Here we are again!

Here we are again!

Back in January, the S&P 500 staged an epic rally that took us over the 2,700 line to 2,850 before falling back to 2,700 in early February, when I wrote "10% Tuesday – Market Correction Hits Our Primary Goal" and "Flailing Thursday – Trouble at 2,700" saying:

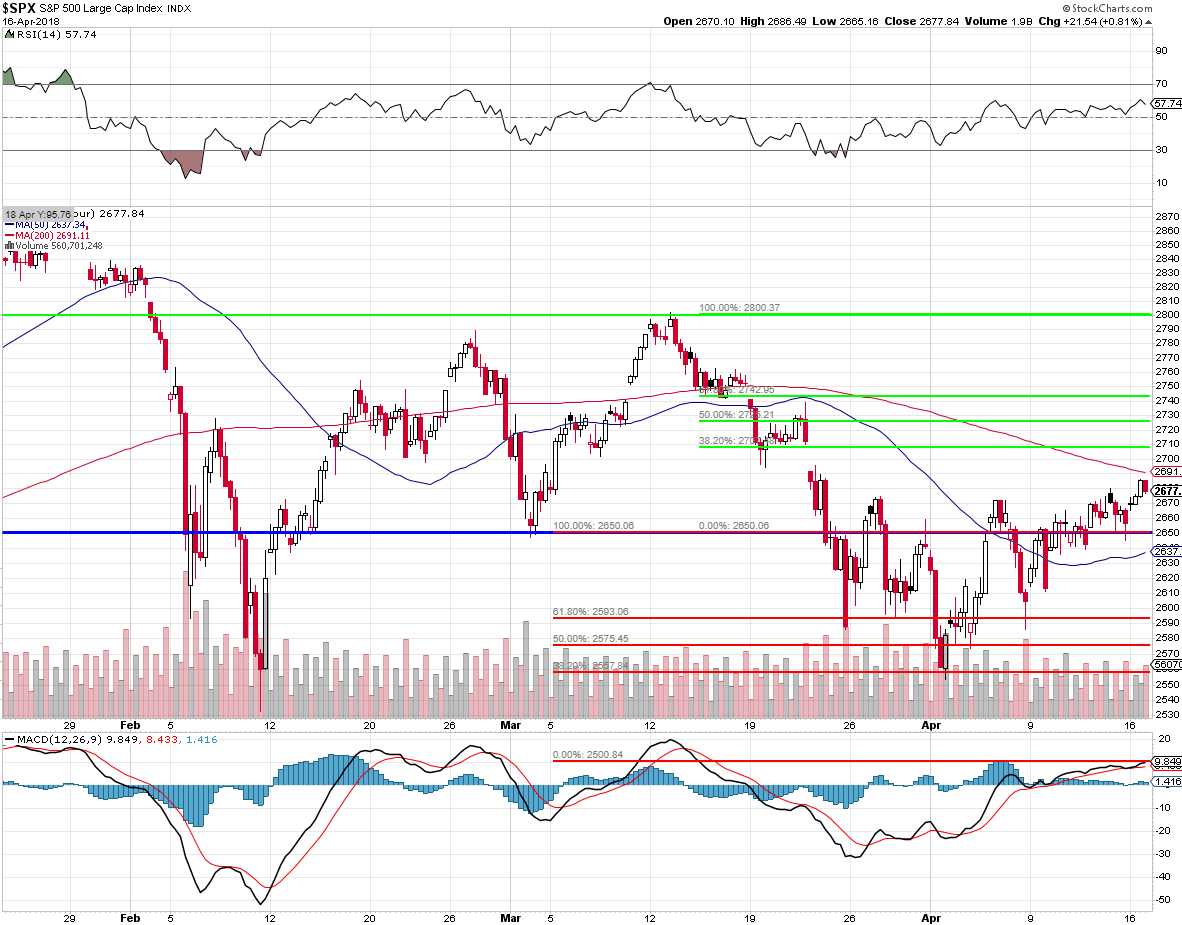

Well, it's been a day and people are already freaking out because we haven't flown back to 2,850 and it's going to be a while before they realize 2,850 shouldn't have happened in the first place and it's more likely that this (2,700) is the top of the range, not the bottom – at least through Q2. On our Big Chart, 2,640 is the 20% line on the S&P and, even being generous, THAT should be the middle of a range we move 5% up (2,772) and 5% down (2,508) in, so call it 2,500 to 2,800 with 2,650 the middle line. That's where I think we'll settle once all the dust clears.

As you can see, from the S&P chart using our predicted lines and the Fibonacci series above and below them – everything is proceeding as I have forseen for the past 3 months and now we get to see if earnings season can keep us in the green end of our trading range or not. Remember, I can only tell you what is going to happen and how to make money playing it (3 months in advance!) – the rest is up to you…

In fact, on Thursday, 2/8, I said in our Morning Report:

I also like /TF over 1,500 and /NQ over 6,600 and /NQ is lagging and likely to pop big if we get moving. /YM 24,800 and /ES 2,675 will confirm and tight stops if 2 of the 3 fail to hold those lines!

As you can see, we're following the 5% Rule™ pretty much to the penny so it's not a good time to "think" when we can just watch and see what happens. If the market is recovering, we should get back over that strong bounce line (2,728) and hold it into the weekend and, if the weak bounce line (2,684) fails to hold this morning – it's more likely we head back down than up.

We hit 2,728 on the nose and that long play of 53 points was good for gains of $2,650 per contract and flipping short at our mark and riding it down to 2,550 the next week was good for gains of $8,900 per contract so – you're welcome! We never made our downside goal of 2,500 (2,535 was the low) but the year is young and we're expecting some earnings disappointments begininng next week – oh, and Trump is still President!

Well, for now – the wagons are circled but they are getting picked off one by one. Anyway, Trump turmoil aside, we're still in our predicted trading range and the closer we get to the top, the more we want to short and the closer we get to the bottom – the more we want to go long. See – not complicated at all…

At the moment, we are shorting the S&P Futures (/ES) at the 2,700 line but we can't be sure we hit it so we short 1x at 2,697.50 and another 1x at 2,698.50 to average 2,698 on 2x short and then, at 2,699.5, we short 2x more and then we're averaging 2,698.75 on 4x short and we stop out at 2,700.25 with a 1.5 loss, which would be $75 per contract (4x!) and then we simply wait for a cross below 2,700 to short again with tight stops. We'll see how that works out tomorrow.

What we have, so far, is a very low-volume rally that makes the majority of its gains in the even lower-volume Futures so our theory is that a big line like 2,700 on the S&P is likely to be rejected and, since we've run up for no reason from 2,660, that's 40 points and our 5% Rule™ says we can expect at least a 20% (of the run) retrace back to 2,692 and that's good for $400 per contract, so why not play it since we're only risking a $75 loss?

A strong retrace would be another 8 points to 2,684 and, below that, it's a fail and we begin to look back down to 2,650 for support.

We have 3 Fed speakers today (Quarles at 10, Harker at 11 and Super-Dove Evans at 1:40, so likely they'll try to keep us afloat as we digest the first week of solid earnings. Industrial Production and Chain Store Sales were both good this morning so no major reason we should do more than retrace a bit off this run. Other than that, it's a watch and wait kind of day.