By Guest Post. Originally published at ValueWalk.

Assessing the likelihood of success for the unprecedented VC giant

On October 14, 2016, SoftBank shocked the world with the announcement of its $100 billion Vision Fund, which would focus on investing in late-stage technology companies. Within 7 months of the announcement, SoftBank had already cemented $93 billion in commitments. To put the unprecedented scale and speed of the Vision Fund into perspective—it took all US-based venture funds 4 years to raise $143 billion from 2014 to 2017.

Q2 hedge fund letters, conference, scoops etc

In its short history, the Vision-Fund has already led enormous financing rounds across the globe, from billion dollar plus investments in ride-sharing services like Uber to a $300 million investment in Silicon Valley’s dog-walking and dog-sitting app, Wag. In comparison, the median global VC deal size for late-stage companies was only around $11 million in 2017. The sheer amount of capital deployed has left the venture capital world stunned, with many questioning if competitive returns are possible at this massive funding scale.

At EquityZen, we decided to take a step back and analyze what it would take for the Vision Fund to deliver competitive returns.

With this fund, Masayoshi Son hopes to replicate SoftBank’s stellar historical returns.

Through 2017, SoftBank boasts an impressive 44% Internal Rate of Return (“IRR”) over its 18 year history. Though Mr. Son’s goal is to replicate his company’s historical returns with this fund, others claim that the goal is not to produce venture capital returns, but instead to beat the returns of private equity firms. According to TechCrunch, investors are expecting to see at least a 20% IRR from the fund. Our analysis moving forward assumes that the Vision Fund will generate a 20% IRR on invested equity.

Before we dive into our returns analysis, we should discuss the Vision Fund’s rare structure and marquee investors.

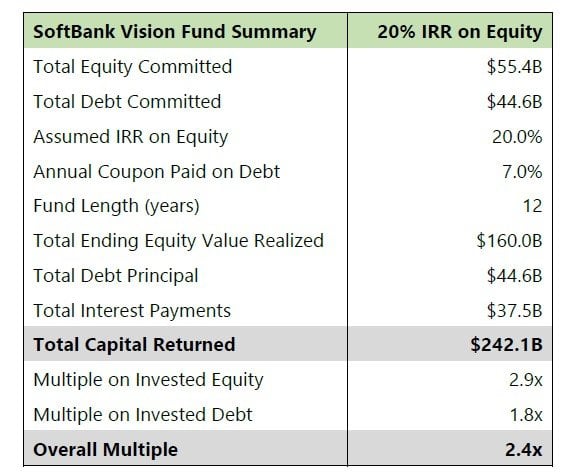

Notably, the Vision-Fund is composed of both equity and debt. As the general partner of the fund, SoftBank has made a $28 billion commitment, all of which is in equity. The remaining $72 billion is a mix of debt (~$45 billion) and equity (~$27 billion) and will come from outside investors. According to the Financial Times, debt provided by investors will be in the form of preferred units, which we assume will be paid an annual coupon of 7% over the life of the fund. The Vision-Fund will have a 5 year investing period with a minimum fund life of 12 years.

Significant debt utilization can magnify both the potential gains and losses of the fund. On one hand, if the fund does well, SoftBank will be able to leverage the ~$45 billion of preferred units to deliver high equity returns to its investors. On the other hand, if the fund does poorly and returns are less than the 7% annual coupon, the equity portion of the fund will get nothing.

For a breakdown of individual investor commitments, which include capital from Apple, Qualcomm and Saudi Arabia’s Public Investment Fund, among others, please see below:

Note: Data as of 06/12/2017. SoftBank has since closed the full $100 billion fund with investments from Daimler, Mizuho, and Oracle co-founder Larry Ellison, among others.

Assuming a 20% target IRR, let’s review the methodology and other assumptions we used in sizing up SoftBank’s prospects:

- SoftBank makes equal capital calls on equity commitment of $55,360,000,000 in years 1-5. This equates to $11,072,000,000 a year.

- SoftBank makes annual 7% interest payments on $44,640,000,000 debt commitment from years 1-12. This equates to $3,124,800,000 a year ($37,497,600,000 in total).

- SoftBank realizes equal equity returns following the investment period of the fund from years 6-12, distributing $22,850,345,450 per year ($159,952,418,148 in total).

- SoftBank pays back debt principal of $44,640,000,000 at the end of the fund in year

If SoftBank meets its 20% hurdle rate on equity, the fund will need to generate $142 billion1 in investment gain over the life of the Vision Fund, a value that took Amazon’s market cap approximately 16 years to reach after its IPO.

Mr. Son definitely has his work cut out for him. To put these target returns into perspective, SoftBank will need to distribute a Spotify-sized company (worth $26.5 billion at time of IPO in April 2018) for 7 straight years. Or they’ll need to match the GDP of El Salvador every year over the same time period.

Note: Calculations do not include management fees or performance fees

1. Interest Payments plus Equity Returns, less Initial Equity Committed

Furthermore, if Mr. Son wants the Vision-Fund to approach SoftBank’s historical returns, the task at hand becomes even more challenging, as demonstrated below. Assuming a 30% and 40% IRR on Equity, the Vision Fund would need to realize the market caps of Wells Fargo and JPMorgan Chase, respectively.

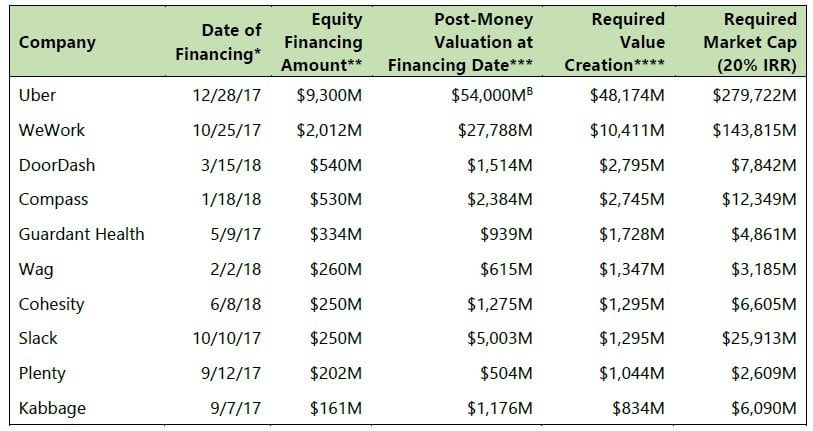

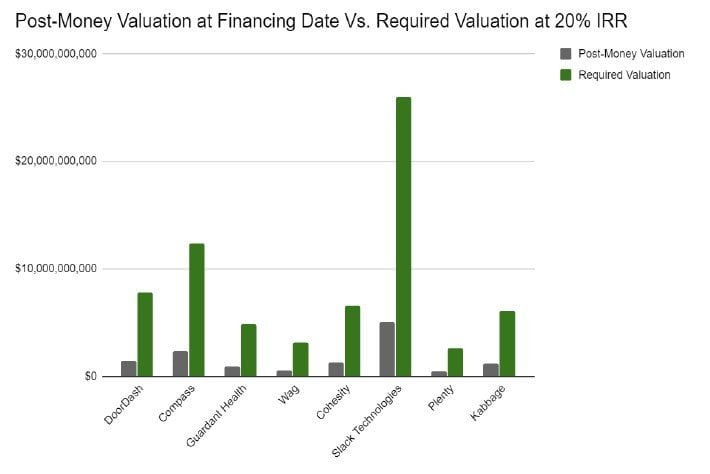

To take this a step further, we’ve analyzed the formidable market caps that some of SoftBank’s individual company investments would have to reach to hit these returns.

We selected 10 U.S. based startups with large financing rounds led by SoftBank and calculated each company’s required exit valuation (assuming an IPO) if each company were to deliver a 20% IRR on equity to SoftBank and the other investors. Given it’s impossible to predict the exact IPO cadence of these companies, we assume the following:

- Each company goes public around year 9 of the fund (the midpoint between the end of the investing period and the final year of the fund)

- No follow-on investments; percent ownership held constant from financing date and used to imply “Required Market Cap”

*Except for Uber, represents the date of filing of relevant certificate of incorporation.

**“Equity Financing Amount” estimates are based on publicly available information, including media reports and regulatory filings collected by VC Experts, and include the entire round’s funding amount, not just SoftBank’s share.

***“Post-Money Valuation at Financing Date” estimates are based on EquityZen’s proprietary analysis and accordingly are estimates that have not been verified by the respective company or third-party sources.

****Reflects required equity value creation for all investors in financing round to reach a 20% IRR.

BReflects the blended valuation that SoftBank paid for Uber shares

The required market caps become even more gargantuan if we assume that SoftBank can deliver an IRR on equity of 30% or even 40% in the minimum fund life of 12 years:

From an individual investment level, these companies will need to greatly exceed their current, arguably frothy valuations. For perspective, if WeWork’s current valuation were based on the same multiple of sales as its closest public competitor, IWG (formerly known as Regus), WeWork would be worth less than $3 billion, a far cry from the $144 billion valuation necessary to achieve a 20% IRR.

In reality, the Vision-Fund’s success will rest on a few outsized exits while many of its investments will disappoint.

Again, we are assuming that every company is able to make a 20% IRR independently. However, the common rule of thumb in the venture capital world is that, given ten startups, three or four

will completely fail, three or four will return their original investment, and one or two will produce substantial returns. While it is important to note that SoftBank is specifically targeting late-stage investments that are less likely to completely fail, it is safe to assume that not every single investment will produce competitive returns. In reality, some of SoftBank’s investments may produce no return at all, which would require the few companies that are successful to achieve even greater market caps than the figures shown above.

Even though investors are looking to only beat private equity returns, even a 20% IRR will require rapid growth from SoftBank’s portfolio. For reference, top-quartile US buyout funds have been able to produce IRRs of around 20% – 30% from 2005 – 2016, according research from Bain & Company. If investors are only looking for an IRR of 20%, buyout funds, which target more stable, cash flow positive businesses, may be a less risky investment than the Vision-Fund’s bet on high growth.

This begs the question, why is Mr. Son embarking on this journey and why is he so confident in his mission? To answer this, we will need to take a look at Mr. Son’s past.

Despite the enormous challenge ahead of him, Masayoshi Son has been an incredibly successful investor in the past.

Mr. Son has been able to deliver outsized returns before. In 2000, Mr. Son famously invested $20 million in Jack Ma’s company, Alibaba. Almost two decades later, SoftBank’s remaining 29% stake in the now Chinese conglomerate is worth over $130 billion. While much of Mr. Son’s wealth rests on this one investment, he has made several other successful investments in companies including Sprint, Yahoo! and Supercell. However, the question remains if he can deliver these

same past returns at the scale of the Vision-Fund. We should also remember that, during the dot.com bubble burst, Mr. Son reportedly lost $70 billion of net worth in one day.

However, Mr. Son seems undaunted by the task as the Vision-Fund has already begun with an impressive start after Walmart’s acquisition of Flipkart in May. According to the Wall Street Journal, “the Vision Fund has agreed to sell its $2.5 billion stake in Indian e-commerce company Flipkart to Walmart for $4 billion.” In a sign of immense confidence, Mr. Son has even begun to plan a second Vision Fund sometime “in the near future.”

In the end, the Vision Fund’s returns may be a secondary concern for Son, who is looking to free entrepreneurs from the constraints of limited capital.

Though we’ll have to wait another decade before we can judge the Vision-Fund’s performance, we’ll likely have to wait another century before we witness the culmination of SoftBank’s self- proclaimed greater mission: “Information Revolution – Happiness for everyone.” Mr. Son has emphasized that he wants to see his company grow for the next 300 years. With this long-term vision and massive checkbook, SoftBank is able to give its entrepreneurs the luxury of asking themselves, “[i]f money was not a constraint, what would you do differently….”

With this mindset, the Vision-Fund has opened the possibility of a new reality. From the virtual worlds of Improbable and the development of autonomous machinery at Brain Corporation, to research in oncology at Guardant Health, Mr. Son is placing huge bets on potentially revolutionary technologies across a variety of industries. Unprecedented funding levels may enable these companies to develop and scale at unprecedented speeds. Regardless of whether SoftBank’s portfolio returns billions to its investors or if the Vision Fund fails to deliver any returns at all, Mr. Son hopes his efforts will unleash a new frontier of profound technological advancement in the coming decades.

Despite the Vision-Fund’ss admirable goals, its willingness to deploy capital at a massive scale is arguably pushing already frothy valuations even higher and crowding out the competition.

According to venture capitalist Megan Quinn of Spark Capital, SoftBank is changing the rules in Silicon Valley, turning standard sub-$100 million rounds led by firms like hers into routine $200 million+ fundraises. NEA and Kleiner Perkins ran into a similar situation when they were in talks with Wag. Last year, the startup was in negotiations with these VCs to raise $100 million when the dog-walking app piqued the interest of SoftBank. SoftBank, however, would only invest in the company for a minimum $300 million round. The increased funding size caused investors including NEA and Kleiner Perkins to drop out of the picture.

In addition to Wag, SoftBank has written several other check sizes larger than most startups have ever seen. Prior to Brain Corporation’s $100+ million funding round led by SoftBank, the company had only raised a little over $10 million. Similarly, Improbable had only received $52 million in funding when SoftBank injected a $500 million Series B investment into the company.

SoftBank’s checkbook comes as a double-edged sword for these companies. Yes, these companies are now allowed to dream big and are much less likely to fail due to lack of funding as SoftBank has pushed the cost of capital lower. However, overfunding also creates significant issues of its own. Primarily, these now cash-rich companies must achieve a certain level of growth to justify their inflated valuations. This in turn could lead to undisciplined spending of capital or forced expansion. Furthermore, the hefty sum of cash in the bank may eliminate the scrappy creativity that many entrepreneurs pride themselves on while building their businesses.

However, these startups may have little choice as to whether they accept SoftBank’s investment. Companies are left with the fear that if they reject SoftBank, the Japanese conglomerate will instead invest in rival businesses. Uber’s CEO Dara Khosrowshahi succinctly sums up the experience of working with SoftBank: “[r]ather than having their capital cannon facing me, I’d rather have their capital cannon behind me, alright?”

In the end, where does EquityZen fit in? More private capital will continue to delay IPOs, making a robust secondary market for venture-backed companies increasingly important.

A critical thesis behind EquityZen’s formation stems from a particular trend: companies are staying private longer. The rise of SoftBank and other mega-funds will likely re-enforce this phenomenon and increasingly diminish the need for public capital to fund innovation. It is important to note that the investors in SoftBank’s Vision-Fund and other mega-funds who are able to reap these gains in the private market are not every-day, retail investors, but rather large corporations, VCs, private equity funds and other wealthy entities. From the start, our mission has been to democratize access for all types of investors to these late-stage private companies while simultaneously unlocking value for startup employees. SoftBank and its new breed of investing make our mission more important than ever.

Article By Andrew Zhan & Adam Augusiak-Boro, EquityZen

The post SoftBank: Vision or Delusion? appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.