimited and he can say what he wants about how China is ripping us off on steel to distract us from a week in which his administration is imploding with scandal after scandal, but there is a World Trade Organization that handles these matters and we do have treaties with partners that Trump needs to keep happy so it's possible that none of this stuff actually gets enacted.

Of course, there's our salvation, Trump's powers are not unlimited and he can say what he wants about how China is ripping us off on steel to distract us from a week in which his administration is imploding with scandal after scandal, but there is a World Trade Organization that handles these matters and we do have treaties with partners that Trump needs to keep happy so it's possible that none of this stuff actually gets enacted.

So the World may not end because Trump can't get his way – this time.

Have a great weekend,

– Phil