WTF?

Elon Musk, the CEO of Tesla (TSLA) gave a Donald Trump-like conference call yesterday where he refused to answer questions and insulted the analysts – even calling out "fake news" on well-documented problems with their auto-pilot system. At one point in the call, Musk ignored the professional analysts for 23 minutes to chat with a blogger who had "friendlier" questions than, for instance "How are you going to replace all the cash you are burning?" and "How many model 3s will you produce now that you've failed to hit goals for the 3rd consecutive quarter?"

This morning, even their biggest supporter at Morgan Stanley is bailing:

"While the consequences are unquantifiable, we believe Tesla’s CEO made a mistake in refusing to answer some of the analyst questions about the Model 3 ramp. Additionally, we found the posture out of character with the normally inviting,enlightening tone of prior conference calls over many years," writes Morgan Stanley's Adam Jonas.

To be clear. Tonight’s conference call didn’t go very well. Feedback we have received from investors during and following the call support this view. Irrespective of the Tesla CEO’s annoyance with the genre of questions he was receiving from the analyst community, we note that an important part of Tesla’s success has been its relationship with the capital markets in funding its ambitious plans. The analysts on the call represent the providers of capital that Tesla has throughout its history depended upon.

Other analysts blasted TSLA as well:

Other analysts blasted TSLA as well:

- TESLA INVESTORS SAY ODD EARNINGS CALL ’SHOOK CONFIDENCE’: RBC

- TESLA LIKELY TO FALL TODAY AFTER ‘TRULY BIZARRE’ CALL: JPMORGAN

- TESLA REITERATED SELL AT GOLDMAN ON LIKELY MISSED TARGETS

Musk is playing a serious game with other people's money and refusing to answer questions about what he's doing with that money and whether or not his company is doing what he said it would do is NOT going to encourage more people to invest – especially in bonds he needs to float again to survive. I have long said Tesla will likely implode as it's essentially a huge Ponzi scheme and he's run out of new projects that are big enough to paper over the running disasters the old projects have become. (Disclosure: We do have shorts on TSLA in our hedge fund).

.jpg) Speaking of shorts, closing last week's Silver (/SI) longs with a $4,170 gain from our Webinar Trade (available to our Options Opportunity Portfolio Members at Seeking Alpha) last week, yesterday, live, we made $110 per contract shorting the Dollar (/DX) and $105 per contract shorting the Russell (/RTX) and then, into the close, we shorted the Russell again at 1,565 and this morning it's a jackpot at 1,545 for $1,000 per contract gains and we'll take those off the table and wait and see how bouncy things are this morning – congratulation to all who played along with us!

Speaking of shorts, closing last week's Silver (/SI) longs with a $4,170 gain from our Webinar Trade (available to our Options Opportunity Portfolio Members at Seeking Alpha) last week, yesterday, live, we made $110 per contract shorting the Dollar (/DX) and $105 per contract shorting the Russell (/RTX) and then, into the close, we shorted the Russell again at 1,565 and this morning it's a jackpot at 1,545 for $1,000 per contract gains and we'll take those off the table and wait and see how bouncy things are this morning – congratulation to all who played along with us!

Last May, when I warned people with "Tesla’s Earnings Miss – Emperor Musk has no Clothes!" we discussed a much better investment that could be made in General Motors (GM), saying:

Meanwhile, General Motors (GM), a company that MADE $2.6 BILLION in PROFITS in Q1 (that's right, TSLA's entire sales, in profits alone!) is still being valued lower than TSLA and it's just as ridiculous today as it was a month ago when I laid out the following bullish GM options spread idea:

- Sell 10 GM 2019 $32 puts for $4.25 ($4,250)

- Buy 25 GM 2019 $28 calls for $7.25 ($18,125)

- Sell 25 GM 2019 $35 calls for $3.60 ($9,000)

We added that trade to our Options Opportunity Portfolio and, so far, it's flat but we are pretty sure that either TSLA is drastically overvalued or GM is drastically undervalued and probably both are right, so we're very comfortable with both of our auto sector calls now that we've seen the actual earnings of both companies. Oh wait – are they still called "earnings" when they are actually horrific losses in Tesla's case?

This trade still has the rest of the year to play out but GM, despite a huge pullback, is still over our goal of $35 and the Jan $32 puts are now $1.50 ($1,500) whole the Jan $28/35 bull call spread is $5.10 ($12,750) for a net of $11,250, which is up $6,375 (130%) from our original $4,875 cash entry and on it's way to the full $12,625 gain so still almost 100% more to gain from what's left of our trade.

See, you don't have to subscribe to our PSW Morning Reports for $3 a day to get these fantastic trade ideas, even a year later – you can still get in on the last 100% gain that's left on our old trades!

I know it's a quaint, old-fashioned notion but we like to invest in companies that actually MAKE MONEY and are trading at reasonable multiples to the money they make because, when things hit the fan (and there are lots of fans to hit) – we're "stuck" with companies that make money and, in the long run, making money does not go out of fashion with investors.

When you invest in cult companies like Tesla, you become very dependent on the cult leader's ability to keep things going and we've been watching the myth of Elon Musk unravel more and more the past few months. I talked about Fake Financial News and it was only 3 weeks ago that Adam Jonas of Morgan Stanley ajdusted his price target on Tesla to $376/share. What sound reasoning was there behind Jonas' faith in TSLA?

The Morgan Stanley analysts said that Tesla might be “too big to fail,” set to employ around 50,000 people in the next couple of years, and every job in an auto maker is believed to support around seven jobs in the economy.

So if someone buys a Toyota Camry Hybrid that was made in Georgetown Kentucky instead of a Tesla Model S that was made in Fremont, California, 7 support people will lose their jobs? No, that's not how manufacturing works – those 7 people will simply supply Toyota instead of Tesla and, not only that but, if you assume Tesla is more automated than Toyota or GM, then you are DESTROYING JOBS every time you buy a Tesla. So yes, the premise is asinine and you need to be careful whose idiotic price targets you are following.

So if someone buys a Toyota Camry Hybrid that was made in Georgetown Kentucky instead of a Tesla Model S that was made in Fremont, California, 7 support people will lose their jobs? No, that's not how manufacturing works – those 7 people will simply supply Toyota instead of Tesla and, not only that but, if you assume Tesla is more automated than Toyota or GM, then you are DESTROYING JOBS every time you buy a Tesla. So yes, the premise is asinine and you need to be careful whose idiotic price targets you are following.

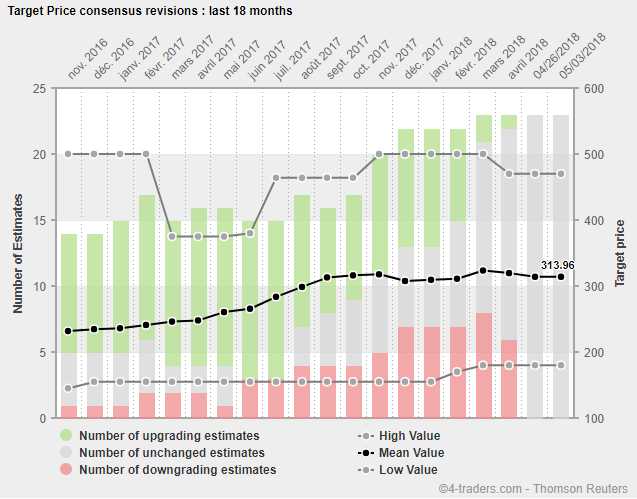

18 of Tesla's 33 analysts upgraded their estimates recently with an average of $480/share while 11 have a hold at $313/share and just 4 analysts (and me) have the balls to say it isn't even worth $200 (I'm at $100 and I doubt I'd even jump in there).

You don't need a degree in economics to spot flawed analysis – a little common sense puts you miles ahead of the pack in this game!