I love it when a plan comes together.

I love it when a plan comes together.

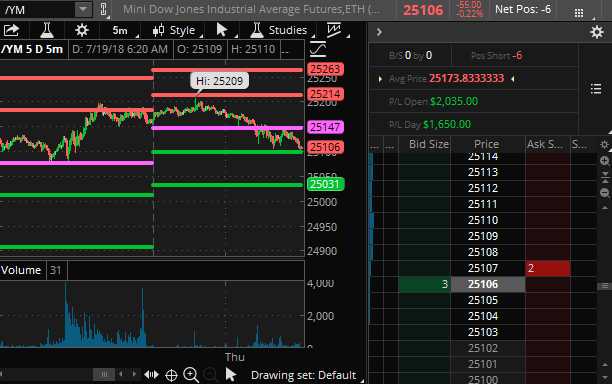

In yesterday's Live Trading Webinar (replay available here) we worked our way into 6 short Dow (/YM) Futures shorts at an average of about 25,167 and we rode them down this morning to the 25,100 line for a quick $2,000 gain on the set and then, in our Live Member Chat Room, we called for a follow-on short below the 25,100 line, with a target of 25,000 for another $500 per contract gain.

It's been a busy week as we have options expirations so we're reviewing our 5 Member Portfolios, one of which we share with the viewers of Business News Network's (Canada's Bloomberg) Money Talk in a portfolio where we only initiate and change trades on the show so every single trade is available to the viewers live. The disadvange to that restriction is that we can't make adjustments between shows (I'm on quarterly) so we try to stick to low-touch value trades but, as we teach our Members, trading does not have to be exciting to be profitable and our Money Talk Portfolio is already up 68.6% since we intiated it last September (10 months). Not bad for free samples!

.jpg)

You can see the review of the adjustments we made yesterday at www.philstockworld.com/moneytalk and here are the clips from the show talking about the market, the portfolio and adding a new trade idea on General Foods (GIS):

Money Talk segments #1 and #2:

As noted, we are moving to a lot more CASH!!! and were shorting the market as we're taking the trade war more seriously than other investors seem to be and, just this morning, to prove my point, there was more saber-rattling from the President about Auto Tariffs, which would be a horrifically bad idea for the entire Global Economy. That's what sent the market lower, despite pretty good earnings reports so far.

Just because we're generally bearish doesn't mean we can't find values in the market – they are just few and far between. On BNN I noted that Barrick Gold (ABX) at $12.25 and Limited Brands (LB) at $32.50 are both great bargains and both of the above spreads are cheaper now than when we first picked them up so our loss is your discount if you are coming in fresh!

We didn't find anything particularly encouraging in yesterday's Beige Book Report by the Fed – not in the context of having record-high stock prices. With record-high stock prices we should be seeing words like "strong" and "robust" not "modest" and "moderate" – this economy is slowing down, not speeding up and speeding up is what's priced in but we won't get a correction until the earnings begin to show how faulty the bulls' premise really is at this point.

We didn't find anything particularly encouraging in yesterday's Beige Book Report by the Fed – not in the context of having record-high stock prices. With record-high stock prices we should be seeing words like "strong" and "robust" not "modest" and "moderate" – this economy is slowing down, not speeding up and speeding up is what's priced in but we won't get a correction until the earnings begin to show how faulty the bulls' premise really is at this point.

As you can see from Citi's Economic Surprise Index, the trend has been lower and lower after a pause on the way down in Q1 but Q2 has been TERRIBLE for data reports yet Consumer Sentiment is still strong, mostly because our Government lies to us an average of 9 times a day, telling us how wonderful things are and how there was no meddling in the election or, if there was meddling, there was no collusion and, if there was collusion, then the investigation into it is taking to long so we should shut it down or let Vladimir Putin take over for Robert Mueller and be allowed to question witnesses and let us know whether he and Trump were guilty. No wonder people are confused!

Speaking of confused: Sasha Cohen gets GOP and NRA idiots into supporting fake and RIDICULOUS idea of arming children in the schools. These are real people who are influential policy makers – what else but "deplorable" describes them?

"The Liberals are using these school shootings to further their anti-tragedy agenda." Priceless (5:50)! And then they guy agrees with him! He also gets the guy to high-five him over "It's not rape if it's your wife." Though at least the guy says (hoping) "That probably won't be on the air."

What's really horrible is how easily he can push himself in front of actual Congresspeople with a lunatic agenda and then gets them to give testimonials reading obvious (to others) nonsense off a teleprompter. He gets Joe Walsh (R-IL) to say "A first grader can become a first grenader" and Larry Pratt cites totally fake studies stating children have "the pheromone Blink 182" which is, of course, a rock band along with other pop-culture nonsense that goes right over this guy's head yet he's the "expert witness" Congress goes to to pass laws!

Only a drastically under-educated populace falls for this kind of BS! (or elects these morons to represent them)

Fortunately, Stephen Colbert has a cartoon we can all understand:

- White House Declines to Rule Out Vladimir Putin’s Offer of Assistance in Mueller Probe

- State Department Denounces Russia’s Demand to Interrogate Americans, Trump Does Not

- Trump crafts straw man argument, says U.S. can accept cooperation with Putin or risk war with Russia

- Trump Tells CBS He’s ‘Always Wanted’ Interview by Mueller

- Trump blatantly lies about NATO, then reveals he doesn’t understand the purpose of the alliance

- The US Just Quit The United Nations Human Rights Council

- Trump’s EPA rolls back Obama-era coal ash regulations

- Trump administration aims to censor ‘soy milk’ and similar terms

- No Russian love. Vladimir Putin’s nation dumped U.S. Treasuries ahead of Trump meeting

- Forget Russia, FBI Director says China is ‘the broadest, most significant’ threat to the US and its espionage is active in all 50 states

- Frank Rich: Trump’s Plot Against America

- Homeland Security Advisory Council members resign over ‘morally repugnant’ immigration policy

- All Hell Breaks Loose As Reporter Hammers Sarah Sanders And Questions Trump’s Credibility

- Sarah Huckabee Sanders has meltdown after Donald Trump changes his treason story yet again

- ‘Trump Is No Longer Our Leader’: Republican Texas State Lawmaker Calls for Impeachment After Putin Meeting

- Paul Ryan is suddenly in real trouble

- Trump and GOP push new tax cuts as budget deficit skyrockets toward $1 trillion

- In bid to impeach Rod Rosenstein, House Republicans are abusing power to protect Trump

- GOP Deplorables STILL Don’t Believe Russia Hacked the Election Even AFTER Trump Said They Did

- How the world’s cartoonists are skewering Trump’s Helsinki performance

- Trump’s military parade expected to cost nearly as much as ‘tremendously expensive’ canceled war games

- WSJ City: Trump Renews Auto Tariffs Threat, When Does a Trade Spat Become a Trade War?

- Trump’s Trade Spats Damage U.S. Energy Companies, May Help China

- How Trump’s tariffs on Mexico are taking jobs from U.S. workers

- China says U.S. blaming Xi for blocking trade deal is ‘bogus’

- Trump’s Tax Cut Hasn’t Done Anything for Workers

- The ‘War on Poverty’ Isn’t Over, and Kids Are Losing

- Equities: 3Q outlook positive but longer term view cloudy

- Bernanke, Geithner & Paulson Warn: “We’ve Forgotten The Lessons Of The Financial Crisis”

That's just TODAY folks – be careful out there!