When February started, the S&P looked like this:

Now May is starting and the S&P looks like this:

It's like we've simply zoomed in on the exact same chart but that "zoom" means we've cut 1.67% off the range and now the S&P is stuck in a 3% range, between roughly 2,600 and 2,700 and, if we zoom out a bit more, we see that tightening range is wedged right between the 200-day moving average at 2,611 and the 50-day moving average at 2,688 and the narrower this range gets, the more those averages squeeze together leading to a very exciting resolution at some point.

Remember, the 5% Rule™ is not TA, it's just math but we illustrate the math on charts – that's all they are good for, really. Charts tell you where you've been, not where you're going and, if you want to stay ahead of the market, you should use the 5% Rule™ – because it tells you which way the markets are heading. In January the 5% Rule™ told us the markets were wrong and the rally was overdone. That's why our Short-Term Portfolio is up 85% for the year – because we made the right bet at the right time.

Knowing the bottom of our range lets us know when to buy while other are panicking that there is no bottom and knowing the top of our range lets us know when it's time to cover or sell to the suckers who think rallies will last forever. What the 5% Rule does, in essense is simply to reinforce Warren Buffet's adage to "Be fearful when others are greedy and be greedy when others are fearful.”

This is not a complicated concept – almost any value investor knows it but there are very few of us value investors left in the World and most of the trading world acts more like the audience in a Bugs Bunny cartoon – stampeding in and out of the positions (5:00) whenever somebody throws a switch. At Philstockworld, we teach our Members to just sit back, relax and enjoy the show and boy, do we get our money's worth!

In Member Chat last week, as well as our Live Trading Webinar, we went over our Watch List and there are still over a dozen stocks we like that can be bought cheaply and, as earnings wind down this season, I bet we will be able to add a dozen more value stocks to the list.

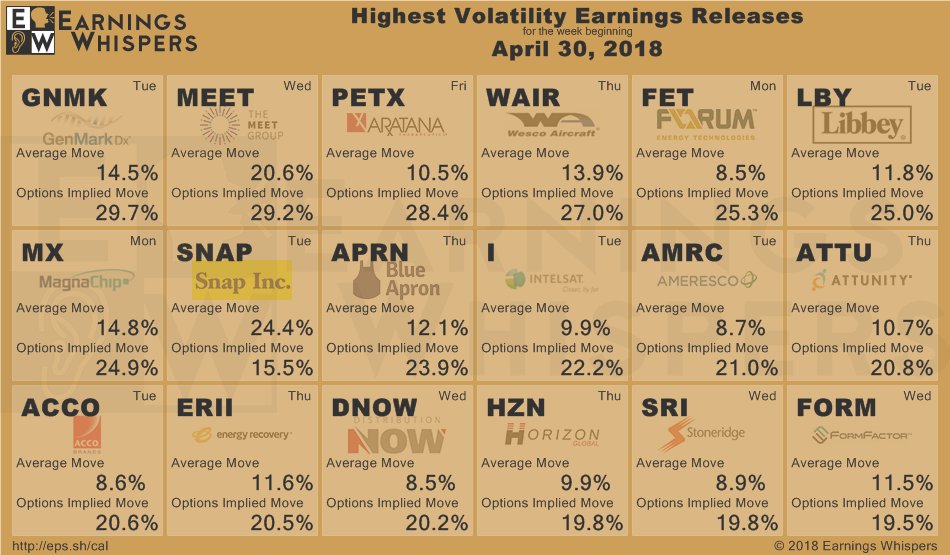

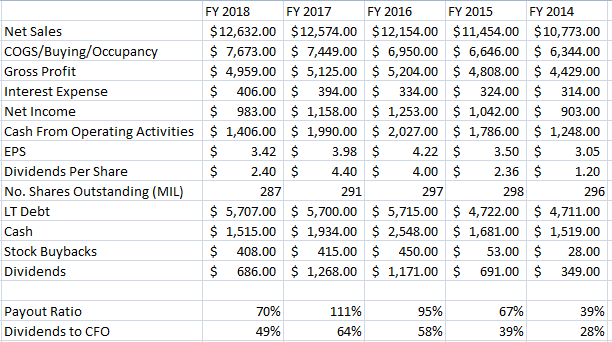

One still ridiculously cheap stock on our Watch List is LBrands (LB), the owners of Victoria Secret, Pink and Bath and Body Works – where your kids always go to get Mom a present. LB was our Trade of the Year when it was $35 last year and we cashed out when it hit $60, because $60 was as stupidly high as $35 is stupidly low but $45-50 is a very good target so we can take advantage of this channel and set up the following trade (we already are long LB in all our portfolios):

- Sell 5 LB 2020 $30 puts for $5.20 ($1,600)

- Buy 10 LB 2020 $30 calls for $8.50 ($8,500)

- Sell 10 LB 2020 $35 calls for $6 ($6,000)

That's a net $100 credit on a $5,000 spread that is 100% in the money to start so all LB has to do is not be lower than $35 in Jan 2020 and you get a 51x (5,100%) return on your $100 credit. It's also a margin-efficient trade as the worst thing that can happen to you is you are forced to buy 500 shares of LB for $30 (less the $100 you collected) or 15% below the current price – that's your WORST case and then you get a $2.40/share dividend for your troubles!

The ordinary margin on the short puts us $1,269 so it's a very efficent way to make $5,000. It's funny to call this an earnings play as it has a 2-year time-frame but earnings are the week of the 15th (no date yet) and that $100 credit can turn into $500 very quickly after that if things go well – or even not as badly as expected.

There are many, many undervalued companies out there so there's really no need to chase after Amazon (AMZN) at $1,600/share against their $10 of projected earnings (p/e 160) and maybe their profits go up 50% in 2019 ($15) and let's pretend they double in 2020 to $30, that's still getting $55 back on $1,600 (0.34%) while LB will likely return $10 in earnings and $7.50 in dividends which is $17.50 or 58% of our worst-case entry.

Of course you might get lucky with AMZN or NFLX or TSLA but, over a career investing – do you think you are likely to beat a strategy that returns 58% through earnings every 3 years vs the one that returns 1/3 of 1%? This is why we prefer value investing – there are plenty of companies out there that actually make great returns for their investors, not in stock price – but in CASH!!! that they produce on the bottom line. When it all hits the fan – which ones do you want in your portfolio?

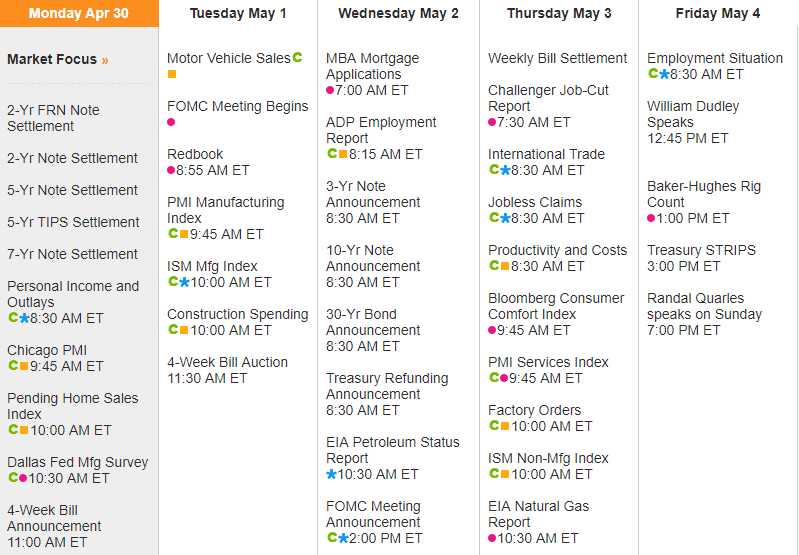

Another 1/3 of the S&P 500 report this week so 2/3 done with earnings after this. The Fed has a rate decision on Wednesday (2pm) and then Non-Farm Payrolls on Friday so it's going to be an exciting week to play – stay tuned for the action!