Europe is closed, Asia is closed.

Europe is closed, Asia is closed.

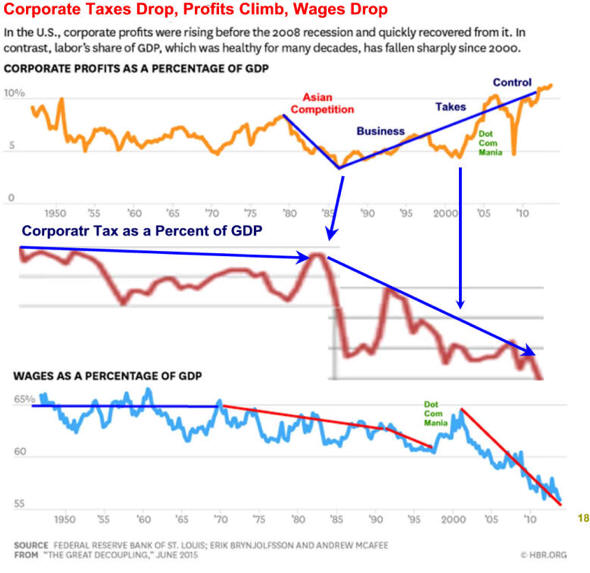

Today is a day the World celebrates it's ordinary workers so, of coure, American doesn't even aknowledge it. As you can see from the chart, since the Reagan Revolution (when the Rich overthrew the Poor and set up an Oligarchy in the United States), the wages of the Top 1% have grown 138% in the past 4 decades while the wages of the Bottom 90% have grown just 15%. To acknowlege the working poor in this country would be to potentially begin a conversation on how badly we treat them – and that's a conversation the Oligarchs dare not have in America.

As the Wage Gap expands, so does the Wealth Gap, exponentially – especially now that we're no longer taxing the wages of the wealthy. As I warned back in 2007's "The Dooh Nibor Economy (that’s “Robin Hood” backwards!)":

One of the great tricks of our economy is that there are avenues of wealth creation that are available to those of us who are already rich that are denied to those of you who aren't. Only 1% of a Prince and Associates survey of high net worth individuals between $5 and $10M invest in ETFs and only 17% invest in mutual funds, NONE of the investors with more than $20M in assets invested in mutual funds, which are the new "opiate for the masses" but that's a whole other article I will write! 76% of the super-rich (> $20M) invest in hedge funds (Ka-Ching for me!) and another 36% invest in my other enterprise, start-up companies privately and through venture capital firms (and you think I just choose these professions at random).

Obviously, if you have less than $1M in household income you are essentially prohibited from investing in hedge funds due to government restrictions aimed at

keeping out the riff-raffprotecting the small investor. This game is rigged so that the bottom 90% are forced to put their money into "safe" investments that return 3-10% a year while the top 10% take that same money and roll it into investments that make over 20% per year. Just ask a person with less than $500,000 in net worth (there's 295M of them in this country) how much money the dividend tax reduction saved them…

In fact, my example at the time (June 6th, 2007) of how the rich get richer screwing the poor was none other than Donald J. Trump himself (I wonder what ever happened to that guy?):

I'm not going to get into a doctoral thesis on the subject but here's a quick example of how the Dooh Nibor economy works:

Donald Trump (and no disrespect to The Donald as I love the guy, but he's a good example), one of our 1,000 Billionaires, spends $1.2B to put up 1,000 new condos in Manhattan. He sells those condos for $2.2M each to 1,000 of our nation's 1.8M people who have $10M or more, pocketing an extra $1Bn for all his hard work.

- Since nice condos "only" cost $1M just 7 years ago, the poor multimillionaires must figure out how to come up with an extra 10% of their net worth in order to maintain the "Trump Lifestyle." Let's say they earn $500K per year and need an extra 50K – doesn't seem like much does it?

- They in turn raise the prices they charge to 1,000 of their clients (the 150M strong "middle class") by 10%. These people are the doctors, lawyers, store owners, white collars, etc. that you do business with every day.

- That forces the middle class, who can barely afford their lifestyle to pass that 10% on to each other, as well as the 120M Americans who have household incomes of less than $48,000 a year, many FAR less than that in the form of vital services they can't live without.

That's how your housekeeper, who spent $3.20 per gallon to fill up her tank in order to clean your house for $10 per hour, ends up paying for the Trump condo she's cleaning. It's a nickel here and a dime there but when you pick the pockets of 270M people for "just" a quarter a dozen times a day that's $3 x 270M x 365 days = $295Bn a year. Multiply this petty theft over a 10-year period and that's how you move $3T of our missing $4T from the poorhouse to the penthouse – Dooh Nibor!

All this would be fine if we were equally creating wealth among our lower classes but we are not. In fact, the median hourly wage for American workers has declined 2% since 2003 after accounting for inflation. Inflation has, in fact, outpaced income for workers earning up to $80,000 per year, (the bottom 90% of our country). The top 1%, meanwhile, made "just" 8.7% of all income in 1996 but made 11.2% of it last year, a 28% increase for the decade or $325Bn a year extra going to 1M very happy households.

Should we (assuming you are lucky enough to be one of Mr. Trump's potential buyers) care? For every one Robin Hood there was a very rich King and his whole court, the wealthy Sheriff of Nottingham and his crew… even Maid Marion had her own maids – it's human nature, it's the way of the world, it's the natural order of things…

Human nature has now given us President Trump, putting the wolf in charge of the hen house is NOT going to help balance the scales (or the books) for the average American and, by average American, I mean anyone who misses the $3.5M cut-off of wealth that puts you in the Top 1% these days.

Human nature has now given us President Trump, putting the wolf in charge of the hen house is NOT going to help balance the scales (or the books) for the average American and, by average American, I mean anyone who misses the $3.5M cut-off of wealth that puts you in the Top 1% these days.

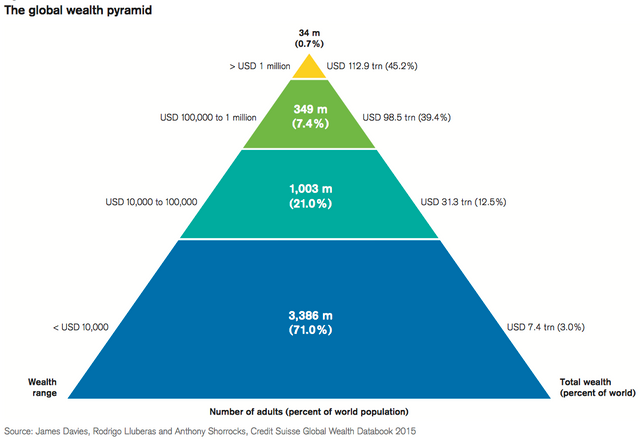

Globally, the Oligarchs of the Top 1% (50M adults) have about $120Tn in wealth, which is an average of $2.4M each. The Bottom 3.4Bn adults have to make due with $7.4Tn between them or $2,176 each. The next 1Bn adults are better off, with $31.3Tn, so thay have $31,000 each in net worth while the Global Top 10% have $100Bn or about $285,000 each to their name.

Clearly, the 3.4Bn adults and their families who have just $2,176 between them aren't able to do much but try to survive from day to day. Lifting them out of poverty would require something radical, like taking $7.4Tn of the Top 1%'s $120Tn (6.2%) and giving it to the bottom 3.4Bn people, which would DOUBLE their lifestyle and lift them out of poverty. Of course, this would leve the people on Top with just $2.24M, down from $2.4M and, to avoid that kind suffering – they have worked hard to put in "Conservative Leaders" around the World and they have bought up the newspapers and the TV stations, the Radio Stations and the movie companies – all in an effort to convince you – the bottom 5Bn adults on the planet – that poor people suck and it would be bad policy to help them.

Now I don't blame your average Millionaire for being unwilling to sacrifice $66,000 to eliminate Global Poverty – they are not generally the ones who are objecting. It's the Top 0.01%, the Billionaire Class, who find it cheaper to buy politicians and TV stations than it would be for them to give up 6.6% ($66.6M per Billion) of their wealth to help their fellow man. Those are the people who are villifying the poor and paying off politicians to kill any program that may attempt to help them – for fear of them actually working, which would demonstrate the wisdom of redistributing the wealth – even slightly.

Now I don't blame your average Millionaire for being unwilling to sacrifice $66,000 to eliminate Global Poverty – they are not generally the ones who are objecting. It's the Top 0.01%, the Billionaire Class, who find it cheaper to buy politicians and TV stations than it would be for them to give up 6.6% ($66.6M per Billion) of their wealth to help their fellow man. Those are the people who are villifying the poor and paying off politicians to kill any program that may attempt to help them – for fear of them actually working, which would demonstrate the wisdom of redistributing the wealth – even slightly.

And bringing half of the World's population out of poverty in exchange for 6.6% of their wealth won't hurt the 1% at all. The poor don't use that money to buy back their own stock or go crazy with their paddles at Christie's – the poor spend their money and, like all money – it funnels right back to the Top 1% – so they get it all back anyway. We're just saying it would be nice if they shared some for a little while.

It was Marx who said: "Workers of the World unite – you have nothing to lose but your chains" and his lessons were taken to heart, by the Top 1%, who broke the unions and divided the workers by party, by race, by gender – by any means they could to keep them from uniting and they turned the chains into things that are less obvious like student loan debt, non-compete clauses, non-transferable health care and underfunded pension plans – all designed to keep the employees chained to the companies they work for at the lowest wages possible.

It was Marx who said: "Workers of the World unite – you have nothing to lose but your chains" and his lessons were taken to heart, by the Top 1%, who broke the unions and divided the workers by party, by race, by gender – by any means they could to keep them from uniting and they turned the chains into things that are less obvious like student loan debt, non-compete clauses, non-transferable health care and underfunded pension plans – all designed to keep the employees chained to the companies they work for at the lowest wages possible.

Now we are entering a new era, where automation will make 50% of the existing jobs unnecessary and that will make the Top 1%, who own the machines, amazingly wealthy while the 1 out of 2 of you who become "unnecessary" will get to fully experience life without a Social Safety Net – especially at the rate this administration is working to dismantle it.

In a World that has invented robots to take care of your every need and perform every labor that needs to be done – you would think we would all be living in paradise. That's not the case, of course, because very rich people have patented those robots and they will collect all the gains from their metal slave labor and they will give none to you – the soon-to-be poor.

Keep voting for the Oligarchs and see what happens to the Wealth Gap. Marx warned us about this 100 years ago but, oops, he's also been vilified – hasn't he?

Happy Workers Day (suckers)!

"History repeats itself, first as tragedy, second as farce." – Karl Marx