We've gotta hold those highs, right?

We've gotta hold those highs, right?

There's nothing Fund Managers and Brokers hate more than to have their clients talking about pulling money out of the market around the barbeque. With a holiday weekend approaching, we can expect all the stops to be pulled out to maintain our record highs but what happens when the big boy traders come back from their summer vacations is anyone's guess.

At the moment, as you can see from the SPX chart with volume, there is a huge surge, like clockwork, at the end of each trading day, that pushes the index higher into the close and even higher overnight (when there is no volume at all) and that has accounted for about 1/2 of the S&P 500s gains for the week. The rest of the gains came from a new trade deal with Mexico that's worse than our old trade deal (NAFTA) and now Trump says he will have a deal with Canada tomorrow, probably also worse – so of course the markets should be higher…

It's all nonsense, of course but Alice in Wonderland was all nonsense for 90 minutes and then she woke up. It's hard to say when investors will wake up but they usually do at some point but, as I noted yesterday, things can get a lot sillier before they get saner.

Oil (/CL) is hitting our silly target of $70 this morning and we discussed shorting at this line in yesterday's Live Trading Webinar and I reminded our Members in Chat this morning that we are shorting below the line only, with tight stops above but I'm willing to lose a few Dollars while wating for the nice, post-holiday pullback we're expecting.

Oil and Gasoline (we're short that too) are things that are bought by the masses, not just rich folks and, although our GDP is expanding at 4.2% in Q2 and people like us (who have enough savings to be able to play with stocks) are feeling pretty good, economically, a new study by the Urban Institute reminds us that 4 out of 10 Americans are struggling to pay for their basic needs such as groceries or housing. It's a problem even "Middle-Class" households confronting.

Middle-class households tend to struggle with paying their health care bills rather than utilities, for instance. Health care costs have outpaced wages and inflation, pushing more Americans into high-deductible plans, which can backfire when serious health problems arise. "A lot of people are looking at the fact that wages aren't keeping up with household costs as one reason families are having difficulty making ends meet," UI's Karpman said. "Even for families with health insurance, they may be facing high deductibles that leave them facing high costs."

Almost 60 percent of Americans with multiple chronic medical conditions experienced material hardship in 2017, compared with about 33 percent of adults without any chronic illnesses, they found. Educational attainment was also tied to hardship. The researchers found that 56 percent of Americans with less than a high school degree struggled to meet their basic needs. By comparison, just 24 percent of college grads experienced hardship. "I hope that people will see," said Karpman, "that even though we're in a relatively healthy economy, a lot of families are still having difficulty meeting their basic needs for food, housing and health care."

In fact, this morning we got the BEA's report on Personal Income and Outlays and, once again, people are spending (+0.6%) faster than their incomes are rising (+0.4%) while Inflation holds steady around 2%. That means about half of the growth in GDP is being driven by consumers who are going further and further into debt as they too buy into all the BS about how GREAT the economy is getting. It is getting better – just not so much better that they should be borrowing against the future…

That's why we steer away from investments that require money from the bottom 50% – they don't have any! Traders don't seem to realize that gasoline is one of those businesses because Jay Leno and Jerry Sienfeld can both have aircraft hangers full of cars but you can only drive one at a time (until we have self-driving cars), no matter how rich you are.

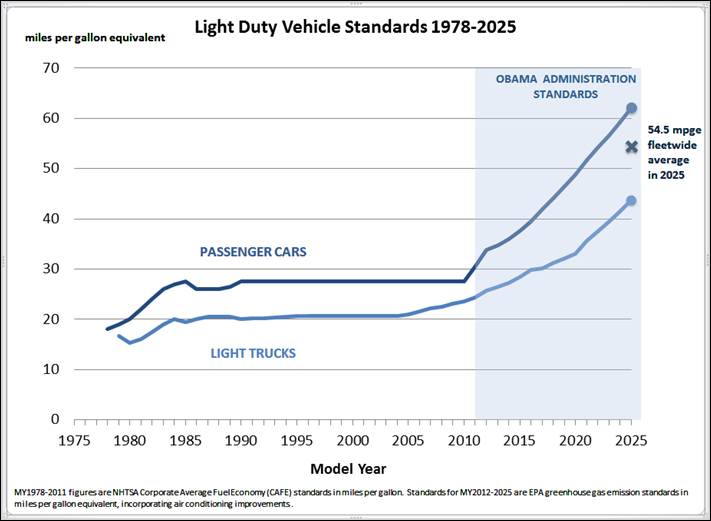

We have 270M cars registered in the US and we sell 17.5M new ones so that means our fleet turns over roughly after 15 years. HOWEVER, auto sales were slow after the crash so it took a while before people bought enough new cars to make a dent but consider that the cars people bought up until 2011 (half a fleet ago) got 27 miles per gallon and new cars are now averaging 40 mpg – that's 37% less feul used by a new car compared to an old one!

We have 270M cars registered in the US and we sell 17.5M new ones so that means our fleet turns over roughly after 15 years. HOWEVER, auto sales were slow after the crash so it took a while before people bought enough new cars to make a dent but consider that the cars people bought up until 2011 (half a fleet ago) got 27 miles per gallon and new cars are now averaging 40 mpg – that's 37% less feul used by a new car compared to an old one!

While President Trump is doing his best to reverse the Obama rules on fuel-efficiency, the rest of the World is still demanding better mileage (and the US is way behind as the rest of the World averages 50 mpg already) so auto makers have not been quick to re-introduce low-mileage cars, though they are very happy to sell high-margin Trucks and SUVs to whoever feels they need those to pick up the groceries but even those "gas-guzzlers" are now averaging 30 mpg when you buy a new one.

So, unless we make more drivers (and Trump is busy kicking them OUT of the country) or get our rapidly aging population to drive a lot more (look out!), then our total use of gasoline is going to grind downwards, year after year, as more and more new cars replace the old ones. That's not even taking into account the possible success of electric cars, which would devastate gasoline demand, of course.

That's what makes Gasoline (/RB) shorts a good play into the holidays as traders are generally lazy and generally chart and pattern driven and don't take into account changing fundamentals that blow their trading premise. It's been a successful strategy for us all year and hopefully it holds up this holiday and then we can look forward to another nice payday around Thanksgiving.