It's a big week for the Central Banksters.

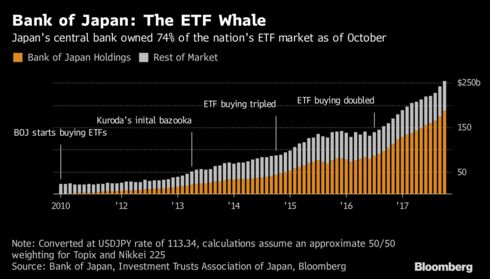

The Bank of Japan kicks off the week with a 2-day meeting in which it is expected they will reduce their spending on ETFs that have been propping up the Nikkei for the past decade. The BOJ has been criticized for favoring large-caps and, with the index at 22,580, the Central Bank has decided to give some love to the broader Topix Index to the tune of 6,000,000,000,000 Yen per year (only $54Bn in real money) but their previous monetary madness has made the BOJ the owner of 75% of the ENTIRE Japanese ETF market (about 4% of the entire market, 10% of the 225 Nikkei large caps).

In theory, the BOJ has made a lot of money buying Japanese stocks but, in practice – good luck selling them when they have been the primary buyer for the past 5 years. Our own Federal Reserve doesn't dabble directly in stocks – they just print money and hand it out to Banksters, who then buy up stocks or, even better, lend Trillions of Dollars to Companies that buy up their own stocks. In Q1 alone this year, S&P 500 companies bought back $190Bn of their own stock in a year that's on track for over $1Tn in buybacks – most of it on borrowed money.

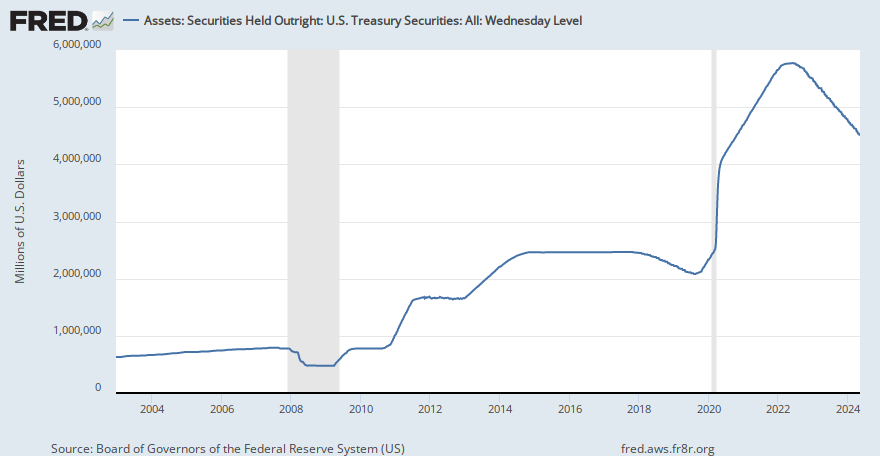

Our Federal Reserve prefers to buy US Treasury notes, about $2.4Tn of those. Isn't it great how easily we can throw TRILLION around? As if it's not a big deal….

Our Federal Reserve prefers to buy US Treasury notes, about $2.4Tn of those. Isn't it great how easily we can throw TRILLION around? As if it's not a big deal….

To put this into context, the Dow has a MONTHLY money flow that is up or down $10Bn for 30 large caps so imagine the effect of $100Bn worth of inflows through buybacks every single month! The BOJ in Japan, the PBOC in China, the ECB in Europe and US Corporations using easy money from our own Federal Reserve represent ALL of the net buying of the Global stock markets. What will happen when and if they ever do decide to withdraw their stimulus.

Of course, that doesn't mean we should be bearish. Consider that Las Vegas is a city in the middle of desert and all of the water in that town is there arificially, right? Logically, the fountains and pools would run dry and the people would die of thirst if the Government ever stopped forcing water into the town yet Las Vegas has grown and grown over the past 50 years from 100,000 to 1.4M so betting against growth there just because it's artificially supported would have been silly, right?

The safer bet is to bet on the collapse AFTER the stimulus is withdrawn, not before. That's why we still have our bullish bets in the Long-Term Portfolio, Options Opportunity Portfolio, Butterfly Portfolio and Money Talk Portfolio while only our Short-Term Portfolio has bearish bets – which are generally hedges to protect the Long-Term Portfolio. You don't go to Las Vegas and predict the fountains won't run the next day – no matter how much water is being pumped into the desert – the fact of the matter is that water IS being pumped into the desert – so the fountan show will go on.

The safer bet is to bet on the collapse AFTER the stimulus is withdrawn, not before. That's why we still have our bullish bets in the Long-Term Portfolio, Options Opportunity Portfolio, Butterfly Portfolio and Money Talk Portfolio while only our Short-Term Portfolio has bearish bets – which are generally hedges to protect the Long-Term Portfolio. You don't go to Las Vegas and predict the fountains won't run the next day – no matter how much water is being pumped into the desert – the fact of the matter is that water IS being pumped into the desert – so the fountan show will go on.

Our Fed has another meeting on Wednesday and the show will go on either way, as they are still a long way from fully tapering or raising rates beyond 0.25% – even though the economy is growing at a 4.1% rate and unemployment is at an all-time low and inflation is picking up quickly. In other words, NONE of the Fed's excuses for handing out Trillions of Dollars to their Bankster Buddies has any basis in reality anymore but – people like fountains, right?

We're also in the midst of Donald Trump's 2nd year of Trillion-Dollar deficit spending and that party is never going to stop because these are the "fiscal conservatives" who are in charge now. That's another $21.3Tn bill that's long overdue (the US Deficit) but it's just a drop in the bucket compared to our $114Bn of unfunded liabilities and that Bill is coming due as the Baby Boomers hit retirement age with 25M of them over 65 this year but it will be 50M in 6 years (2024) and 75M 5 years after that (2029).

We're also in the midst of Donald Trump's 2nd year of Trillion-Dollar deficit spending and that party is never going to stop because these are the "fiscal conservatives" who are in charge now. That's another $21.3Tn bill that's long overdue (the US Deficit) but it's just a drop in the bucket compared to our $114Bn of unfunded liabilities and that Bill is coming due as the Baby Boomers hit retirement age with 25M of them over 65 this year but it will be 50M in 6 years (2024) and 75M 5 years after that (2029).

Even Las Vegas has to manage their growth but we've got 125M MORE people (we aren't killing off the old ones fast enough) hitting retirement age over the next 11 years and that's 11M a year x $2,000 a month in benefits (low end) that kick in and that's $265 BILLION more required next year than this year and $530Bn MORE than this year in 2020 and $795Bn MORE in 2021 and $1.06 TRILLION more in 2022… get the picture? What exactly do you think Donald Trump's plan is? Will more tax cuts fix this problem? Will ignoring it fix this problem?

Well, it's worked so far…