I am now a Donald Trump fan!

I am now a Donald Trump fan!

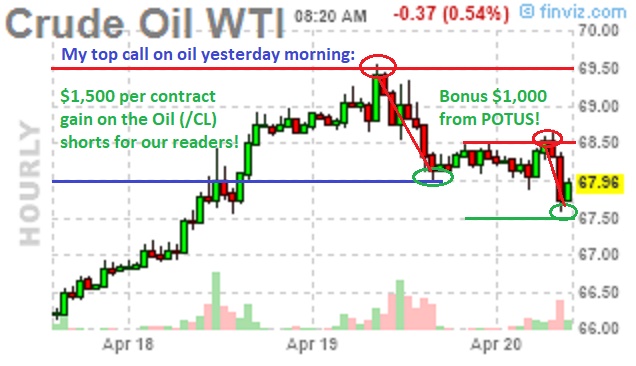

Yesterday morning I was interviewed on the Benzinga Pre-Market Show where our trade of the day was to short Oil (/CL) (USO) Futures at $69.50 and, during the day yesterday we got had a nice $1,500 per contract gain as oil dropped to $68 and then, this morning, as oil climbed back to $68.50, where we wanted to short again, our beloved President, Donald J. Trump tweeted out exactly what I had said yesterday afternoon at my Nasdaq interview, with the President saying:

Needless to say we are thrilled, not just with the money but with the President's ability to summarize what we say during a 5-minute interview in a single tweet – THAT'S LEADERSHIP! Now, if the President would just put me in charge of the Strategic Petroleum Reserve and stake me with the Treasury, we could pay off the National debt in no time buying and selling oil contracts.

We wouldn't need OPEC to back down if we simply break the NYMEX and we could do that by calling their bluff and promising to sell their fake, Fake, FAKE orders for 223M barrels of oil for May delivery, which we said last Friday would be cancelled or rolled by today and, lo and behold, as of this morning, there are only 26,672 contracts left open for May delivery, representing just 26.6M barrels (90% cancelled) and that will be cut in half today, leaving the US with just 13Mb imported to Cushing at $67.50 per barrel when, earlier this month, we had "orders" for over 500M barrels at $62.50 that were canceled by the criminal NYMEX trading cartel WHO ARE UNDERMINING THE ENERGY SECURITY OF THE UNITED STATES, which happens to be TREASON!

Well, the orders were not "cancelled" – they "roll" the orders into other months to FAKE demand there as well and this little shell game pushes the price of oil up and up and costs US Consumers Billions of Dollars at the pump every month. In fact, this month's $5 gain x 20M barrels a day x 30 days is $3Bn we're being screwed out of in April alone. On the whole, manipulation of this sort accounts for 50% of the price of oil or $216Bn a year just on the base oil barrels and another $216Bn on refined products – that's $432Bn a year that is being extracted from American consumers by home-grown manipulation at the NYMEX – HALF or our deficit! If you don't believe me – just ask former Exxon CEO and former Secretary of State Rex Tillerson – who said as much to Congress.

|

Click for

Chart |

Current Session | Prior Day | Opt's | ||||||||

| Open | High | Low | Last | Time | Set | Chg | Vol | Set | Op Int | ||

| May'18 | 68.26 | 68.62 | 67.62 | 67.85 |

08:50 Apr 20 |

– |

-0.44 | 3069 | 68.29 | 26672 | Call Put |

| Jun'18 | 68.22 | 68.66 | 67.61 | 67.89 |

08:50 Apr 20 |

– |

-0.44 | 245721 | 68.33 | 584545 | Call Put |

| Jul'18 | 67.88 | 68.40 | 67.37 | 67.64 |

08:50 Apr 20 |

– |

-0.44 | 19750 | 68.08 | 234272 | Call Put |

| Aug'18 | 67.43 | 67.83 | 66.86 | 67.11 |

08:50 Apr 20 |

– |

-0.42 | 7527 | 67.53 | 164915 | Call Put |

| Sep'18 | 66.79 | 67.20 | 66.27 | 66.50 |

08:50 Apr 20 |

– |

-0.40 | 4228 | 66.90 | 232714 | Call Put |

As you can see from this morning's NYMEX strip chart, the front 4 months plus what's left of May have 1.243 BILLION barrels of open orders which is 178M barrels more than were open just a week ago. That means that, not only was every single FAKE order from May simply transferred to longer months but they added 178,000 FAKE orders to jam the prices higher.

The problem is it's far to easy for the manipulators to roll the contracts but, if the President allows me to run the SPR (and gives me a Treasury checkbook to cover the margin), we could have called their bluff and promised to sell them (by shorting) 200M barrels at $69.50 from the SPR and when oil drops $2 like it did a week later, we pocket $400M in profits. The worst case is they call our bluff and buy 200M barrels of oil from the SPR for $69.50 and that puts $13.9Bn into treasury and causes a build in commercial oil inventories of 50M barrels a week for the month of May – that would be fun!

Clearly, they could never do that so I could continue to make $400M a week for Mr Trump and much, much more if, for example, the President were to make more tweets like this morning's and, of course, there would be NO COLLUSION – I would just happen to make Billions of Dollars any time Trump tweets something about oil – that's the American way, right? Certainly that's what the people who did make Billions of Dollars will be saying when questioned abou these trades.

Have a great weekend,

– Phil