Wow, just wow!

Wow, just wow!

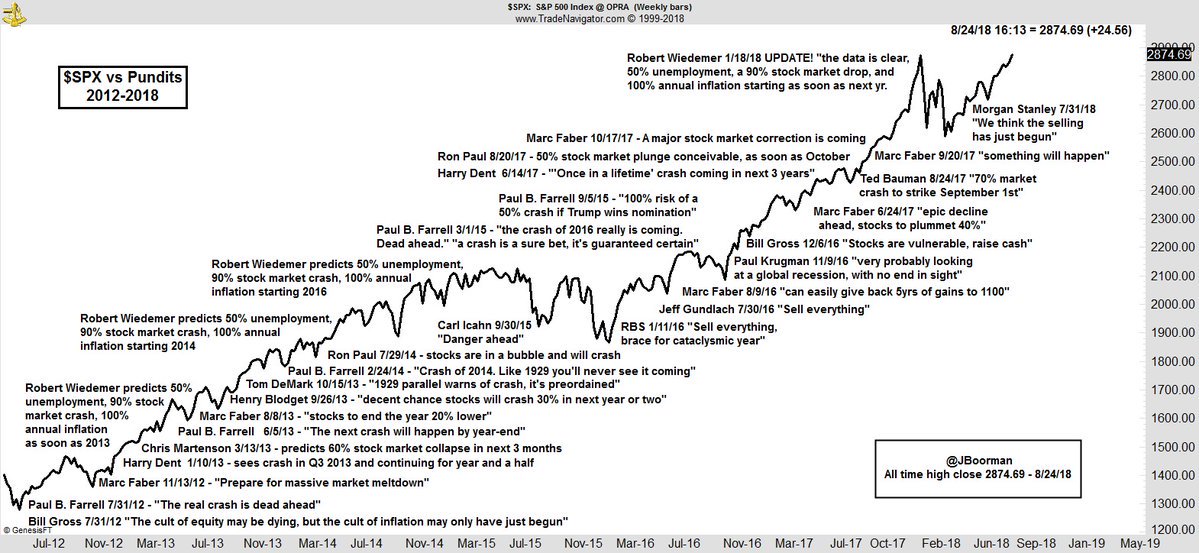

As you can see from the chart on the right (click for bigger view), people have been saying this rally is going to end since it started – and that was about 10 years ago at this point! I'm included in those people as, on several occasions, including this year – I have wanted to cash out and, in fact, I did cash out my kids' college accounts into the Summer (still in cash) and our Hedge Fund is mainly in cash as well as we wait for the market correction (and buying opportunity) that never seems to come.

I was bearish in 1999 and the market went up 100% that year before it collapsed and I was bearish in 2007 and the market went up before it collapsed (about 10%) and I have been bearish most of this year – well, after we did a lot of buying during the February dip. Even our Big Chart is still full of the old Must Hold levels that there's little chance of re-testing. Granted they were the levels we set in 2015 for our expectations of the end of 2017 but we never changed them because we kept thinking the move 20% above our lines would correct – that was incorrect…

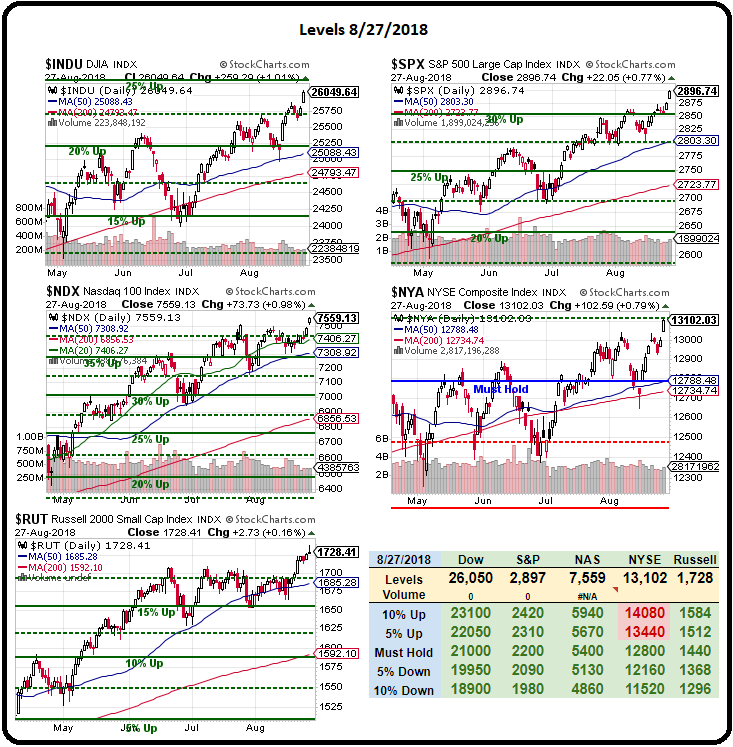

Being cautious hasn't stopped us from making money but we certainly could have made more money if we hadn't hedged (and yes, we just put more money into hedges yesterday). Still, that's not the right way to play but we do need to make some realistic assumptions about where the bottom of this new range should be and it's probably not 2,200 on the S&P – which would be a 24% correction from here.

Without getting into the whole "fair value of the S&P" which we do when we are setting our major Must Hold Levels, what has really changed since 2015? Well mostly we have higher wages, a stronger GDP, lower unemployment and much lower taxes – mostly good things for the bottom line of S&P 500 companies. Good but not so good they should be trading at 35x Cash Flow (which they are) but good enough for 25x cash flow – even though that's based on a shaky assumption that these tax cuts will never be rescinded and rates will only rise gradually.

Without getting into the whole "fair value of the S&P" which we do when we are setting our major Must Hold Levels, what has really changed since 2015? Well mostly we have higher wages, a stronger GDP, lower unemployment and much lower taxes – mostly good things for the bottom line of S&P 500 companies. Good but not so good they should be trading at 35x Cash Flow (which they are) but good enough for 25x cash flow – even though that's based on a shaky assumption that these tax cuts will never be rescinded and rates will only rise gradually.

Still, until those things change, there's no reason to expect such a huge correction in the indexes so we will need to adjust our lines to a "more fair" value, which is mostly a factor of adding the tax cut effect to our old numbers. We'll also have to consider that the Tax Cuts are not evenly distributed as the S&P 500 Companies (the Top 1%) were given full advantage of the cuts while some small-cap companies were actually hurt by them. The discrepency between where the Nasdaq is and where the broad NYSE is 2 years after Trump was elected is amazingly large:

Of course the Nasdaq is made up mostly of Amazon, Apple, Google, Facebook and Netflix and those stocks racking to $1Tn valuations (AAPL won) have driven the Nasdaq up 20% since March. FAANG is 12.8% of the S&P and they are up an average of 111% since Trump's election (FB – 40%, AAPL – 116%, AMZN – 171%, NFLX – 160% & GOOGL – 66.6% – really!) – 12.8% of 111% is 14.2% so those 5 stocks added 14.2% to the S&P's 33% returns of the last two years – about half the growth.

On the Nasdaq, FAANG is 30% of the index now with AAPL alone at 15% and 30% of 111% is 33.3% (half of 66.6%) and that is 2/3 of the Nasdaq's 2-year gains coming from 5 stocks. $2.5Tn has been added to those 5 stocks over 2 years, which MORE THAN ALL of the GDP growth (12.5%) of the United States of America going to just those 5 stocks – that's MADNESS!

On the Nasdaq, FAANG is 30% of the index now with AAPL alone at 15% and 30% of 111% is 33.3% (half of 66.6%) and that is 2/3 of the Nasdaq's 2-year gains coming from 5 stocks. $2.5Tn has been added to those 5 stocks over 2 years, which MORE THAN ALL of the GDP growth (12.5%) of the United States of America going to just those 5 stocks – that's MADNESS!

So you can understand, perhaps, why I may still feel that these prices are unrealist or, even if they are realistic for FAANG stocks – why should that then translate to the rest of the index? Are they ALL on their way to becoming Trillion Dollar companies? Are they ALL exceeding expectations?

Let's say that Usain Bolt (who plays soccer now) can run 100 yards in 8.2 seconds. We KNOW he can do it – we've clocked him. Does that then mean his whole team can run that fast? If I'm paying Usain $3M to play soccer, should I then pay them all $3M because, clearly, if he's that fast then they should all be that fast, right?

No, not right at all! That's silly, flawed logic. There are people who outperform and there are companies who outperform yet we are valuing ALL companies as if they are incredible performers – even companies like Tesla (TSLA), who don't even make any money or Uber (private) who just got a $78Bn valuation from TM, who just gave them $500M to cover this quarter's losses. That's a little bit crazy and, more to the point – it's unsustainable.

But it's not just about TSLA, it's about every average company that isn't going to earn $50Bn to justify a $1Tn valuation in the near (or distant) future. These valuations are insane, as in – they are not sane, rational valuations and, for the first time in a long time, we are working on a Sell List of companies we want to short because, sooner or later, this market will correct and the question is how deeply it will correct and where will it recover to. Those will be our new Must Hold lines and I'm going to work on them over the weekend.

Meanwhile, last Tuesday, we talked about how Coffee (/KC) was too cheap as it tested $100 and it blasted up to $107 yesterday and is at $104 now but that's still up $1,500 per contract so you're welcome. We took ours off the table at $106 (we were playing /KCN9 and we do plan to get back in when it's done pulling back) but there was also the longer-term BJO spread and that's fine to hang on to.

Today we're starting to put on shorts on Gasoline (/RB) as it tests $2.10 but it should go higher into tomorrow's inventory but for sure we'll be shorting /RB over the weekend along with /CL and we already picked up the Ultra-Short ETF (SCO) in yesterday's Live Member Chat Room almong with shorts on /CL at $69 with tight stops above and we'll short every $1 line it hits until it fails!

Let's be very, very careful out there – while it's been suicide to short this market – it hasn't been illogical!