That's $1,000,000,000,000 and that means each $195 (the target) share of AAPL would be worth 0.000000000195 of the company – so don't laugh at Crypto traders for working with completely meaningless fractional currencies! The difference is that AAPL makes $12 per $195 share which is, in theory, your money as a shareholder. That means your $195 investment is paid back through earnings in 16.25 years while BitCoin, et al, of course, earn nothing at all. Although, as anyone with a timeshare can tell you – fractional ownership is never as good as you thought it would be…

If AAPL is not worth $1Tn, then the markets are in big trouble as AAPL is about 15% of the Nasdaq and 4% of the S&P 500 so, if they are going to top out here – the whole market could falter. Even worse, AAPL has climbed just under 20% in the past 3 months while the Nasdaq is up 7.2% and that's not good since 15% of 20% is 3% so AAPL is responsible for 1/2 of the Nasdaq's total gains since last earnings – if that trend reverses – things can get ugly very fast!

So, step one to figuring out if the market is going to go higher is figuring out whether it's reasonable to pay $1 TRILLION for AAPL stock. Apple certainly thinks so, the company is in the process of buying back $250Bn worth of it's own stock and the average volume of AAPL is 37M shares or $6.8Bn at the current $185 price so just the additional $100Bn they have announced would make them the sole buyer of stock for 15 days but, in reality, all they need to do is buy 10% of that per day to create a lot of upward pressure on the price so, in effect, AAPL can easily be the biggest buyer of their own stock every business day for the rest of the year.

If most companies were doing that, I'd be very unhappy as it's often a waste to buy back your own stock but Apple just repatriated $250Bn in cash from overseas and, frankly, they have nothing better to do with their money. The average p/e ratio for the rest of the S&P 500, sans AAPL (which brings it way down for all of them) is over 21 times earnings so there are no "bargains" to be had if Apple wants to go shopping. Take out AAPL's $55Bn in earnings and the p/e of the Nasdaq goes over 30 times what's left of earnings and, once again, there's nothing to buy.

If most companies were doing that, I'd be very unhappy as it's often a waste to buy back your own stock but Apple just repatriated $250Bn in cash from overseas and, frankly, they have nothing better to do with their money. The average p/e ratio for the rest of the S&P 500, sans AAPL (which brings it way down for all of them) is over 21 times earnings so there are no "bargains" to be had if Apple wants to go shopping. Take out AAPL's $55Bn in earnings and the p/e of the Nasdaq goes over 30 times what's left of earnings and, once again, there's nothing to buy.

So Apple is "returning" the cash to shareholders by reducing the outstanding share count by 10%, which will then pop your earnings per share from $12 to $13.20, which then drops AAPL's p/e ratio to 14.77 and they STILL have $150Bn in the bank, or 15% of your share price and they are STILL making another $5Bn a month in after-tax profits. WOW! How can you not own AAPL?

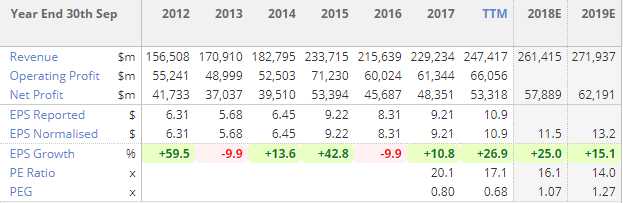

We do own AAPL in our Member Portfolios as well as our Hedge Fund but we bought it (most recently) on pullbacks to the $160s – as we close in on that magical Trillion Dollar target at $195, we have to wonder if it's time to sell but the number are still very good and we're hard-pressed to find better places to put our money. The above chart, from Stockopedia, does not take buybacks into account so those EPS numbers can really take off as Apple reduces their share count.

Oddly enough, through the magic of options, you can still net into AAPL for $150 by selling the 2020 $160 puts for $10.25 – which means you are getting paid $10.25 (now) in exchange for your promise to buy AAPL for $160 between now and Jan, 2020. Of course, AAPL may never get that low in which case you just keep the $10.25 and don't get to buy the stock for $160 but $10.25 is more than 5% of the stock price – not bad money for doing nothing.

We can use that to construct a play on AAPL and let's say we're willing to buy 500 shares for $160 ($80,000), which would ultimately use $40,000 of ordinary margin. Then we can sell 5 puts without fear as our worst case is getting AAPL for a net 20% discount and we can construct the following spread:

- Sell 5 AAPL 2020 $160 puts for $10.25 ($5,125)

- Buy 10 AAPL 2020 $165 calls for $34.50 ($34,500)

- Sell 10 AAPL 2020 $195 calls for $19.10 ($19,100)

That's a net cash entry of $10,275 on the $30,000 spread that's currently $20,000 in the money at $185. The short puts require $5,717 in ordinary margin but that's well worth it as the upside to this spread at the modest target of $195 is $19,725 (192%), which is a very nice 20-month return. In fact, if this trade goes well and AAPL is steadily over $185, you should make 10% a month on this position as the value of the premium you sold to others (the short puts and the short calls) diminishes over time – that's the only sure thing in the markets – premium decays!

With AAPL buying another $100Bn worth of their stock over the next year or so, I certainly like the odds of this play working out HOWEVER, you have to take your obligation to buy 500 shares of AAPL very seriously – if the market crashes, AAPL will not be immune and you may end up owning the stock and having to wait patiently for it to recover over time (hopefully).

Meanwhile, we're not going to sit and do nothing. While we are waiting 619 days until Jan 2020 expiration, we can also sell some short-term calls – especially as we don't think AAPL will blast over $195 too quickly as people balk at the Trillion Dollar valuation. The July calls expire in 73 days and we can sell the July $190s for $4.45 so, if we sell just 3, we collect $1,335 and, if AAPL goes higher, the Sept $200 calls are $3.85, so that's our target and Jan $215 calls are $3.60, so that's our next roll and if we really think AAPL will gain $165Bn in market cap by the end of the year – then we should be making much more aggressive bets!

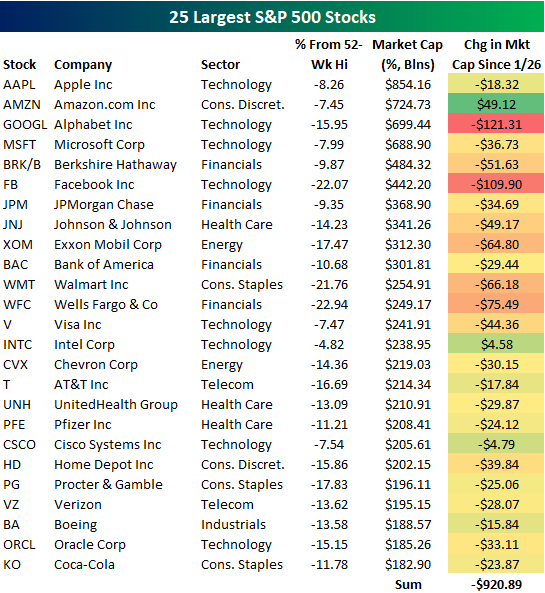

Since $165Bn is more than the ENTIRE market cap of all but 25 companies on the planet – let's assume AAPL is not going to go up that much, right? This chart is a bit old as AAPL is up to $939Bn at $185 and AMZN is at $776Bn at $1,600 but you get the idea. If Apple or the market made that kind of move between now and January – I'd short the crap out of it.

Since $165Bn is more than the ENTIRE market cap of all but 25 companies on the planet – let's assume AAPL is not going to go up that much, right? This chart is a bit old as AAPL is up to $939Bn at $185 and AMZN is at $776Bn at $1,600 but you get the idea. If Apple or the market made that kind of move between now and January – I'd short the crap out of it.

Anyway, assuming all goes well and you are able to sell those 3 short calls and then do it again about 8 more times while you wait, you'll collect another $10,000(ish) and then it's a net free spread that pays $30,000 in 20 months. Now does it sound interesing?

Leaning to squeeze another 50% out of your trades is what we teach our Members at Philstockworld. All part of our "Be The House – NOT the Gambler" school of investing!

We're seeing a lot of underlying weakness in the indexes but we're sure not blaming AAPL – who have been holding things up this week and last. Overall, we're still expecting a pullback that brings more companies in-line with AAPL's 16x p/e – not that AAPL will pop $165Bn to catch up with the rest of the idiotic valuations.

After all, if AAPL is 4% of the S&P then $165Bn x 25 = $4.125 TRILLION! Where the f*ck do you think that money could possibly come from? Keep in mind the entire US GDP is less than $20Tn so we're talking 20% GDP growth just to justify that increase. Nope, that's where I'll put my foot down.