What a wimp!

What a wimp!

As soon as China threatened to match Trump's tariffs, the White House went into emergency spin control and started saying those were only "PROPOSED" tariffs and they wouldn't really be putting them in place and, even if they go in place, it won't happen for at least 2 months. 2 months from now will be June and the elections are in November so, in short, tariffs are never going to happen.

I'm thrilled as I was STRONGLY against the tariffs though a bit disappointed that we didn't get a bigger dip first but 2,550 on the S&P was only 150-points over our 2,400 goal on the S&P, so we're not going to cry over it after getting a 300-point drop from 2,850.

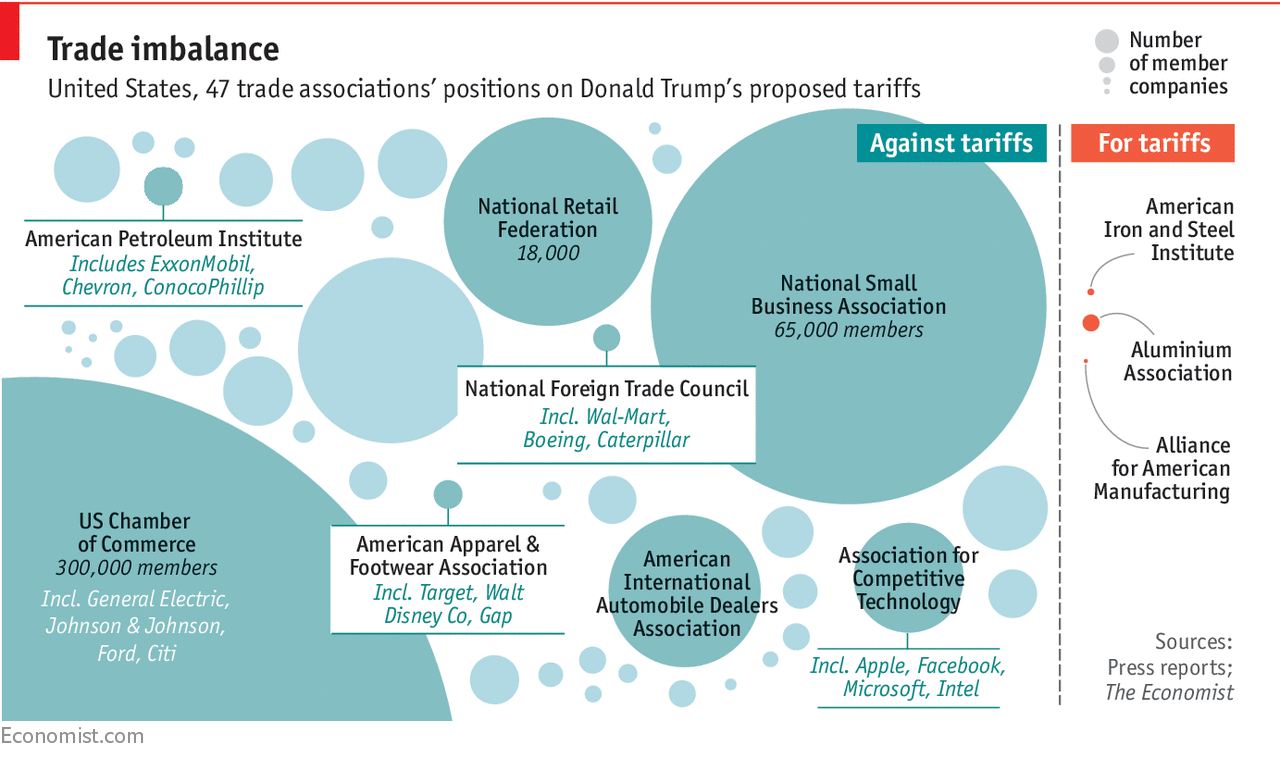

We're not out of the woods yet, Trump is still President so anything can happen but, as I've been saying all year, Trade Wars were and still are my number one market fear and at least now we know the adminstration isn't completely ignoring well, everybody (as noted in the chart above), when making their policies.

Meanwhile, let's accentuate the positive this morning and look at how close our indexes are coming to the bounce lines we predicted in Tuesday Morning's Report (see that post for details and math):

- Dow 23,800 (weak) and 24,200 (strong)

- S&P 2,640 (weak) and 2,684 (strong)

- Nasdaq 6,500 (weak) and 6,700 (strong)

- NYSE 12,450 (weak) and 12,600 (strong)

- NYSE at 12,468

- Russell 1,520 (weak) and 1,540 (strong)

So, as exciting as this recovery is – we're not there yet, though this is a big save and puts us back on a possibly bullish track but we MUST clear those strong bounce lines into the Weekend and then, as I said a week ago – it's really up to earnings, which start in earnest when the Big Banks report next Friday (and we decided they would start out pretty well). In fact, for our Members in yesterday's Live Chat Room, we played:

- If you think you need a bullish hedge, XLF should be fun at $27.62 and the April $27 ($1)/$27.50 (0.65) bull call spread at 0.35 pays 0.50 if they hold $27.50 and that's good for 0.15 (42%) in 16 days.

- You could also combine it with short C 2020 $65 puts at $6.50, say 3 of those short for $1,950 pays for 50 of the spreads at $1,750 with $200 left as a credit (net $64.33 on 300 C) with the quick $1,500 upside if the bull call spread pays off.

- Also works with WFC, where you can sell the 2020 $50 puts for $5 so maybe 4 short there collects $2,000 and nets a $250 credit in that case.

We're not there yet for adding a more longs from our Watch List but, if we're two months away from even potential Trade Wars and making progress on NAFTA, then we can expect at least a good start to the season as the big financials weigh in with some good news. In fact, JP Morgan's (JPM) Jaime Dimon just said things are looking very good for Q1.

Today we'll see if we can make and then hold those strong bounce lines but a rejection there will have us shorting the indexes again very quickly.