What total insanity!

Now China's Xi gave a speech last night promising foreign companies greater access to China’s financial and manufacturing sectors, pledging Beijing’s commitment to further economic liberalization. In a speech that officials had billed as a major address, Mr. Xi said Tuesday that plans are under way to accelerate access to the insurance sector, expand the permitted business scope for foreign financial institutions and reduce tariffs on imported automobiles and ownership limits for foreign car companies.

Though these were vague statements, the markets instantly reacted as if the Trade War ended and we flew back to the highs that we lost yesterday afternoon (still not strong bounces). There's nothing really to do but sit back and see what sticks but, far from a victory for Trump, Xi took the time to criticize the US President and his policies. As noted in the Wall Street Journal:

“In a world aspiring for peace and development, the Cold War and zero-sum mentality look even more out of place.” Mr. Xi told the Boao Forum, a government-backed gathering of business and political leaders on the tropical island of Hainan.

“Putting oneself on a pedestal or trying to immunize oneself from adverse developments will get nowhere,” he said.

Many of the initiatives Mr. Xi offered up have been previously proposed. That, along with the lack of definite schedules for action, drew some skeptical reviews from foreign business executives and Chinese researchers alike. “We have every intention to translate the measures into reality sooner rather than later,” Mr. Xi said, though he didn’t provide a clearer timetable for those or the other measures announced.

If Trump is smart (debateable), he'll thank Xi and move on – WITHOUT declaring victory. Only by stressing cooperation can we back off the cliff of this Trade War but, of course, the cooperation Xi envisions is essentially Globalization – the very thing the Trump Administration and their media lackeys have been working hard to vilify in 2018. China, of course, knows this and seeks to usurp the US's previous position as the Global Leader in Trade and Commerce by acting like the adult in the room.

If Trump is smart (debateable), he'll thank Xi and move on – WITHOUT declaring victory. Only by stressing cooperation can we back off the cliff of this Trade War but, of course, the cooperation Xi envisions is essentially Globalization – the very thing the Trump Administration and their media lackeys have been working hard to vilify in 2018. China, of course, knows this and seeks to usurp the US's previous position as the Global Leader in Trade and Commerce by acting like the adult in the room.

Meanwhile, Trump has much bigger fish to fry as the offices of his personal attorny, Steven Cohen, were raided by the FBI last night, presumbly over Cohen's claim that he paid off Stormy Daniels to stop her from talking about the Presidential Penis which may have been an illegal campaign contribution but Trump claims he didn't know anything about it, which clearly makes it an ethical violation (attorneys may not act on their client's behalf without their client's knowledge) so, either way – laws were broken.

Of course, this is like taking out Tom Hagen (Corleone's right-hand man) in the Godfather – he knows way too much about the family business and where all the bodies are buried and Trump really can't function without him at this point.

Of course, this is like taking out Tom Hagen (Corleone's right-hand man) in the Godfather – he knows way too much about the family business and where all the bodies are buried and Trump really can't function without him at this point.

It's difficult to run a vast, criminal empire by yourself – even if you do have sons to help you. You need a sharp legal mind who knows all the deep, dark family secrets to keep the Feds at bay and to silence your enemies with threats and intimidation. Take away that guy and the head of the family becomes vulnerable…

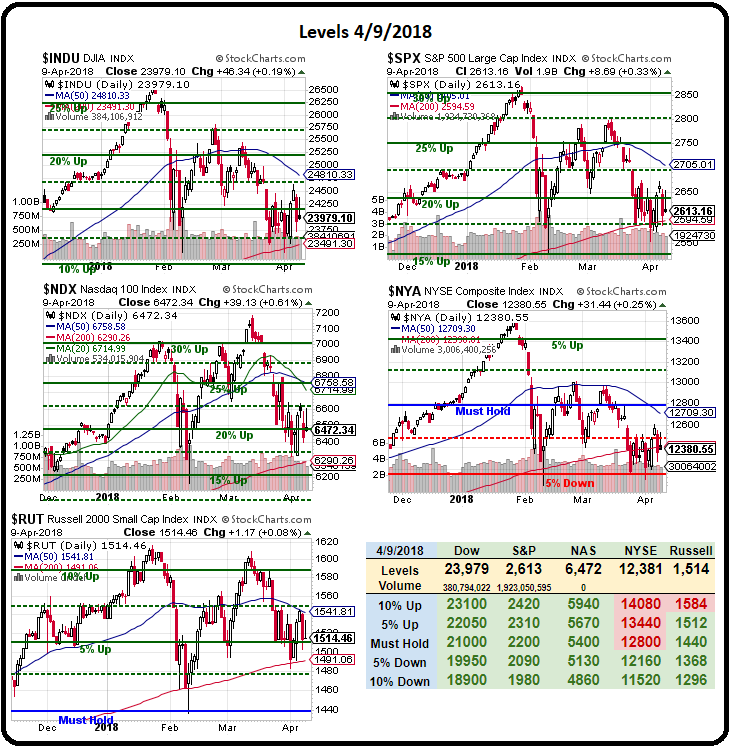

Meanwhile, the markets were weakening long before Trump declared a Trade War and vague promises by Xi don't really end things so we're still watching those bounce lines to see if we make any progress and, as they were yesterday (because we're all pumped-up again in the Futures), they are:

- Dow 23,800 (weak) and 24,200 (strong)

- S&P 2,640 (weak) and 2,684 (strong)

- Nasdaq 6,500 (weak) and 6,700 (strong)

- NYSE 12,450 (weak) and 12,600 (strong)

- Russell 1,520 (weak) and 1,540 (strong)

We're actually a bit stronger than yesterday, when the S&P was all red and the Dow had not made the strong bounce but now, like yesterday, we'll see if they can hold it FOR AN ENTIRE DAY – WITHOUT GOING UNDER and THEN it might be time to go fishing through our Watch List, looking for bargains.

Until and unless the NYSE clears it's must-hold line at 12,800 (now 12,500), you can't call this a rally anyway and the Russell is a long way from clearing 1,584 at 1,533 – even with the 19-point pop in the Futures. The Dollar is still way down at 89.30, down a full 1% from Friday's close – making the market's gains even less impressive, since they are priced in Dollars.

That's got Oil (/CL) back near our shorting line at $65 but Brent (/BZ) is also testing $70 so we can't short oil if /BZ is over $70 but, at this line ($64.75) it is worth a poke with tight stops above OR if /BZ goes over $70 as either a bounce in the Dollar or a simple loss of momentum (or a poor inventory report tomorrow) can send oil lower fast.