The markets are back up to our weak bounce lines (see yesterday's report) though I think we'll be using them as shorting lines this morning as the Dollar is recovering quickly, up 0.6% and that's bound to put a bit of pressure on the markets as they finally hit some resistance. Dow (/YM) 24,350 is my favorite short at the moment, with tight stops over the line and 6,850 on the Nasdaq (/NQ) will make a fun shorting line as well.

Why short? Well, nothing at all has changed other than it's POSSIBLE that China and the US will have a trade agreement instead of a trade war but, other than that – all the other stuff that caused the market to fall off it's highs all month haven't gone away – Thursday's trade talk just made them worse and now they are not worse – they are the same – not better either.

The President is still being indicted, the Government is still in turmoil, Russian "diplomats" were just expelled from pretty much every NATO country (even ours, surprisingly) so we may have just started the next cold war only this one is being fought with a guy who already has your browser history and all of your passwords.

Of course Khrushchev was very much cut from the same cloth as our President, as noted by this summary of the "shoe-banging incident" at the UN:

On 12 October, head of the Filipino delegation Lorenzo Sumulong referred to "the peoples of Eastern Europe and elsewhere which have been deprived of the free exercise of their civil and political rights and which have been swallowed up, so to speak, by the Soviet Union".[12] Upon hearing this, Khrushchev quickly came to the rostrum, being recognized on a Point of Order. There he demonstratively, in a theatrical manner, brushed Sumulong aside, with an upward motion of his right arm—without physically touching him—and began a lengthy denunciation of Sumulong, branding him (among other things) as "a jerk, a stooge, and a lackey", and a "toady of American imperialism"[13] and demanded Assembly President Frederick Boland (Ireland) call Sumulong to order. Boland did caution Sumulong to "avoid wandering out into an argument which is certain to provoke further interventions", but permitted him to continue speaking and sent Khrushchev back to his seat.

Khrushchev pounded his fists on his desk in protest as Sumulong continued to speak, and, according to some sources, at one point picked up his shoe and banged the desk with it.[14]

Was America "great" during the cold war? I'm still not clear on what "great" is supposed to be and when it is that "again" refers to. I've looked it up – it's not actually clarified or stated specifically anywhere. "Making America Great Again" is simply a propaganda phrase for adults, kind of like saying "All your dreams will come true" to children because you don't know specifically what their dream is but you know that, if you promise to make them come true – they'll behave themselves for you. Kids aren't experienced enough to ask for a clarification – I can't imagine what excuse adults who fall for this idiocy have...

The same is true for traders, who are happy to buy into the fantasy that we can go $1.3Tn (6%) into debt on top of the $21Tn we already owe while the economy is growing at less than a 3% pace and everything will be awesome and there will be nothing to worry about. Since late January, we have careened from crisis fall to relief rally in the markets – like a house of cards that topples and is immediately rebuilt – over and over again.

Of course, in the big picture, we're still far below the January highs but almost halfway back to the February and March highs (2,800 on /ES), so that's something, right? If we establish a channel with a floor at 2,640 (our 20% line), that will indeed be very bullish and it means we may actually be seeing our 30% line at 2,860 again but, for the moment, as we noted yesterday morning in this chart, we're still waiting just to see the weak bounce at 2,684:

As I said above, I'm more inclined to go short here because there is NOTHING that I'm seeing in the news or the data that justifies us moving to the more positive range (over the 20% line) which means we're more likely still on track to fall into the 10-20% range, where 2,640 is the top and 2,420 is the bottom. That's the range we predicted we'd end the year in and this year is just getting started but it seems to me there's still more money in shorts than in longs at this level.

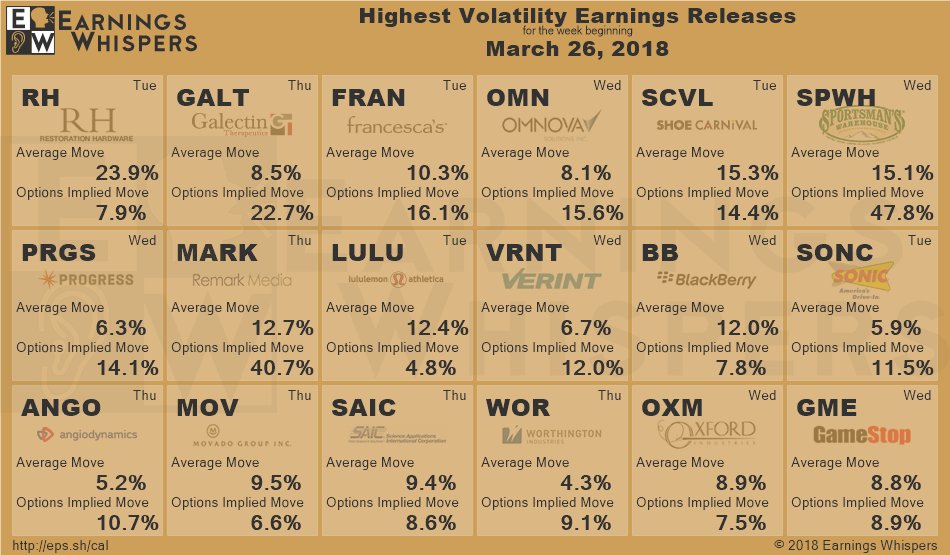

I may change my mind after earnings. McCormick (MKC), the spices company, knocked it out of the park this morning with an 18.5% beat and IHS Markit (INFO) beat by 10% while FactSet (FDS) beat by 14% so things are good in the world of spices and data so far. Lululemon (LULU) reports this evening along with Shoe Carnival (SCVL), Restoration Hardware (RH) and Sonic (SONC) and SONC is cheap at $24.79 but the others are not cheap at all and I'll be interested to see if they can justify their high valuations.

As you can see from Earning's Whispers' chart, options on SONC imply a higher move than it usually makes and we can turn that to our advantage by selling premium into earnings. In this case, the Sept $22.50 puts are $1.25 and that would net us into the stock at $21.25, which is a $3.50 (14%) discount to the current price so that's a no-brainer to sell if you don't mind owning SONC for $21.25 as the worst case. We can leverage that further by betting $25 will hold up and add a spread as follows:

- Sell 10 SONC Sept $22.50 puts for $1.25 ($1,250)

- Buy 20 SONC Sept $22.50 calls for $3.50 ($7,000)

- Sell 20 SONC Sept $25 calls for $2.20 ($4,400)

The net cost of that spread is $1,350 and it pays $5,000 if SONC is over $25 at September expiration. That would be a $3,650 (270%) return on cash and the ordinary margin for selling the 10 puts is $1,745 so it's a nice, efficient way to make $3,650 in 6 months if all goes well. We'll track this one and see how it goes.

Tomorrow morning we'll hear from Walgreens (WBA) and I really like what they are doing so a good chance to pick them up low in the channel at $67.47. In this case, we can just do a long-term play for our Long-Term Portfolio (LTP):

- Sell 5 WBA 2020 $65 puts for $7.50 ($3,750)

- Buy 10 WBA 2020 $60 calls for $13 ($13,000)

- Sell 10 WBA 2020 $75 calls for $5.50 ($5,500)

In this case, we're obligated to buy 500 shares of WBA at $65 ($2,786 in margin required) and the net of our $15,000 spread is $3,750 so the upside potential at $75 is $11,250 (300%) over 2 years if all goes well. Either they get off to a good start after earnings or we'll adjust.

Earnings season is fun, we can make trades like this almost every day!