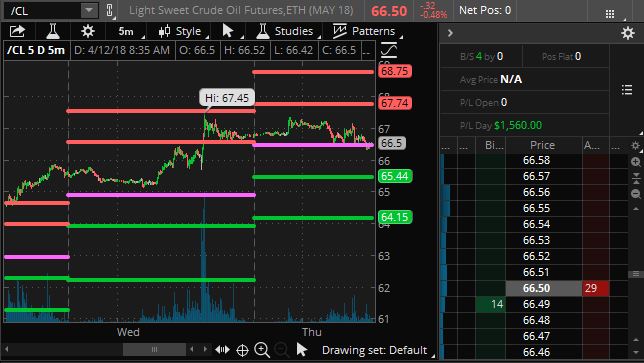

As you can see from the chart, we made just under $2,500 shorting Gasoline (/RB) futures into yesterday's run-up after inventories. We also picked up $1,560 on our oil shorts so all is very, very well this morning despite a slow week trading futures (it's generally been too crazy to risk).

Things are still risky but we had a net build in EIA inventories yesterday so the Fundamentals were bearish and oil spiked up on Syria fears but Syria themselves are not big suppliers of oil and the real news is OPEC, for the 5th time this year, being forced to admit the rest of the World is simply filling the gap of their production cuts (now 1.8Mb/d) with overall Global Supply UP 180,000 barrels a day led by the US adding 1.5Mb/d – mainly from shale production.

There's simply no Fundamental reason for oil to be over $65 so, yesterday, when we got that silly spike up on oil after the weak Inventory Report, I said to our Members:

Wow, that was a crazy reverse on /CL. I'm back short at $67.45 with a stop over $67.50 – I dare them! /RB too at $2.075 – ridiculous!

If you are Futures-challenged and want to make a longer-term play against oil prices, the Ultra-Short ETF (SCO) is down at $18.78 and we can play to get out before the May Holiday weekend with the May (18th) $18 ($1.70)/$20 (0.85) bull call spread at 0.85 on the $2 spread so upside potential of $1.15 (135%) but I'd be thrilled to take a quick 0.40 (47%) off the table, as that's a very nice short-term gain.

Otherwise, as usual, the Futures are up and, as usual, we're waiting tosee if they can make our Strong Bounce Lines before we begin chugging the Kool-Aid and joining the buying frenzy. Since Tuesday, we've gained a single green box on the Russell (now 1,555) but still waiting for recovery signals from the S&P, Nasdaq and NYSE and, since the levels need to hold for a full day, at least – nothing they do today really matters anyway:

- Dow 23,800 (weak) and 24,200 (strong)

- S&P 2,640 (weak) and 2,684 (strong)

- Nasdaq 6,500 (weak) and 6,700 (strong)

- NYSE 12,450 (weak) and 12,600 (strong)

- Russell 1,520 (weak) and 1,540 (strong)

Don't forget, we expect strong bank earnings tomorrow and if that can't get us over the hump, nothing will. Bed Bath and Beyond (BBBY) had good earnings but bad guidance and they are getting hit hard this morning so it would be foolish to rush back into the market if other retailers begin warning as well.

It's a good time to be patient.