$420 per share?!?

$420 per share?!?

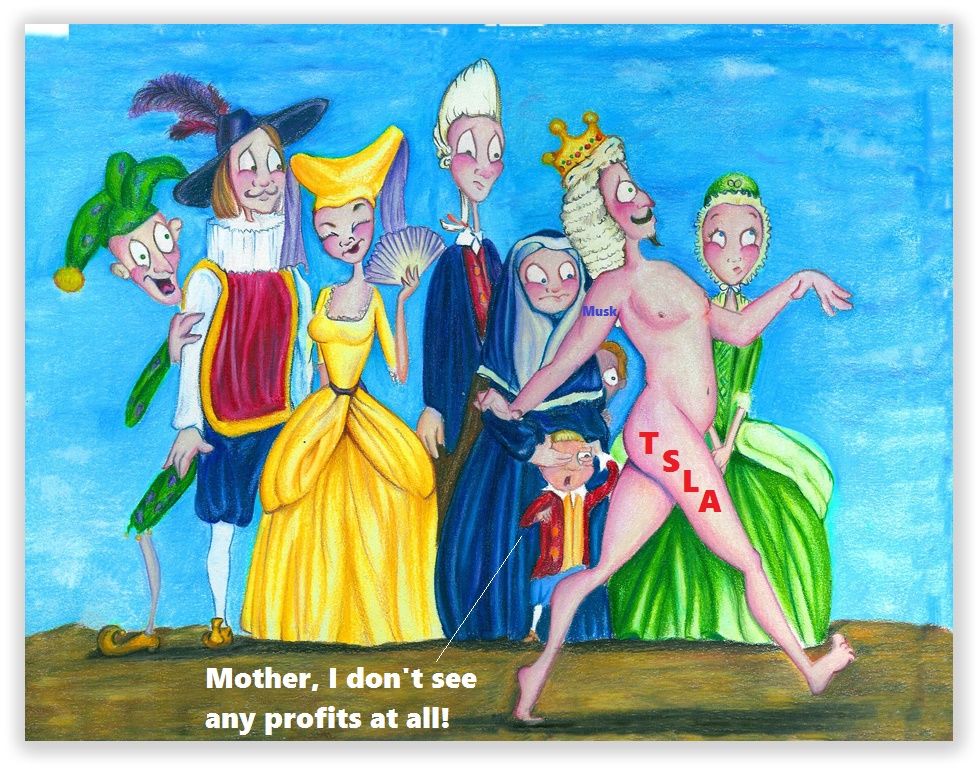

That's $72Bn for a car company that had to run production lines in tents to push out 5,000 cars in the last week of July and, aside from the high level of defects reported in the cars that have been delivered, word is that it's taking weeks to get even basic repairs done and MONTHS for replacement body parts to arrive. Not only that but the Model 3s that are being delivered are averaging $64,000, not $35,000 as promised and TSLA is going to run out of $7,500 EV credits this year – as well as cash.

The company lost $1.9Bn in 2017 on $11.7Bn in sales and, in Q1 and Q2 of 2018, they have lost $1.4Bn on $7.4Bn in sales so 58% more sales 47% more losses – I guess that COULD be called improvement, right? Liabilities have "improved" from $21.9Bn to $22.6Bn but what's another $700M between friends, right? TSLA also "needs" to build a $2Bn factory in China and maybe put a roof on their new production lines in Freemont so that's what, about $100Bn to take over TSLA for the joy of losing another $1.5Bn for the rest of 2018?

I don't want to say FRAUD in regards to Elon Musk's claim that someone is offering to take Tesla private for $420/share as I don't know it's a FRAUD but it does sound kind of like a FRAUD – given what we know about the situation yet FRAUD is a word we don't toss around likely, even when dealing with known con men – not when there's no hard evidence of FRAUD – just a large amount of indicators that point to FRAUD…

Tesla has $2.3Bn of convertible debt that has to be repaid in CASH!!! (which would be all ($2.2Bn) the cash they claimed to have as of 6/30) which would, instead, convert into stock if TSLA is trading "more than 5% over the bond's conversion price of $359.8675", which would be $377.86, which is right about where TSLA settled yesterday after Musk's unprecidented tweeting yesterday.

While it's very hard to imagine that Musk simply made up the offer of $420/share – as that would send him directly to jail without passing go – it is possible that the offer is from one of his investors who are looking to pump up the price or it could be a legitimate offer from outside investors who Musk has convinced of the value of the company but they have not completed any due diligence yet and, when they do, they will drop the offer but under confidentiality so they won't be able to tell others what they discovered. Either way, it buys Musk time to scramble for cash before the company runs out of it.

While it's very hard to imagine that Musk simply made up the offer of $420/share – as that would send him directly to jail without passing go – it is possible that the offer is from one of his investors who are looking to pump up the price or it could be a legitimate offer from outside investors who Musk has convinced of the value of the company but they have not completed any due diligence yet and, when they do, they will drop the offer but under confidentiality so they won't be able to tell others what they discovered. Either way, it buys Musk time to scramble for cash before the company runs out of it.

A real buyer with $100Bn to burn could buy Ford (F) for $40Bn, who sell $156Bn worth of cars and made $7.6Bn last year and $2.8Bn in Q1 and Q2 of this year AND General Motors (GM), for $53Bn who sold $145Bn worth of cars last year and made $8Bn (but paid $11Bn in taxes on money they repatriated) and $3.4Bn in Q1 and Q2 of this year. That's taking over 75% of the US Auto Market and making a $15Bn annual profit for $100Bn or buying TSLA and their 1% market share and dropping $3Bn a year for the pleasure. Hmmmmm…..

We took the opportunity, while TSLA was shooting for the moon yesterday afternoon, to set up a short position (we already had both longs and shorts in our Hedge Fund) as I said to our Members:

Let's take Elon at his word and sell 2 TSLA Jan $420 calls for $23 ($4,600) in the STP and buy 3 Jan $450 ($100)/420 ($79) bear put spreads for $21 ($6,300). That's net $1,700 on the $9,000 spread.

The way this spread works is that we bought the $450 puts and offset the cost of them by selling the $420 puts so anything below $420 net's us $30 per contract ($3,000) and we also sold the $420 calls, so anything under $420 casuses them to expire worthless. If Elon is committing FRAUD and TSLA gets bougth for $420, the short calls are still worthless (as it's not over $420) and we win. If Elon is committing FRAUD and TSLA drops lower – we win. The stock has to go up over 20% by January expirations for us to lose and, even then, we can roll the short calls to a higher strike in a longer month. So – many ways to win, not too many ways to lose, 417% upside potential return on cash.

At the close, the $420 calls were back down to $19 ($3,800) and the $450/420 spread was $79/$60 for net $19 ($5,700) so net $1,900 is up $200 (11.7%) on day one, simply selling premium to suckers on both sides of the trade and simply waiting for things to calm down! It's still good as a new trade and you should be able to shave a couple of bucks off the cost as TSLA continues to gyrate around.

While I strongly suspect Musk may have committed a FRAUD – I don't know for sure so I'll make my money betting against people who think they know for sure!

We'll take another look at Tesla in today's Live Trading Webinar, Live from Orlando at 1pm, EST – join us there!