As long as you are quiet, the monsters can't get you.

As long as you are quiet, the monsters can't get you.

While it's a fun plot for a movie, it dosn't play out very well as a trading premise and just because we choose to ignore problems, doesn't mean they will go away – or leave us alone. The market was heading back up into the close and again in the Futures but then those dummies at Dailmer had to make a sound (a profit warning due to tariffs) that sent all the EU auto-makers lower.

This isn't about Trump's tariffs, this is about the Chinese tariffs that are a retaliation to Trump's tariffs to which he has threatened to retaliate with more tariffs which will, of course, cause China to retaliate with even more tariffs and so on and so on – we're only in the first inning of this game! Both Dailmer and BMW are down over 5% for the week now after dropping 4% this morning in EU trading and EU markets are down about 1% but the US Futures are flat because we still think we can sneak past all the monsters without getting hurt.

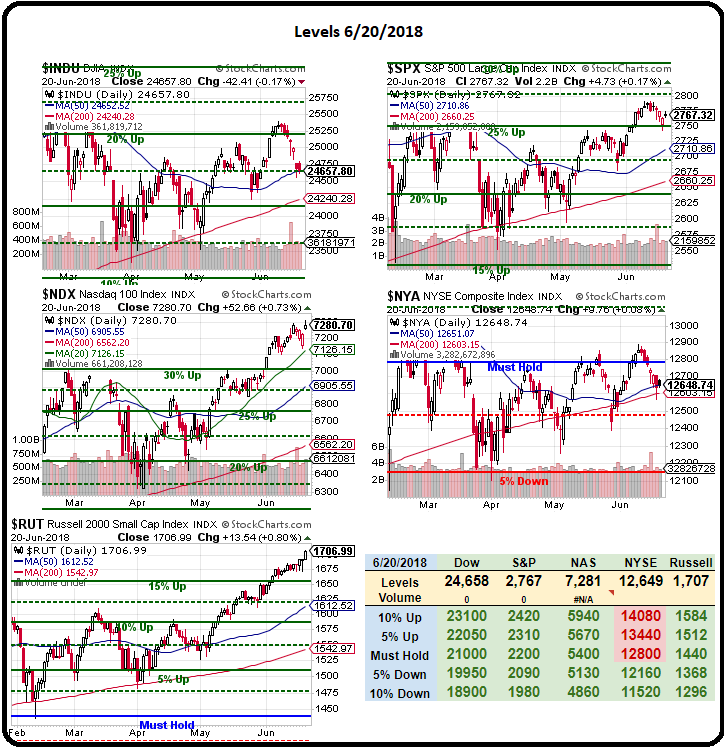

Yesterday, in our Live Trading Webinar, we discussed some of the many reasons we were not going to chase the indexes higher and, in fact, we took a short on the Nasdaq as it tested 7,330 and caught a nice dip back to 7,300 for a $600 per contract gain and this morning we'll look for a chance to short it again as it's up for no reason.

We're still not a believer in the "rally" until we see the NYSE get back over that 12,800 line and we're about 1% away from it now and it's very, very doubtful that we'll get there today, no matter how quiet the US investors are.

In fact, on the NYSE, we are wathing for a failure at 12,600 (the 200-dma), which would signal the very strong possibility of a leg down for the indexes. We still have our long hedge on the Nasdaq and our 10 QQQ 2020 $220 calls from our June 12th Morning Report at $2,000 are already $2,550 for a 27.5% gain even though QQQ is only at $177.25, up $2.25 or 1.3% so we are getting the 20x leverage we expected on a move higher – just in case we're wrong and the index doubles before it drops 10%.

Still, that 6,500 target is very tempting with /NQ at 7,300 as it's down 800 points and that would pay $16,000 per contract on a correction – that puts the risk of playing here with tight stops above into perspective, right? While US Investors may not be worried about the impact of Trump's Trade Policy, Fed Chairman Powell sure is, saying:

“Changes in trade policy could cause us to have to question the outlook,” Federal Reserve Chairman Jerome Powell said during a panel discussion at a European Central Bank conference in Sintra, Portugal. “For the first time, we’re hearing about decisions to postpone investment, postpone hiring.”

Shhhhh, say it quietly so people can ignore it – even though the monsters are right next to your assets! Meanwhile, Congress is not, so far, letting Trump get away with his ZTE deal and that will really piss off Chaiman Xi, who paid Trump $500M to lift the sanctions against that company. While Trump is used to screwing people out of hundreds of Millions of Dollars and giving them nothing but empty promises in return – that is not the way Xi expects to be treated as the leader of 1/4 of the World's population.

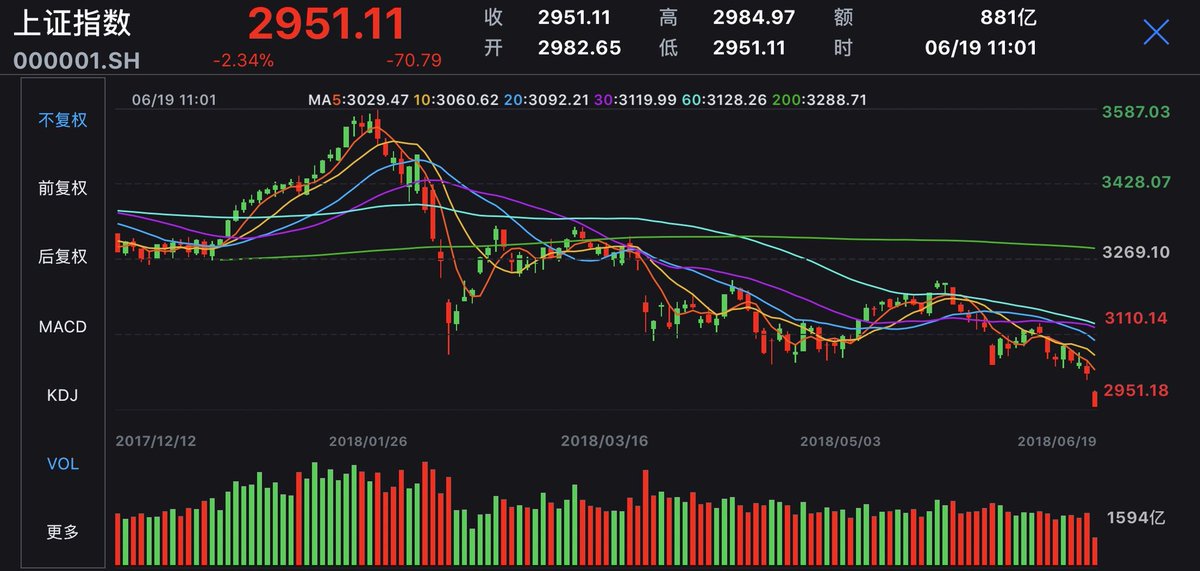

Xi is also not happy to see the Shanghai Composite crashing to the lowested level in two years, failing the 3,000 mark, all the way down to 2,950, which is down 20% from the highs it hit after Trump and Xi's "successful" November meeting. I guess you can say it's a chart of our rapidly deteriorating relationship with China but, shhhhhhhhhhh…..

Speaking of things to be quiet about – it's no accident that OPEC is having their meeting to raise production ahead of the July 4th weekend and ahead of Europe's August holidays because they can raise their output into rising summer demand before people realize we still have a glut. Yesterday, we told you we were shorting oil as it rose into the inventory report and it went all the way up to $66.25 before plunging back to $65 for a lovely $1,250 per contract gain for our Report Readers – you're welcome!

The meeting is tomorrow but it looks like we'll hit our predicted 1Mb/day output increase on the nose and, as noted in yesterday's Live Trading Webinar, we're not keen on shorting oil into July 4th but stay tuned for a wonderful shorting opportunity around then. Until then, we're actually HOPING (but not betting) that oil goes back to $70 – so we can make more on the way down but it certainly doesn't deserve a penny over $68.50 based on the current Fundamentals – so that's around where we'd begin scaling into some shorts.

Remember, I can only tell you what is likely to happen and how to make money trading it – that is the extent of my powers…

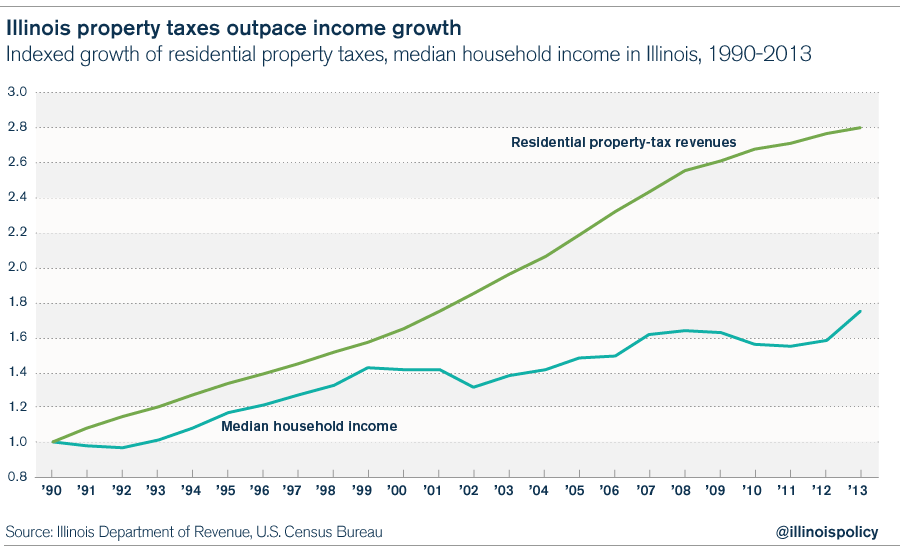

Speaking of predicting the Future – I'm not at all happy with Zillow's Housing Affordabilty Report, which shows home mortgages have risen to take the biggest slice of the average paycheck since 2009 (17.1%), driven up 1.2% since Q4 on rising rates and rising prices. The median US home is now 5.4 TIMES household income, compared to 2.78 times income that was typical from 1985 to 2000. Not only that, but a huge flaw in Zillow's report is the failure to account for property taxes (including school taxes) – which have risen completely out of control over the same period as the Federal Government drops more and more of the cost burden on local Governments (in order to save Top 1% taxpayers from having to fund it).

Speaking of predicting the Future – I'm not at all happy with Zillow's Housing Affordabilty Report, which shows home mortgages have risen to take the biggest slice of the average paycheck since 2009 (17.1%), driven up 1.2% since Q4 on rising rates and rising prices. The median US home is now 5.4 TIMES household income, compared to 2.78 times income that was typical from 1985 to 2000. Not only that, but a huge flaw in Zillow's report is the failure to account for property taxes (including school taxes) – which have risen completely out of control over the same period as the Federal Government drops more and more of the cost burden on local Governments (in order to save Top 1% taxpayers from having to fund it).

I couldn't find a good chart but Illinois is a good example with Household Income rising 80% since 1990 while Property Taxes went up 180%. Anyone who owns a home in America knows this pain. Not only do rising property taxes suck money out of your pocket but they DEVALUE your home because people don't buy a home, they buy a mortgage and higher taxes means the person looking at your home has to allocate less money to you and more to your local Government.

That's the big lie when they lower Federal Aid – the aid is still required – it just needs to be made up for on the local level, where it doesn't impact rich people or corporations as much. Why is that, because no matter how rich you are -you can only have so many homes. Bill Gates has $100Bn more money than you do but he's only got 3 or 4 homes and yes, they are big homes, but not even 1/4 of 1% of his wealth so taxes, no matter how high, are miniscule to the Top 1% while a $10,000 property tax bill to you may be a bit more inconvenient, right?

Taking taxes into account, homes have never been less affordable than they are now and peaks in housing costs are often preludes to recessions.

So please, be careful out there!