On Second Thought…

Courtesy of Michael Batnick

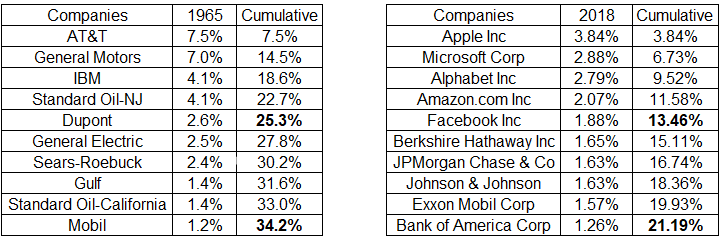

In 1965, AT&T and General Motors represented 14.5% of the S&P 500. Today, the top five names, Apple, Microsoft, Alphabet, Amazon, and Facebook make up less than that.

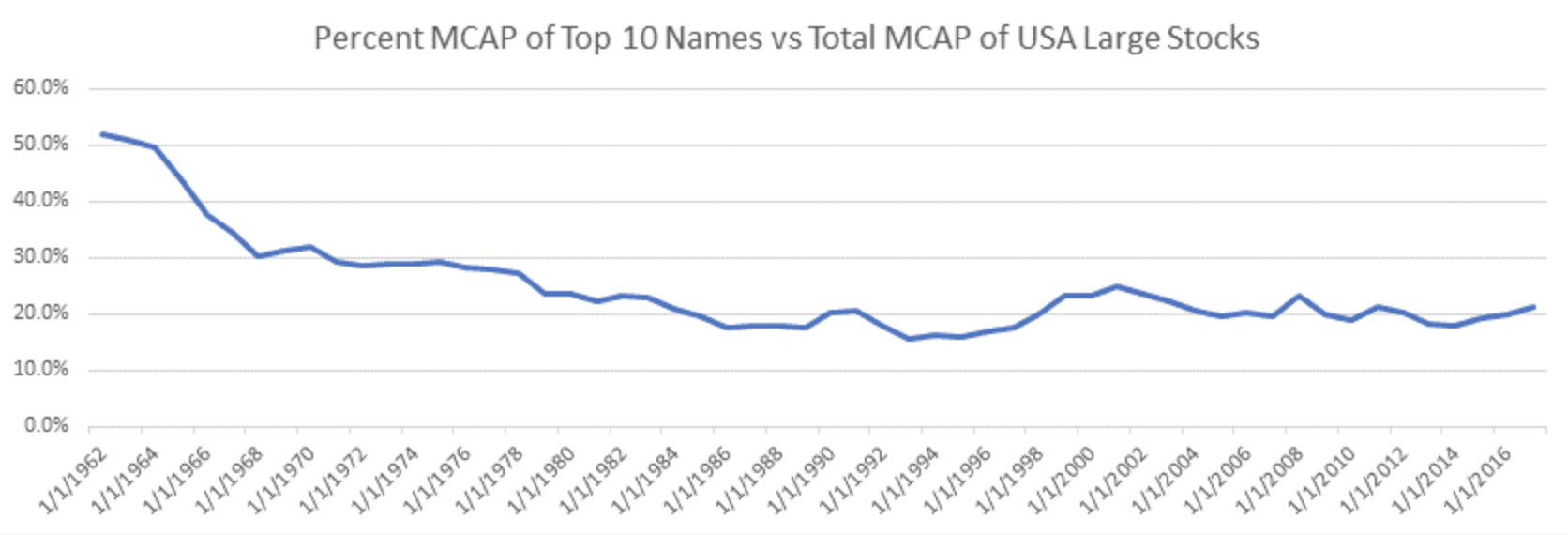

The percent of market cap made up by the ten largest names was cut in half from 1962-1980, and has held steady for the better part of the last four decades, as shown in the chart below from Travis Fairchild of O’Shaughnessy Asset Management.

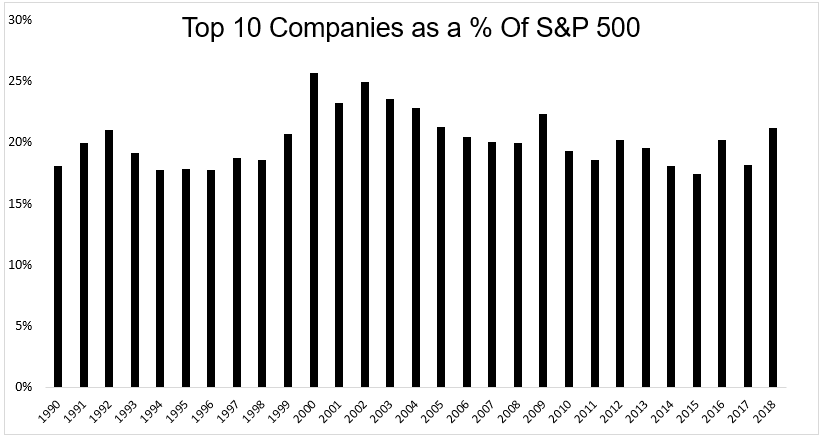

In the 29 years since 1990, General Electric and Exxon were the largest stocks in the S&P 500 nineteen times. The only others to claim the top spot were IBM, Microsoft, and now Apple.

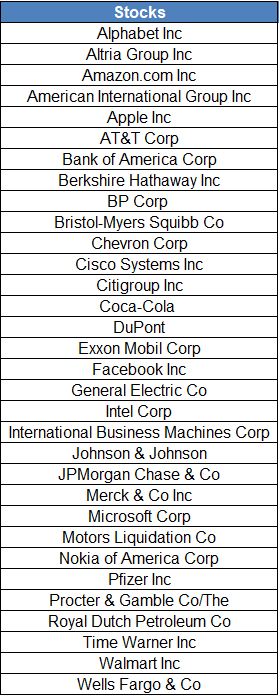

The top ten has been tough to crack, with only 33 names appearing on this list since 1990 (table below). Exxon is the only company that has been in the top ten in market cap every year (General Electric also held this distinction until 2018).

One more interesting nugget and I’ll arrive at the point. In 1965 AT&T’s market cap was 7.5% of the index and had a market cap of $317,350,000, equivalent to $253.83 billion today, which would make it the 13th biggest stock. I doubt we see a repeat of this any time soon. A 7.5% weighting today would be $1.78 trillion.

I asked Patrick and Travis to take a look at this because I was wondering whether the recent stampede into index funds was distorting the market. I was thinking that if it were, then the distortion would show up in the biggest names and their weighting in the index. You could plainly that there is no pattern in the chart below.

I recently wrote about General Electric falling from the 5th biggest weighting in the S&P 500 down to the 40th, despite the torrent of flows. But does this prove anything? Travis told me I might be thinking about this the wrong way. He said:

“Lets say a large sovereign wealth fund throws $500 billion into the Russell 1000. If that much money moves into that index I don’t think it is going to increase the percent of the top 10 vs the rest. You might even argue it would decrease that metric, the logic being that the smaller/illiquid names will have more of an upward market impact than the larger more liquid names given the substantial inflow.”

I think Travis is onto something, but my brain hurts thinking about this. What are the best ways to examine what affect, if any, flows to index funds are having at the micro level? I’d love to hear some feedback and maybe we can look further into this.