Gee, who could have seen this coming?

Gee, who could have seen this coming?

China did what they said they'd do and took steps to retaliate against Trumps latest round of sanctions, only China is doing it by making a LEGAL appeal through the World Trade Organization while Trump just does whatever the F he wants because, you know, the US isn't part of the World anymore and we don't have to play by THEIR rules. After all, Trump has already said "Trade Wars are good, and easy to win" and when has our President ever lied to us?

As noted by the FT: "It is possible that Mr Trump would accept a symbolic victory. But Mr Xi cannot afford a symbolic defeat. The Chinese people have been taught that their “century of humiliation” began when Britain forced the Qing dynasty to make concessions on trade in the 19th century. Mr Xi has promised a “great resurgence of the Chinese people” that will ensure that such humiliations never occur again."

This is not just about trade, so it won't be easy to "fix". This is about China's emergence as a global leader, something that really bothers Trump & Putin as they take a back seat to Bejing in setting the Global Agenda and China has their 2025 program – a 10-year plan for China to dominate Trade and Tech in the 21st Century. Rather than promoting similar efforts at home by encouraging innovation and R&D, like China is doing, Trump just wants China to stop it.

Seen from Beijing, it looks as though the US is trying to prevent China moving into the industries of the future so as to ensure continued American dominance of the most profitable sectors of the global economy, and the most strategically-significant technologies. No Chinese government is likely to accept limiting the country’s ambitions in that way.

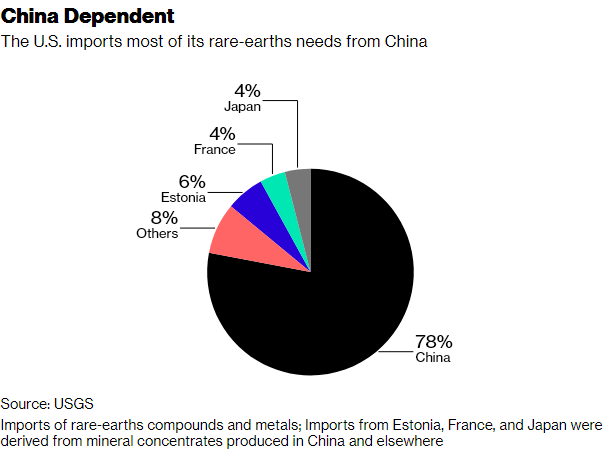

Unfortunately, Trump has not learned or doesn't want to learn from Nixon's great mistake which is: Don't get into trade wars with people you depend on and with Nixon it was OPEC and oil while Trump doesn't seem to understand that China can cripple what little manufacturing there is in the US by simply cutting off our supply of Rare Earth Metals, which we import 78% of from China and it's not possible to get it from other sources, as China produces 85% of the Earth's supply of Rare Metals.

Unfortunately, Trump has not learned or doesn't want to learn from Nixon's great mistake which is: Don't get into trade wars with people you depend on and with Nixon it was OPEC and oil while Trump doesn't seem to understand that China can cripple what little manufacturing there is in the US by simply cutting off our supply of Rare Earth Metals, which we import 78% of from China and it's not possible to get it from other sources, as China produces 85% of the Earth's supply of Rare Metals.

And those are just the metals we import from China directly. Indirectly we import twice as much inside IPhones and TVs and Computers. They make our solar panels work and our LED lights as well. Magnets are Rare Earths and those make speakers work as well as hard drives for data storage and Lanthanum is used to make lenses of all sorts while Cerium goes into catalytic converters while both Lanthanum and Cerium are used to refine and process oil. Who needs that stuff?

There is nothing we can do to China that they can't get from some other country but Rare Earths are vital to the function of US Industry yet Team Trump would rather fight than talk. Fortunately, so far, China has made no threats to use their ultimate weapon but, knowing that they have it means they are very unlikely to capitulate to Trump's demands which means we will be having this overhang on the markets for a long, long time.

As I noted last Thursday, our Trade Imbalance with Canada was just $9.2Bn out of $500Bn in total trade yet we can't even get Canada to agree on trade adjustments. We did get Mexico to agree to adjust our $58Bn (out of $500Bn) deficit in trade because Mexico doesn't have other large trading partners while Canada has the EU and Asia and can afford to tell us to go take a hike.

As I noted last Thursday, our Trade Imbalance with Canada was just $9.2Bn out of $500Bn in total trade yet we can't even get Canada to agree on trade adjustments. We did get Mexico to agree to adjust our $58Bn (out of $500Bn) deficit in trade because Mexico doesn't have other large trading partners while Canada has the EU and Asia and can afford to tell us to go take a hike.

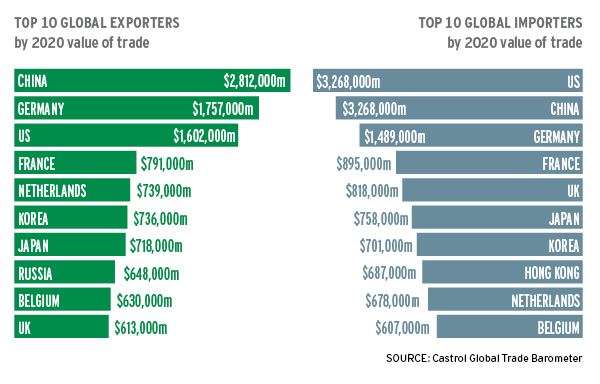

China imports more goods and services than any other country except the US and, despite being 1/2 the size of the US economy, they are almost identical in the amount of goods they import. The US, on the other hand, exports only 60% of what China does so the "trade imbalance" between the US and China is really just a reflection of our own economic shortcomings – not some insipid way China is "picking on us".

Also, while Trump is pushing China and the rest of the World away from the US, President Xi spent the weekend at the Eastern Economic Forum in Vladivostok where Xi and Putin look to "advance cooperation on energy, agriculture, high-tech and infrastructure." As noted by China Daily: "The intensification of the US’ unilateral and policies, seen as unpredictable and threatening both Russia and China, now make economic partnership essential for the two giant Eurasian powers."

Climate change is unlocking the resources of Siberia and the Arctic Basin in ways inconceivable even a decade ago. Moscow and Beijing are the obvious partners to develop the new opportunities on offer. But to focus on economic development in Central Asia, especially in Kazakhstan, as so many studies do, is to miss the point of the long-term focus of specific Sino-Russian economic cooperation. That lies further east and far to the north, across Siberia and the Arctic and along the longest common borders in the world.

The enormous distances, lack of infrastructure and harsh climatic conditions across northern and eastern Eurasia for much of the year have always been the main factors obstructing more rapid economic development between Russia and China.

So who wins from Trump's denial of Global Warming? Russia and China. Who wins from Trumps Trade War with China and sanctions on Russia? Russia and China. Who wins when Trump withdraws the US from the World stage and leaves a vacuum of leadership in the UN, WTO, NATO, etc.? Russia and China. There has never been a better US leader to advance the interests of Russia and China than Donald J. Trump.

So who wins from Trump's denial of Global Warming? Russia and China. Who wins from Trumps Trade War with China and sanctions on Russia? Russia and China. Who wins when Trump withdraws the US from the World stage and leaves a vacuum of leadership in the UN, WTO, NATO, etc.? Russia and China. There has never been a better US leader to advance the interests of Russia and China than Donald J. Trump.

I think we should give the President the benefit of the doubt and assume he is not knowingly an agent of Russia, carrying out Putin's agenda. Trump is merely an innocent dupe of Russia, carrying out Putin's agenda. You can choose to believe that it's merely coincidence that every single policy decision made by Trump ends up furthering the interest of Putin and Russia. Yes, you can choose to believe that – it's fine – only history will judge you…