Wait – did I call the top in Bitcoin?

Courtesy of Joshua M Brown

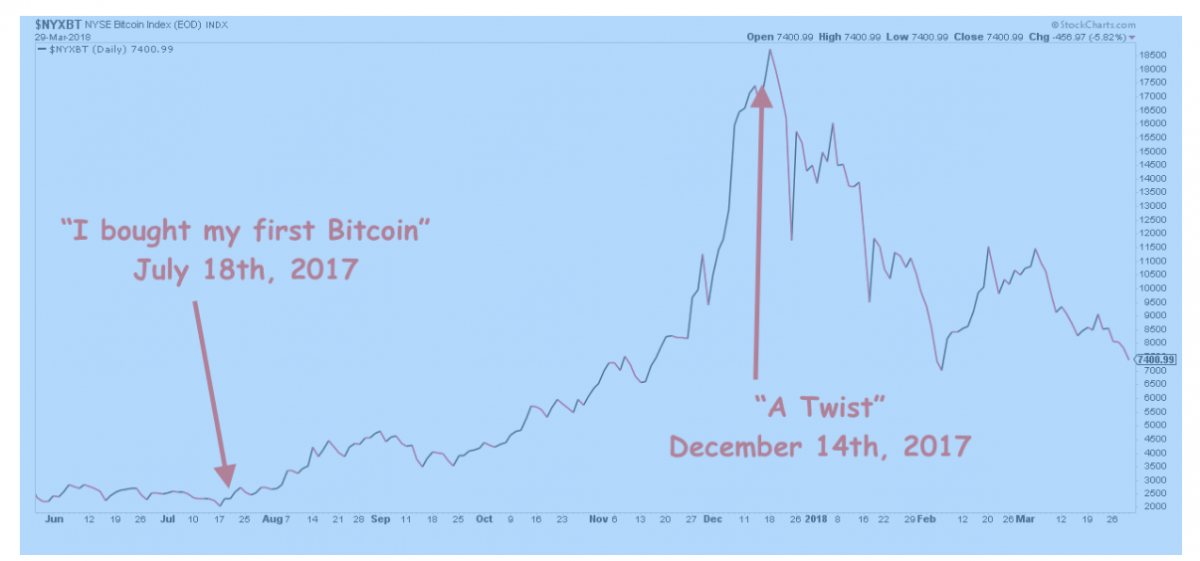

Last July, I bought my first Bitcoin and announced it here on the blog. I was the ultimate noob, but too curious to stay out. I bought it right as it was about to break a new record high above $2300. It broke out, sure enough, and then went on to run to 19,000 and change, one of the biggest bull markets I’ve ever seen.

Last July, I bought my first Bitcoin and announced it here on the blog. I was the ultimate noob, but too curious to stay out. I bought it right as it was about to break a new record high above $2300. It broke out, sure enough, and then went on to run to 19,000 and change, one of the biggest bull markets I’ve ever seen.

I rode it. Skeptically. I played around with ETH and LTC too. The amounts were never serious for me, but I had a lot of fun meeting experts in the field, setting up my storage, etc. I even recorded a PSA for CNBC.com warning moms and pops that the whole thing was pure speculation – no fundamentals, and that crashes were a regular feature of digital coins and tokens. I said ICOs would be a giant fraud (this call I will take credit for) last September.

And then, after attending a private Bitcoin dinner / discussion in Manhattan with some of the top people in IT for Wall Street investment banks, I grew extremely skeptical. I decided I was done buying into the scarcity argument that very night. More importantly, I was done accumulating any crypto currencies for good.

I wrote about it the next day in a piece that generated a substantial amount of feedback, called A Twist.

My bearish take was geared around the fact that blockchain had major potential as a process and administrative tool for companies all over the world – but none of this had anything to do with the prices of coins going up or down. So I became one of those “bullish on the distributed ledger, bearish on the coin” people that the diehards seem to hate so much.

This guest post I ran for The Unassuming Banker – The Fatal Mistake Crypto Investors are Making Right Now – went viral throughout both the Finance and Crypto blogosphere. A crossover! People were f***ing pissed.

And then I shut my mouth and just read and listened. And the enthusiasm for blockchain spread while the price of the coins crashed. Hard.

Someone reminded me of my timing on both of these posts. I took a look at the dates and bugged out a little. Calling the breakout in real-time was lucky. Getting bearish four days before the absolute top (December 14th) is just straight up freaky. I can assure you, I had no clue. If you see me launching a fund on this “track record”, by all means hit me with a can of tomato sauce as hard as you can.

But just for fun, here’s the chart:

I still have a few coins. I don’t log into Coinbase anymore or read as much about the technology these days. Maybe now is the time we should be getting interested, now that the fever has broken and the dregs are being flushed out of the system.

I’m still very excited to see what happens with the ledger projects. I don’t see myself ever getting excited about coin prices again.

All in all, that was a lot of fun. I can’t wait to tell new investors and traders about this episode many years from now. Because I’m sure there were lessons learned that will be applicable next time out.