Down 6.9% for the month!

Down 6.9% for the month!

That's the damage on the Nikkei after yesterday's 4.5% dip, putting Japan's market down 10% for the year (so far). China's Shanghai dropped 3.4% in response to Trump's Tariffs but, so far, China has not responded in kind so, as we expected, the indexes are finding a bit of support at S&P 2,640, which is exactly what we prediced they would do on Wednesday morning.

Remember: I can only tell you what is likely to happen and how to make money trading it – that is the extent of my powers. The rest is up to you!

In the case of our S&P call from Wednesday morning's report, the 80-point drop from 2,720 to 2,640 was good for gains of $4,000 per contract (you're welcome!) and now we'll see what kind of bounce we get on the way to a full correction at 2,400, which will be good for another $12,000 per contract if all goes well (or badly, I suppose).

In the case of our S&P call from Wednesday morning's report, the 80-point drop from 2,720 to 2,640 was good for gains of $4,000 per contract (you're welcome!) and now we'll see what kind of bounce we get on the way to a full correction at 2,400, which will be good for another $12,000 per contract if all goes well (or badly, I suppose).

As 2,640 is the 20% line on our Big Chart (a level we drew more than a year ago) and as the fall from the 25% line at 2,750 was 110 points – we'll be looking for 22-point bounces to 2,666 (weak and satanic) and 2,688 (strong) and, if the weak bounce fails to hold today – look out below on Monday! the next proper support for the S&P Futures (/ES) will be the 15% line at 2,530 and the next stop below that is our 2,400 goal (2,420 to be exact). THEN we get excited to buy things – despite the Trade Wars.

.gif) Until then, we have plenty of longs and plenty of hedges so we just sit back and watch and wait. The US and European markets are closed next Friday (my Birthday, actually Thurs but it's celbrated on Friday this year) and Easter is Sunday and that Monday will be slow and that whole week will be slow, as will the weak before (next week) so not the best time to determine what levels are holding up but a great time to take a break!

Until then, we have plenty of longs and plenty of hedges so we just sit back and watch and wait. The US and European markets are closed next Friday (my Birthday, actually Thurs but it's celbrated on Friday this year) and Easter is Sunday and that Monday will be slow and that whole week will be slow, as will the weak before (next week) so not the best time to determine what levels are holding up but a great time to take a break!

- Dow (/YM) 24,150 was the 15% line so that has to be taken back before we're even recovering. 25,200 was the 20% line and that fall was just over 1,000 points which calls for 200-point bounces 24,350 (weak) and 24,550 (strong) but, given the news-flow, that's not going to happen so, logically, we're going to remain bearish the morning.

- Nasdaq (/NQ) was 35% over it's Must Hold Level (5,400) that did not account for Amazon (AMZN) trading at 250 years worth of earnings along with other silly valuations like Netflix (NFLX), Tesla (TSLA) and AliBaba (BABA) but even FaceBook (FB) and Alphabet (GOOGL) had gotten ahead of themselves – which is why our main hedges are ultra-short Nasdaq ETFs (SQQQ). Anyway, 7,290 was the 35% line and we actually topped out at 7,200, which is close enough to count it. From there, back to the 25% line at 6,750 is a 540-point drop and we know the Nas loves the 25s so we'll use 100-point bounce lines to 6,850 (weak) and 6,950 (strong) but those don't matter because we're testing 6,700 at the moment and again, looking at the news flow – they are never gonna make it.

- Finally, the Russell has had the least damage so far at 1,548 but they also had the least gains and are not even 7.5% over their Must Hold Line at 1,440. /TF fell from the 12.5% line at 1,620 and that's down 72 points so we'll call it 15-point bounces off 1,550 (though failing 1,548 would be catastrophically bad) and we'll look for 1,565 (weak) and 1,580 (strong).

Well, I haven't calculated a single strong bounce line that I think will be taken and I don't even think we'll make weak bounces today so you'd BETTER have good hedges over the weekend. If you have a $100,000 portfolio that will lose about $20,000 in a 20% market dip, then you want a hedge that mitigates about half the damage and that's easy with something like this:

- Sell 5 IMAX 2020 $20 puts for $4 ($2,000)

- Buy 20 SQQQ May $17 calls for $2.25 ($4,500)

- Sell 20 SQQQ May $22 calls for $1.05 ($2,100)

The net cost of that spread is just $400 and it pays $10,000 if SQQQ is over $22 at May expiration. Since SQQQ is a 3x reverse track of the Nasdaq, to gain $4.20 from the current $17.80 would be 23.6% and that would require just an 8% drop in the Nasdaq to put you in the money.

We're offsetting the cost of the spread by promising to buy 500 shares of IMAX for $20 in Jan 2020 and that requires $975 in ordinary margin and IMAX is at $19.25 now, so it requires a bit of faith in IMAX as well (we have that). You can offset the cost with a short put on any stock you REALLY want to own if the market corrects but IMAX is a good fit for a $100K portfolio since the net assignment would be just $10,000 worth of shares.

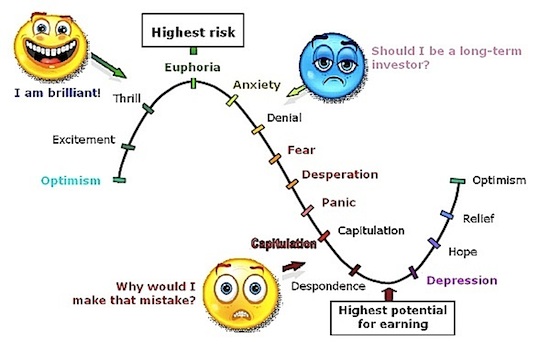

Meanwhile, why only mitigate half the damage? Well if we're wrong, it's very expensive to overhedge and, if we're right, your $100,000 in stocks drops to $80,000 but then you get $10,000 in cash from the hedge and now you have $90,000 to spend on stocks that are 20% off the old prices. That means you can buy 112.5% of the stocks you were able to buy before the market fell so, if you are a long-term investor, you have exactly what you want – more stock when it's cheap.

After that, the market either comes back or the next set of hedges kicks in and you buy more stock at even lower prices. Don't you wish that was your strategy in 2008? Our system simply reinforces the concept of buying while other people are panicking by putting cash in your pocket at the exact time you want to go bargain-shopping!

After that, the market either comes back or the next set of hedges kicks in and you buy more stock at even lower prices. Don't you wish that was your strategy in 2008? Our system simply reinforces the concept of buying while other people are panicking by putting cash in your pocket at the exact time you want to go bargain-shopping!

Have a great weekend,

– Phil