Here come those tears again

Just when I was getting over you

Just when I was going to make it through

Thinking I might just be strong enough after all – Browne

Here we go again.

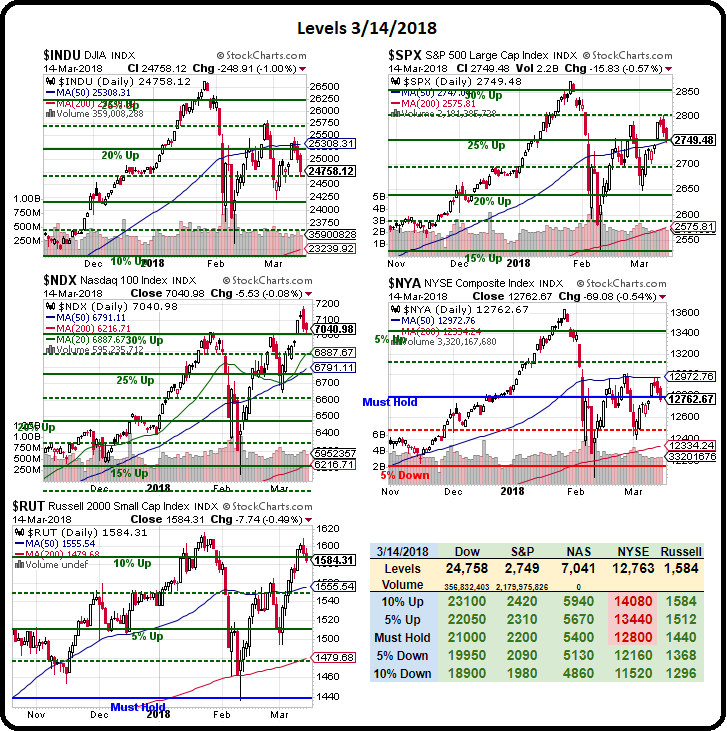

If the markets were as strong as the Wall Street narrative suggests – they wouldn't keep failing the 50-day moving averages, would they? Not only that but we STILL haven't gotten the broadest index, the NYSE, over their Must Hold level, which means we haven't even really confirmed a broad-market rally.

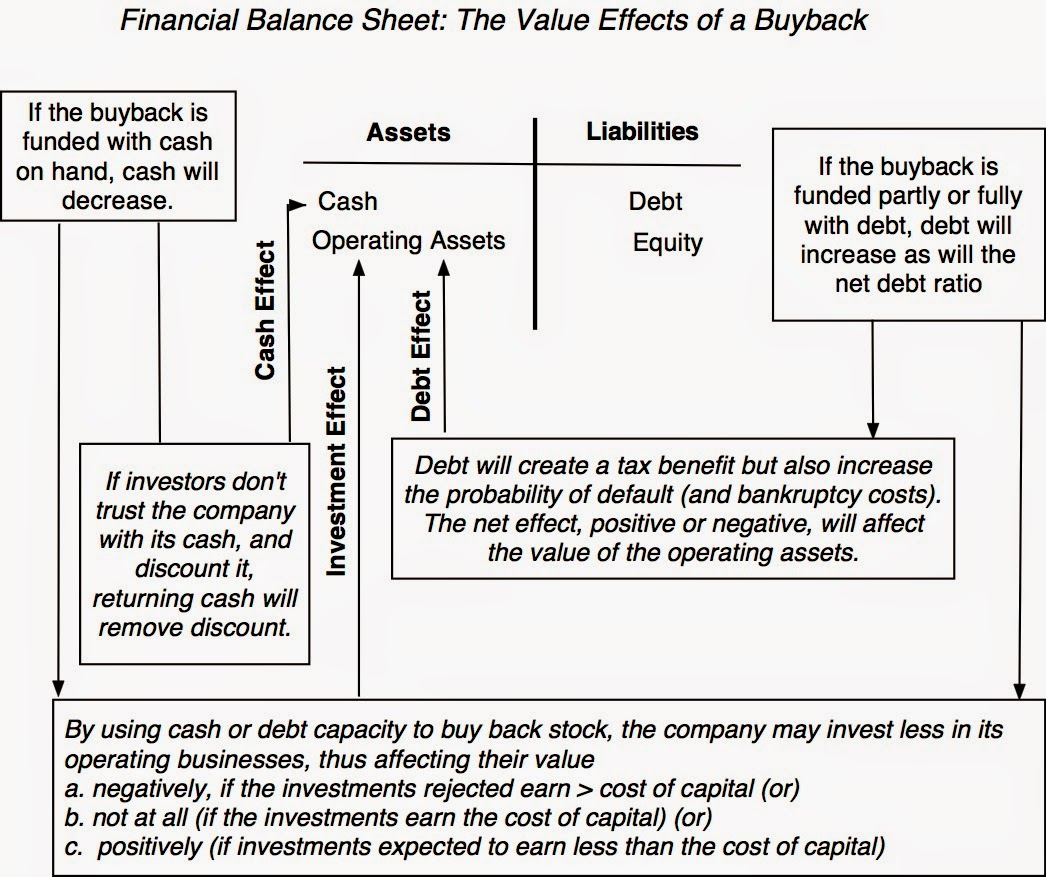

Not only has the rally had a very narrow focus but, as it turns out, the main buyer of US Corporate stocks is — US Corporations! Last week alone, US companies bought back $1.5Bn worth of stock through Bank America (BAC) alone – the biggest week they ever recorded. In the past 3 months, $250Bn in additional buybacks have been announced, possibly pushing us to a $1Tn year in Corporate Buybacks or about 2.5% of the entire market.

And, of course, they are not buying every stock, mostly their own so it's those big, Top 1% Corporations, 90 of the 9,000 listed companies – the ones who were given $1.5Tn worth of tax breaks by the Trump Administration – that are bringing back the cash they hid overseas to avoid paying taxes under Obama (at no penalty) – and are using it to buy back their own stock to mask the fact that earings are not actually improving by reducing the number of shares those earnings are divided by.

And, of course, they are not buying every stock, mostly their own so it's those big, Top 1% Corporations, 90 of the 9,000 listed companies – the ones who were given $1.5Tn worth of tax breaks by the Trump Administration – that are bringing back the cash they hid overseas to avoid paying taxes under Obama (at no penalty) – and are using it to buy back their own stock to mask the fact that earings are not actually improving by reducing the number of shares those earnings are divided by.

All in all, it's just a huge Ponzi scheme where companies plow back declining profits into their own stock so the CEOs can justify their outrageous salaries and lure investors into their stock while insiders and Fund Managers (ie. "smart money") cashes out. Then, when the whole thing ultimately collapses, they will say: "Who could have seen that coming?"

I know it's complicated but let's make it as simple as possible. Let's say, for example, that your friend wants to open a car dealership and he needs to get 100 cars on the lot for $25,000/car ($2.5M) and he needs a lot and a building to sell them from so call it $3M. Clearly, the liquidation value of the business is $3M, perhaps not even because there may not be an immediate market if you and he change your mind about the business but, for the moment, you can call it a $3M asset.

Now, in Q1, we sell 10 cars for $30,000 each and make $50,000. As your friend is the CEO and salesman he reasonably asks for 40% of the profits so $20,000 and maybe $5,000 to keep the lights on, so "SG&A" (Salaries, General and Administrative costs) is $25,000 and there's a $25,000 profit.

If the business continue like this, it will make $100,000 for the year and your $3M "valuation" would require a 34x multiple of earnings to be justified. Well it's a start-up and you hope to do better so you spend money to advertise ($5,000) and you hire another salesman and a receptionist for $10,000 and now you sell 15 cars for a $75,000 profit less what is now $40,000 in SG&A and, congratulations, you now made $35,000 in Q2 – up 40% from Q1!

If the business continue like this, it will make $100,000 for the year and your $3M "valuation" would require a 34x multiple of earnings to be justified. Well it's a start-up and you hope to do better so you spend money to advertise ($5,000) and you hire another salesman and a receptionist for $10,000 and now you sell 15 cars for a $75,000 profit less what is now $40,000 in SG&A and, congratulations, you now made $35,000 in Q2 – up 40% from Q1!

Now your business is trading at "just" 21.4 x earnings and let's say by Q4 you are making $45,000 a month but now your dealership is full and the CEO wants a raise and, to expand the business further, you need another $3M to open another showroom.

So now you go public and you project your $180,000 annual profits will be mirrored or exceeded in 5 new stores and, though you make just $180,000/yr now, you project 5x that in 2 years for $900,000 and you ask for a valuation of 20x that for $18M and you sell 10% of your business for $1.8M to investors and you borrow $1.2M from the bank. Very exciting, right?

But wait, what is the reality? The reality is that we're still just one car shop with $1,080,000 in sales and $180,000 in profits yet you've raised $1.8M in cash and borrowed $1.2M which, at 5% will cost you $5,000 a month in interest alone and a 10-year repayment means you need another $10,000 a month to pay back principal so $15,000 a month to service debt is the ENTIRE $180,000 you made last year!

So now you are netting $0 per month so you'd better open that new store fast and staff it up and train people before the investors get pissed but, in your hurry, you make a few mistakes and, at the end of year one, store two is making only $90,000, which means the whole company is making $90,000 on $1.5M in sales and now has spent all the cash and borrowed money – oops.

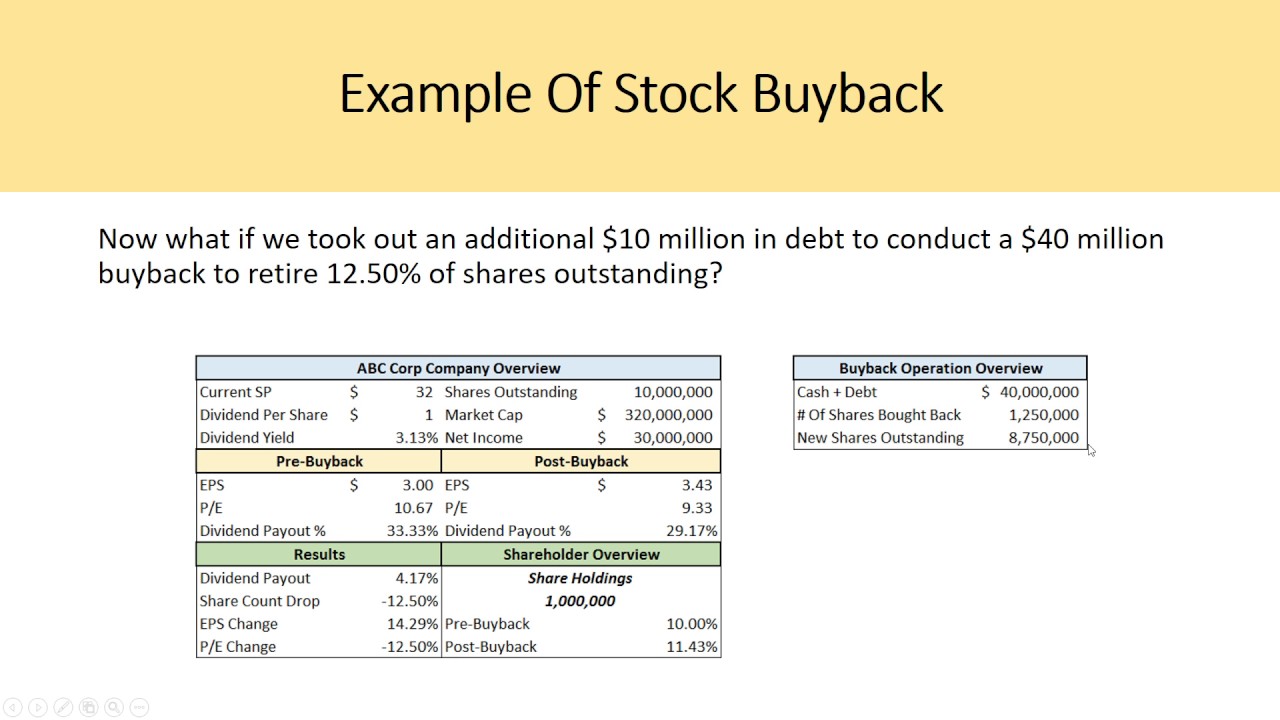

Still worth $18M? On a larger scale, this is what happens to corporations all the time as they get overly ambitious and struggle to justify their amazing salaries, not to mention the Corporate Jets and fancy offices and secretaries, etc. I used to have a secretary – I really miss that! Anyway, that's why Corporations like to buy back their stock – they don't need to figure out how to make more money if they make less stock and then the same monney is divided by less stock and their earnings per share increase and they look like geniuses.

Let's say you and your buddy instead took the $1.8M you raised and the $1.2M you borrowed and spent $1.5M buying back half the stock. Now you are still making nothing (due to the loan repayment) but, in non-GAAP reporting (see TSLA), you ignore your debt and focus on the $180,000 you made, now divided by half as many shares so your earnings per share double and you still have $1.5M to spend so NOW you do another round of capital raising at higher prices and pay back some of your debt.

You can see how attractive this path is for Corporations but all they are doing, as a company, is treading water while their valuations skyrocket and, as soon as they stop – they will drown as the weight of their valauations and expectations crash into the reality that they haven't built up their businesses at all.

Think about this when evaluating your investments. Are they really growing into the future or are they just playing accounting games? Sadly, for a very, very large sampling of major stocks – the answer is accounting games.

Be careful out there!