The Dollar is down 0.5% this morning.

Dow Futures (/YM) are up 0.5% to match but the Russell (/RTY), Nasdaq (/NQ) and S&P (/ES) are up less than 0.25% as of 8am and that's not at all impressive. /NQ is right on the 7,100 line, so an easy short below the mark but Apple (AAPL) is holding their developer's convference this afternoon and may say something bullish – so it's a very dangerous short. Apple popped over $190 last week, now just $65Bn shy of a $1Tn valuation and 7% more ($13.30) will do the trick and we'll have the World's first Trillion Dollar Company.

If AAPL is doing well, the Nasdaq does well and so does the Dow, where every AAPL point is 8.5 Dow points and so does the S&P, where Apple makes up 4% of the 500 Indexe's total weighting.

If it were not for Apple's great effect on the market, I'd be enthusiastically shorting the indexes but, as it is, we keep getting stopped out of our short positions as they keep making new highs. This morning we're taking a whack at shorting the S&P Futures at 2,745 and the Dow Futures at 24,750 but tight stops over those lines as we near the pont of maximum crazy but the Dollar (/DX) should be councy at 93.70 and that will hopefully cause a pullback into the open – but only a small one as we expect it to have trouble getting back over 94.

Trade Wars are bad for the Dollar because the Dollar is an instrument of trade and China, Canada, Mexico and Europe have all threatened to retaliate if Trump doesn't reverse his position by this Thursday-Saturday G7 meeting so you bulls out there are betting on Trump being a great deal-maker, which is his repution but not at all his actual results.

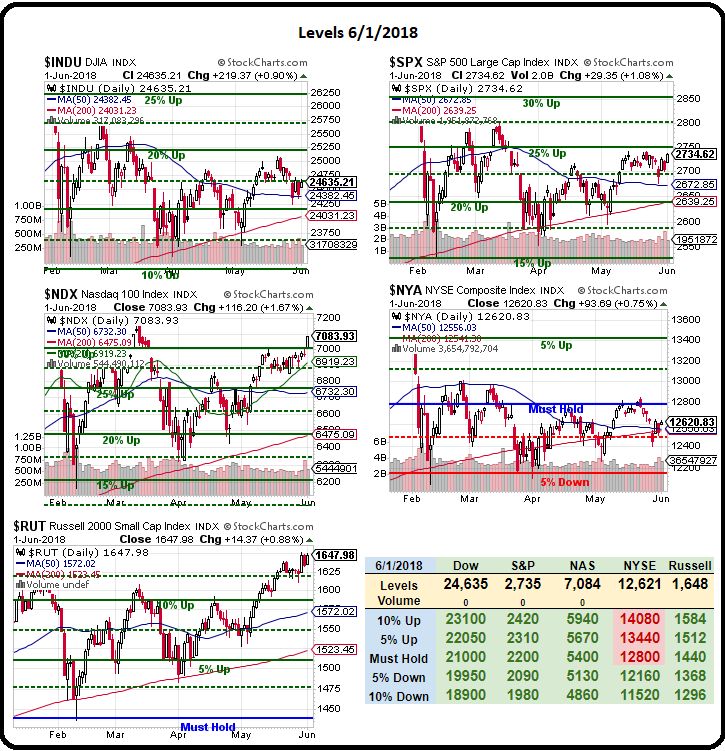

Nonetheless, we've punched back over that 2,728 line on the S&P, which generally puts us back in bullish territory until it fails but I called for CASH!!! in early May, as we briefly popped over the line – as I didn't think it would last and I don't have enough faith in Trump's negotiating skills to think this rally will last either but, if we do manage to stay over the line for more than a day – we may have to consider some defensive longs as our portfolios are not balanced bullish enough to keep up with a proper rally.

Note we were at 2,875 back in January and that's 5% higher than we are now and, in the bigger picture, this is all just a small, bullish consolidation of the rally from our Must Hold Line on the S&P at 2,200 where 2,860 is the 30% line so the expected retracement from there, according to the 5% Rule, would be 20% of the 660 run or 132 points, back to – you guessed it, 2,728, which is why we're forced to be bullish above that line!

The strong retracement is basically the 2,600 line and, as you can see, that held up like a champ so, in truth, we should have followed the 5% Rule and been more bullish as we consolidated down there but I was too worried about all the Global issues the market seems very happy to ignore, which is not very different than the way things were 10 years ago – right before we collapsed so, unfortunately, I have to continue to play cautiously until the S&P proves it can make AND HOLD that next 5% gain.

Effectively, that means our caution and hedging will cancel out about 1/3 of the move higher so we expect to underperfom a bullish market by 33% but, as I said, we can fix that with some bullish hedges and we'll look more closely at those during the week. Oil is back to $65 this morning and gasoline is back to $2.12 so no lasting effect from the pre-holiday pump job that took us to $72.50 – indicating demand is simply not there to support it.

Unlike the US, Investor Confidence in the Eurozone is at the lowest since October, 2016 at 9.3, in June and that's down from 19.2 in May and significantly below the 18.4 expected by leading economorons. Investors were spooked by turbulence in the Eurozone, driven by the political uncertainty in Italy that caused significant disruption to Italian markets last week – the things I worry the US is ignoring.

Germany's DAX is actually down 600 points (5%) from its May high while our markets are making new ones. Usually we all move in lock-step so it's an unusual break and we've been betting Europe is right and US investors are wrong but, so far, it's costing us as the US markets defiantly climb higher – no matter what news hits it.

In on Monday's report, Sentix said “Economic expectations in the eurozone are downright tilting,” adding that investors appeared to be expecting a “serious slowdown in growth” in the euro area. Please use the sharing tools found via the email icon at the top of articles. The eurozone’s biggest economy, Germany, was also “under pressure,” and saw its reading fall for the fifth month in a row to its lowest level since July 2016. The country appears particularly vulnerable to any escalation of trade disputes with the US, said Sentix, with key sectors such as automobiles and banking “increasingly suffering.”

I suppose I'm just an old-fashioned guy who thinks things like this actually matter – especailly when the US market reaction is to slam up to record highs. Perhaps it's because there has been no official retaliation yet or perhaps it's because US investors inclue enough Trump voters who believe we can "win" a trade war and that it will be good for the economy (unlike every trade war ever fought).

So it's going to be an introspective week if the market keeps going higher as we need to think about why we're too bearish in a bull market but, hopefully, this pre-market rally will collapse and I'll get to say "I told you so" and we can get back to our normal trading range.

Either way, it will be an interesting week!