The Compound

Courtesy of Michael Batnick

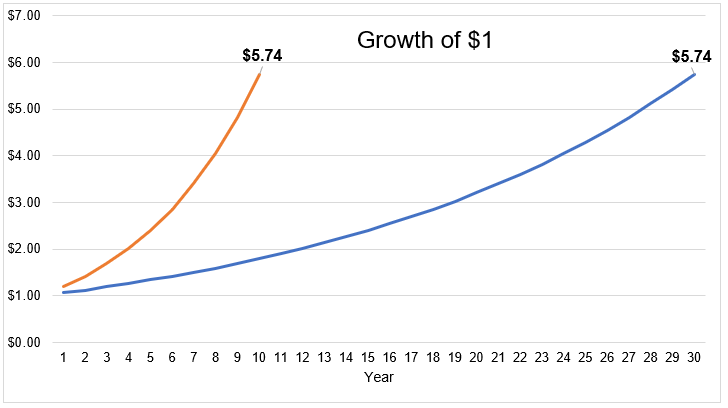

What’s greater, 306 or 612? You might be inclined to pick the first choice, because 30 is five times larger than 6. But due to the (miracle/magic, Einstein quote, etc.) of the compound*, 612 is three times larger than 306.

$1 earning 6% a year over 30 years grows to $5.74, a rate of return that many investors would find satisfactory. But why wait thirty years if you can do the same thing in ten years? In order to squeeze those 30 years of gains into 10, one would need to earn 19% a year.

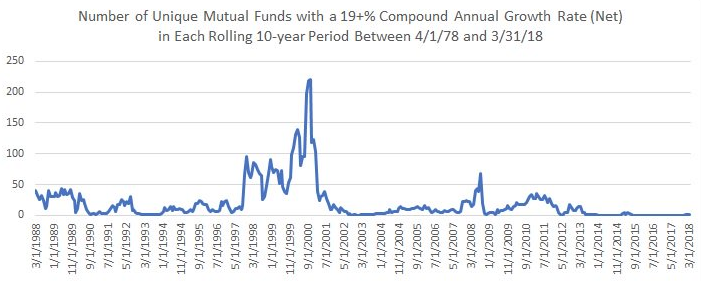

How often have investors been able to compress 30 years into 10? To answer this, I turned to Jeffrey Ptak, who dug up some data on this (emphasis mine).

Of the 5,697 unique mutual funds that had at least one 10 yr net return in the 40-year span 4/1/78 – 3/31/18, 407 had at least one 10-yr period in which its CAGR >= 19% p.a. More than half of those occurred just before the tech/internet bubble burst in ’00. Since the 10-yr period ended 3/31/13, there have been no more than 5 funds w/19%+ CAGR in any rolling 10-yr period. It’s been very quiet in that regard. There are 7,075 rolling 10-yr periods in which a fund generates a 19%+ CAGR after fees, of 743,732 rolling 10-yr periods total across all funds. So, essentially, funds generated a 19%+ return in about 1% of all rolling 10-yr periods that happened within the 40-year span ended 3/31/18.

There are no easy ways to grow your wealth over the long-term, but looking for short cuts is a good way to to fail quickly.

*Shameless plug, subscribe to our YouTube channel, The Compound.