This is good news.

This is good news.

We actaully have a deal with North Korea to bring some stability to the region. The document signed by Trump and Kim early this morning contained four key points:

- Establishing new US-DPRK relations

- Building a lasting and stable peace regime on the Korean Peninsula

- Reaffirming commitments to work toward complete denuclearization

- Recovering POW/MIA remains.

It's a long way between this agreement and actually making the lasting peace but this is a great start though it's nothing for the markets to get excited about as I had mentioned last Wednesday that North Korea's entire economy is just $17.4Bn, which is less than Jeff Bezos gained in wealth last month. Jeff Bezos has rockets and top-notch scientists and doesn't like Donald Trump – make peace with him and THEN I'll be impressed…

Meanwhile, the Amazon (AMZN) and Apple (AAPL) driven Nasdaq is up 30 points (0.42%) since last Wedneday and we're back at our shorting line at 7,200 on the /NQ Futures but tight stops above because there's no end to the crazy in this market. Things seem to be on hold at the moment, ahead of tomorrow's Fed Meeting but I'm not sure what more good news is going to propel the market even higher.

Meanwhile, the Amazon (AMZN) and Apple (AAPL) driven Nasdaq is up 30 points (0.42%) since last Wedneday and we're back at our shorting line at 7,200 on the /NQ Futures but tight stops above because there's no end to the crazy in this market. Things seem to be on hold at the moment, ahead of tomorrow's Fed Meeting but I'm not sure what more good news is going to propel the market even higher.

The Dow and the S&P were higher in January but the Russell is also making new highs at 1,680 and 1,700 would be up 10% since May 1st (1,550) and again – that's crazy! What did the markets do in the past 30 days to gain 10% in value? 10% a month is a 120% a year pace and we'll all soon be Billionaires at that rate of return so you can bet it's going to continue – but it's very unlikely to…

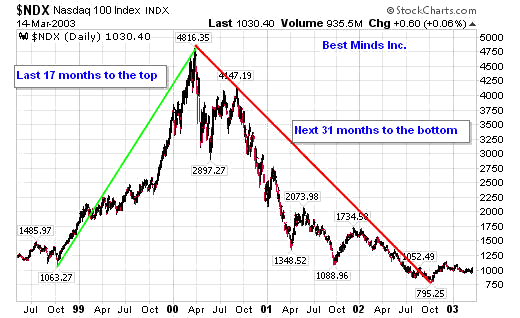

Of course the market did gain about 140% between April of 1999 and March of 2000 so it's not like it can't possibly happen. Then it lost 80% over the next 8 months but let's not dwell on the negatives, right? Like now, the time leading up to April of 1999 had been generally positive and the markets just entered a brand new phase of crazy as we broke over the 2,000 line on the Nasdaq, triggering an epic run.

Of course the market did gain about 140% between April of 1999 and March of 2000 so it's not like it can't possibly happen. Then it lost 80% over the next 8 months but let's not dwell on the negatives, right? Like now, the time leading up to April of 1999 had been generally positive and the markets just entered a brand new phase of crazy as we broke over the 2,000 line on the Nasdaq, triggering an epic run.

How do you make money betting on a run like that? Well, you can simply buy something like the Nasdaq ETF (QQQ) 2020 $220 calls for $2 as QQQ is currently $175 so doubling from here is $350 and that would make those calls worth $130 for a 65x gain so, if you think you may be too bearish in a $150,000 portfolio, you can buy $2,000 worth of QQQQ 2020 $220 calls (10) and, if the Nasdaq doubles you'll have about a $130,000 gain. See – you can more than double your portfolio while risking just $2,000 so it's not like you need to pay 250 times earnings for Netflix (NFLX) at $362 for fear of missing out.

Speaking of missing out – it's almost time to short Tesla (TSLA) again as Muck cranks up the crazy and engineered a short squeeze on his stock with all sorts of amazing claims including:

SpaceX option package for new Tesla Roadster will include ~10 small rocket thrusters arranged seamlessly around car. These rocket engines dramatically improve acceleration, top speed, braking & cornering. Maybe they will even allow a Tesla to fly …

Almost forgot! Due to recent regulatory/customs rules enacted to inhibit transport of anything called a Flamethrower, we have renamed our product: “Not a Flamethrower”.

In 8 years we've gone from building 500 vehicles per year in California to 100k+ and growing

It's great that they got production to 100,000 and now he's claiming a 200,000 rate for 2019 but that's 9 years to get that far and still nowhere near break-even. I did the math on Wednesday and Tesla needs to sell 20,000 cars week (1M) before breaking even and that's under the silly assumption that they'll make 20% per car sold (currently they lose 25% per car sold), which is double the industry average.

So we're excited to get another chance to short TSLA but we have to wait and see how high it can fly as they break up to test $350 and hopefully retest the highs at $380 to give us some juicy entries. Even now, you can sell the Jan $400 calls for $25 and pair that with the Jan $400 ($90)/350 ($57) bear put spread at $33 for net $8 on the $5 spread and $42 of upside (525%) in 220 days if TSLA is below $350 at Jan expirations. As I said, we're going to wait to see if we can play at higher strikes but that's what I mean when I say it's very tempting.

The same goes for all of our shorts – even Nasdaq 7,200 – we can't afford to have conviction betting against an irrationally exuberant market. We'll just have to go with the flow and see how high we can fly before the sun melts our wings.