Courtesy of Declan.

Yesterday, Small Caps led the rally as Large Caps lost ground. Today, those same weak Large Caps took another hit and dragged Tech indices with them. Small Caps also suffered but they have plenty of wiggle room before they hit trouble.

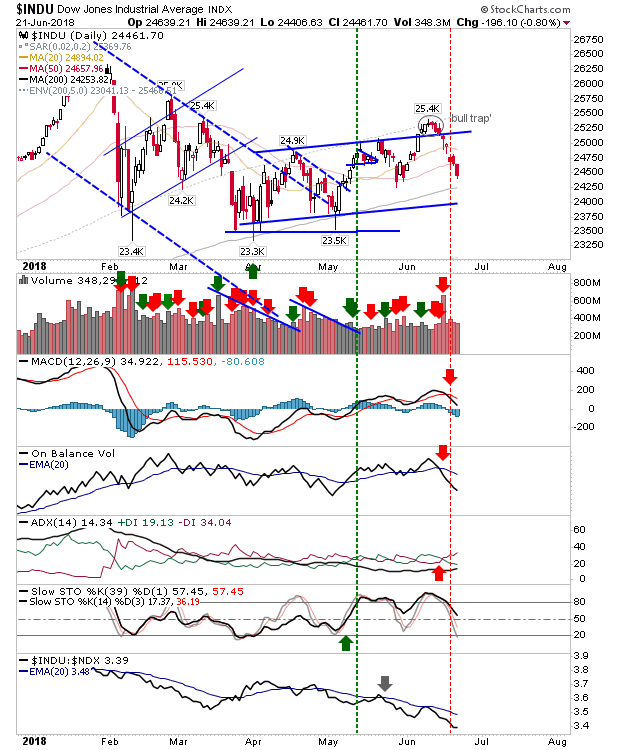

The Dow sell-off didn’t stop at its 50-day MA and is now on course to test its 200-day MA. Technicals, aside from Stochastics, are bearish.

Of greater concern was the hit to the Semiconductor Index. The attempt to hold 1,393 support was swiftly undone by a bearish engulfing pattern to follow on from the ‘tweezer top’. Next up is the 50-day MA. The sharp underperformance relative to the Nasdaq 100 is also weighing on the index.

The damage in the Semiconductors hasn’t yet spread to the Nasdaq or Nasdaq 100 but the outlook for their breakouts is not good. However, for now, their respective breakouts are intact. The only damage done was a fresh ‘sell’ trigger in the MACD.

The Russell 2000 also got hit with a MACD trigger ‘sell’ but 20-day and 50-day MAs are available to play as support.

For tomorrow, eyes should be on the Semiconductor Index. The Dow is effectively range trading and not that interesting but the Semiconductor Index was looking to challenge highs with Tech Indices hitting new all-time highs. Should the former fail then the chance for ‘bull traps’ in the Nasdaq and Nasdaq 100 become significantly higher. Aggressive traders could look to play for a reversal in the Nasdaq and Nasdaq 100.

You’ve now read my opinion, next read Douglas’ blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for “fallond”.

If you are new to spread betting, here is a guide on position size based on eToro’s system.