That's what Robert Reich calls the confusion and bewilderment Americans feel when listening to the President but the same can be said for our New Federal Reserve Chariman, Jerome Powell, who testified before the Senate yesterday and will testify again tomorrow without actually saying anything at all but, like the parable of the blind men feeling an elephant – everyone will be able to draw a conclusion about what he said – even if those conclusions are diametrically opposed to each other.

CNBC says "Powell backs more rate hikes as economy growing "considerably stronger"" while Market Watch says Treasury yeilds are heading lower on doveish testimony and CBS says "Jay Powell shrugs off trade worries, expects rates to keep rising" and Bloomberg says "Powell's 'For Now' Caveat a Sign Fed Rate Hikes Not on Autopilot." So Jerome Powell, like the President, is all things to all people – whatever you want to think he said – he kind of said it.

Is that really what we want in a Fed Chairman? Why is our monetary policy a closely guarded secret? There was, briefly, a movement to make the Fed more transparent and have them set firm tartgets for actions well ahead of time but investment banks can't make money if EVERYONE know what the Fed is going to do – who would they be able to bet against with their inside information?

It doesn't get more inside than Goldman Sachs, of course, who have alumni like Neel Kashkari, Stephen Friedman, Bill Dudly, Patrick Harker and Robert Kaplan. In fact, there are 12 GS Alumni currently on the Fed Board (not to mention Carney heading the Bank of England, and, of course Draghi at the ECB) and Goldman was even fined $50M after one of it's emploees was caught obtaining regulatory documents from former collegues at the NY Fed but don't worry, no one has been caught since! Treasury Secretary Steve Mnuchin is also a former GS partner.

It doesn't get more inside than Goldman Sachs, of course, who have alumni like Neel Kashkari, Stephen Friedman, Bill Dudly, Patrick Harker and Robert Kaplan. In fact, there are 12 GS Alumni currently on the Fed Board (not to mention Carney heading the Bank of England, and, of course Draghi at the ECB) and Goldman was even fined $50M after one of it's emploees was caught obtaining regulatory documents from former collegues at the NY Fed but don't worry, no one has been caught since! Treasury Secretary Steve Mnuchin is also a former GS partner.

And, of course, a few Trillion Dollars worth of our National Debt (which you and your children owe) was accrued by the Fed (who still have $4.5Tn worth of debt on their balance sheet) bailing out Goldman and other Banksters during the Financial Crisis. Don't worry, there's no conflict of interest because the Fed is not a Government entity and doesn't work for your interests – they are actually just a Government-annointed cartel, no different than OPEC – except they have no assets of their own and get to take your money and give it to Banksters.

It would be nice if there were some sort of Congressional oversight but that old "balance of power" thing went out the window in the last election and now it's just a free-for-all with our National Debt now $21,214,609,000,000 and that will grow by another $1,800,000,000 by the end of the day and not only is no one doing anything about it – but we've gone completely in the opposite direction and more than doubled down on the annual deficit since Trump took office.

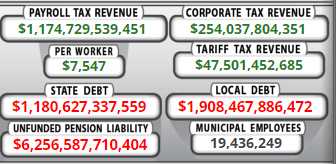

Out of $3.4Tn collected by the Government, $1.6Tn comes from Income Taxes, $1.2Tn comes from Payroll Taxes and just $254Bn comes from Corporate Taxes – about $12.5% of their $2Tn in profits. Our citizens are also being asked to pay $47.5Bn in taxes in the form of tariffs and that's just on the $50Bn announced so far – Trump is planning to up it to $250Bn and that will draw another $200Bn out of voters' pockets – the biggest tax increase on the people in history but call it a "tariff" and nobody can see it's a tax – MAGICAL!

Out of $3.4Tn collected by the Government, $1.6Tn comes from Income Taxes, $1.2Tn comes from Payroll Taxes and just $254Bn comes from Corporate Taxes – about $12.5% of their $2Tn in profits. Our citizens are also being asked to pay $47.5Bn in taxes in the form of tariffs and that's just on the $50Bn announced so far – Trump is planning to up it to $250Bn and that will draw another $200Bn out of voters' pockets – the biggest tax increase on the people in history but call it a "tariff" and nobody can see it's a tax – MAGICAL!

Corporate contributions do not even cover our $305Bn annual interest on our debt and that figure is set to double by the end of 2019 if the Fed keeps on a path to hike 6 more times for another 1.5%. Meanwhile, our poor consumers have been also going into debt at record levels with $15Tn in Mortgage Loans, $1.5Tn in Student Loans and $1Tn in Credit Card Debt for an average of $58,000 per PERSON or about $170,000 per family.

Now, if you are in the Top 1% and make over $600,000 a year then $170,000 doesn't sound too bad but, oddly enough, the Top 1% don't have much debt – it's the bottom 99% and especially the bottom 80% that are deeply in debt and not likely to get out of it. What happens to them when interest on all that debt doubles up next year?

And don't even get me started on the monetary dillution they've used to accomplish this all. The Monetary Base (the amount of hard currency in circulation) has gone up 500% in the first 18 years of this century. Of course, it had to to keep up with the 600% increase in Treasuries, which are the IOUs printed by the Government but, most horrifying, is the 500% increase in derivatives – now $558 TRILLION Dollars or about 55 times all the money in the World.

If you saw this kind of nonsense on a company's balance sheet, you'd dump the stock but, for some reason, investors seem oblivous to the Credit Bubble and Debt Bomb that's ticking beneath our feet. The Median Income in the US (half above, half below) is now $32,041 and the Median Home Price is now $328,529 – never in history has a home been less affordable to the average American. In 2000, the Median Income was $31,471 and the Median Home Price was $165,349 – effectivly, it's gotten 100% worse in the past 18 years!

No wonder people don't think America is "Great" anymore – it's kind of a nightmare for people below that median line and I don't see how you can have a stock market making record highs when 50%, or more like 80% of the population is clealy being left behind.

As I noted on CNBC/Japan last night – we're moving back to CASH!!! in our portfolios and continuing to short the indexes (same levels as yesterday). I'll also be on BNN's Money Talk tonight at 7pm.