And we're short again!

Nasdaq (/NQ) 7,000 seems like a lovely shorting line and we grabbed a couple this morning in our Live Member Chat Room along with Russell (/RTY) shorts at 1,580 – these are now the June contracts, so they are a little higher than our shorting lines earlier in the week but essentially the same. Not only that but we bought back half the covers on our primary SQQQ short yesterday afternoon – essentially flipping us much more bearish into the weekend.

We're expecting a pullback on the Nasdaq next week (not today) to at least 6,850 and 150 /NQ points is good for $3,000 per contract gains and we weigh that against stopping out over 7,005 with a $100 per contract loss – so it's a very nice reward vs a fairly small risk – the kind of trades we love to take in the Futures. The same with the Russell but 1,580.50 only costs us $25 per contract vs 1,550 would be a gain of $1,500 each.

We have Non-Farm Payrolls out at 8:30 and economists expect 200,000 jobs to be created, which is the same amount of jobs we always create – there has been no improvement at all under Trump and, in fact, we've been drifting lower but hourly earnings are on the rise (due to Obama-era Minimum Wage increases that are kicking in now) and that's good for the economy – though not so great for Corporate Margins.

We have Non-Farm Payrolls out at 8:30 and economists expect 200,000 jobs to be created, which is the same amount of jobs we always create – there has been no improvement at all under Trump and, in fact, we've been drifting lower but hourly earnings are on the rise (due to Obama-era Minimum Wage increases that are kicking in now) and that's good for the economy – though not so great for Corporate Margins.

With unemployment hovering around 4% – everyone is working so the labor market is tight and we're expecting to see some serious wage inflation over the next few years that, in turn, sparks a broader inflationary cycle in the economy. In fact, China was ahead of us in increasing wages (still much lower than ours) and now they have 2.9% inflation – double what it was a month ago but possibly a blip from the New Year celebrations last month.

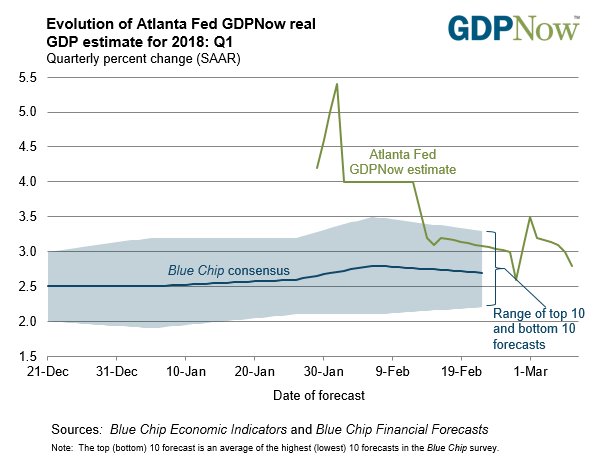

Meahwhile, the GDP estimates are in free-fall and no one seems to notice, no one seems to care as the Atlanta Fed has taken their ridiculously optimistic GDP Now forecast down from 5%, which rallied the markets to all-time highs in late January, to 2.7% and very likely to be revised below 2% by the time it's official.

Meahwhile, the GDP estimates are in free-fall and no one seems to notice, no one seems to care as the Atlanta Fed has taken their ridiculously optimistic GDP Now forecast down from 5%, which rallied the markets to all-time highs in late January, to 2.7% and very likely to be revised below 2% by the time it's official.

Although Trump claims GDP is over 3%, the FACT is that Q4 was 2.5% which made 2017 2.5% – well shy of the mark and the trend is not positive and now we are engaging in Trade Wars – which never, ever, in the history of mankind on the planet Earth – has ended well.

But party on markets – we'll take the short side of that bet!

Not that we don't have longs, of course. Just because we think it's ridiculous that Amazon (AMZN) trades at 252 times earnings and Netflix (NFLX) is at 253 times earnings and Tesla (TSLA) trades at infinity times earnings (because they are negative with no chance of turning positive this decade or, maybe, EVER) doesn't mean there aren't stocks we do like.

Our Long-Term Portfolio is full of them and we're already up 11.6% for the year – so of course we're going to press our hedges in the Short-Term Portfolio to lock in those ill-gotten gains. After all, it's only March 9th so 11% in two months is 66% for the year and we certainly don't expect to make that so we have to assume there will be a correction at some point – so we hedge to lock in our profits.

Our Long-Term Portfolio is full of them and we're already up 11.6% for the year – so of course we're going to press our hedges in the Short-Term Portfolio to lock in those ill-gotten gains. After all, it's only March 9th so 11% in two months is 66% for the year and we certainly don't expect to make that so we have to assume there will be a correction at some point – so we hedge to lock in our profits.

That's also why we favor playing the indexes short vs long – we already have massive bets to the long side and we will make MASSIVE amounts of money if the rally continues so it's only the downturns we need to guard against with our day-trading plays.

That doesn't mean we never go long in the Futures. Yesterday, in our Live Member Chat Room, at 1:42 pm, we went long on Gasoline Futures (/RB) as they hit the $1.875 line. On the way down to $1.87, we decided to stick with them and we scaled in and out and ended up with 2 contracts at $1.867 avg and already this morning we're up over $1,600 ($800 per contract) with a stop at $1.885 to lock in $1,500 gains. That's how we have a nice weekend over at PSW!

That doesn't mean we never go long in the Futures. Yesterday, in our Live Member Chat Room, at 1:42 pm, we went long on Gasoline Futures (/RB) as they hit the $1.875 line. On the way down to $1.87, we decided to stick with them and we scaled in and out and ended up with 2 contracts at $1.867 avg and already this morning we're up over $1,600 ($800 per contract) with a stop at $1.885 to lock in $1,500 gains. That's how we have a nice weekend over at PSW!

Hopefully we hit $1.90 for $3,000 gains so we can afford to see Hamilton (mezzanine) – that would be nice… That also means you can make $1,500 from here with 2 long contracts at $1.8875 and a stop at $1.8849 would lose about $105 per contract so still a pretty good risk/reward ratio on those but, be aware, we'll be raising our stops each time it crosses the next 0.005 because we already got our fill – so it's nowhere near as safe as it was when we featured it for our Members yesterday.

Speaking of picking up the scraps our Members leave behind – Imax (IMAX) is getting cheap again at $20.35 and that trade was featured last Month on Money Talk, where we adjusted that portfolio to get more aggressive as they tested $19. IMAX shot up to $24 in Feb but back to $20 now means yet another chance to enter this trade at not too much more than we paid at the time:

A Wrinkle in Time comes out this weekend but, much more importantly, the Avengers is coming along with plenty of other potential hit films so we still love IMAX and the Sept calls capture the summer box office. The $15s are now $6.10 ($12,200) and the $20s are now $2.60 ($5,200) for net $7,000, which is up $1,000 (16.66%) from our entry in a month but it will still pay back $10 for a $3,000 additional profit (42%) in Sept if IMAX does manage to hold $20. That seems like an easy way to make money, right?

So there are PLENTY of stocks we like long and, when they pay you 42% in 6 months – we don't need many of those to make really good returns. That's how our Long-Term Portfolio can be over 80% in cash and still make 11.6% in just over 2 months That leaves us plenty of cash on the sidelines to improve our positions (as we did with IMAX last month) and, most importantly, to hedge – because these markets are crazy and so is our leader – anything can happen and we need to be ready for it!

8:30 Update: Non-Farm Payrolls came in strong at 313,000 and last month was revised up 39,000 (20%) so very bullish but not necessarily good for the markets (though they are popping) as the wage inflation will pressure Corporate Profits and, of course, low unemployment and high inflation will force a Fed hike at the March 21st meeting – they simply don't have any reason at all not to hike now.

So we took a loss at 7,005 on /NQ (-$100) and 1,580.50 on /TF (-$25) but now we can re-short at 7,050 and 1,590 with the same 5-point tight stops over but that should be about it as it was a knee-jerk reaction that's very likely to spark some profit-taking at these levels. We can add a short at Dow (/YM) 25,100 too!.

So we took a loss at 7,005 on /NQ (-$100) and 1,580.50 on /TF (-$25) but now we can re-short at 7,050 and 1,590 with the same 5-point tight stops over but that should be about it as it was a knee-jerk reaction that's very likely to spark some profit-taking at these levels. We can add a short at Dow (/YM) 25,100 too!.

Don't forget, nothing has changed other than this single data point and the Fed tightening cycle will be the story of the next two weeks. In fact, we have Charles Evans from the Fed speaking right now on CNBC on his way to a speech on Monetary Policy in New York this afternoon. He's not a voting Member and he's the biggest dove on the Fed but even he is saying these jobs numbers are "very strong" and the Fed is likely to remain on a tightening path with at least 3 rate hikes.

That will, of course, take longer to filter through the news than the headline jobs so plenty of time to line up our shorts and we'll look to make more favorable adjustments to our hedges – using the additional gains from our longs this morning.

Next week will be very busy with CPI and PPI and Retail Sales, the Philly Fed, Industrial Production and Housing Starts and then it's time for earnings again as Oracle (ORCL) reports on the 19th, Lennar (LEN) and FedEX (FDX) on the 20th and our 2017 Stock of the Year, Wheaton Prescious Metals (WPM) rports on March 21st and there's another bargain to be had at $19.66 – down from $22.50 in Jan.

We don't play WPM to win, per se, we simply play them not to lose and there's huge premiums so sell so what we like on WPM is:

- Sell 5 WPM 2020 $20 puts for $3.55 ($1,775)

- Buy 10 WPM 2020 $15 calls for $6 ($6,000)

- Sell 10 WPM 2020 $20 calls for $3.50 ($3,500)

That's net $725 on the $5,000 spread that is almost 100% in the money to start. All WPM has to do is be above 20 in Jan 2020 and the short puts expire worthless and the spread pays $5,000 for a $4,275 (589%) return on cash (the ordinary margin on the short puts is $1,014) and those are the kind of "set and forget" trades we love to have in our Long-Term Portfolios (we already have longs on WPM in all 3 of our bullish portfolios).

We'll see how the day plays out but, if we do finish at the opening highs, we won't be all that bearish into the weekend after all – as it would be a technical victory for the week. Still, I love the shorts this morning – seems like a fun play!

Have a great weekend,

– Phil