The Dollar is testing 94.

That's down over 1% since Sept 1st and 1.5% off it's highs so take the market "gains" with a Lot's wife-sized grain off salt since the indexes have gone nowhere for the month yet the Dollars they are priced in have lost 1% of their buying power – that's not good!

We're picking up longs on /DX off the 94 line, looking for at least a $200/contract bounce to 94.20 and, of course, keeping very tight stops below the line but 94 should be nice and bounce – even if it ultimately fails. Brexit still isn't finished and the Trade War is far from settled (despite the relief rally on White House happy talk) so it won't take much to jam the Dollar right back to 95, which would be $1,000 per contract gains if all goes well.

Meanwhile, despite the huge boost from our weak currency, the S&P (/ES) is right where we left it at the end of August and the volume has gotten even lower by 10-15% – any lower than this and the last two guys trading can just get together in person to make their few transactions. Professional traders do not like seeing low liquidity in the markets but it sure doesn't seem to bother the Robots and ETFs that are trading the market these days. That's becuse people think things are great and aren't trying to sell but God help us all when they do…

.jpg) In Wednesday's Live Trading Webinar we were shorting Gasoline (/RB) Futures at $2.04 and we let one contract ride overnight and that one contract made a nice $2,112 yesterday afternoon so – you're welcome! It's too risky to keep playing over the weekend so we'll just hope "THEY" spike it back up over the weekend so we can short it again next week.

In Wednesday's Live Trading Webinar we were shorting Gasoline (/RB) Futures at $2.04 and we let one contract ride overnight and that one contract made a nice $2,112 yesterday afternoon so – you're welcome! It's too risky to keep playing over the weekend so we'll just hope "THEY" spike it back up over the weekend so we can short it again next week.

More likely we'll switch to shorting Oil (/CL), which is still at $69 as oil is coming into a very difficult roll as December is already stuffed with almost 300M barrels worth of fake, Fake, FAKE orders and the 4 front months now have over 1Bn barrels worth of FAKE!!! orders that will have to be cancelled or rolled by the end of the year. Just imagine if they actually took delivery of 1Bn barrels of oil over a 4 months period. The US only uses 19M barrels a day so each month we go through 570M barrels but we produce 11Mb on our own and import 8Mb so just 240M per month is imported for the entire US but 3.5Mb of that comes from Canada in piplelines and 1.5Mb comes in pipelines from Mexico which means only 3Mb/d arrives by ship and certainly not all of that goes to Cushing, OK – a facility that can only handle 50Mb per month!

|

Click for

Chart |

Current Session | Prior Day | Opt's | ||||||||

| Open | High | Low | Last | Time | Set | Chg | Vol | Set | Op Int | ||

| Oct'18 | 68.79 | 69.14 | 68.66 | 68.84 |

07:52 Sep 14 |

– |

0.25 | 96879 | 68.59 | 194488 | Call Put |

| Nov'18 | 68.63 | 68.95 | 68.46 | 68.64 |

07:52 Sep 14 |

– |

0.23 | 21637 | 68.41 | 363927 | Call Put |

| Dec'18 | 68.56 | 68.85 | 68.40 | 68.57 |

07:52 Sep 14 |

– |

0.22 | 9783 | 68.35 | 289955 | Call Put |

| Jan'19 | 68.41 | 68.72 | 68.30 | 68.45 |

07:52 Sep 14 |

– |

0.20 | 1560 | 68.25 | 154772 | Call Put |

Still, the NYMEX is trading 250Mb per month worth of FAKE orders for delivery to Cushing, OK – a physical impossibility yet the regulators do nothing to stop it and I have complained to Democrats and Republicans for two decades and nothing ever changes so all we can do is accept the fact that these are fake orders and make our money back betting that, when expiration day comes along (next Thursday) they will have a lot of pressure to roll contracts. That's going to make Oil (/CL) a very good short below the $70 line.

If you want to hedge your short position on front-month /CL contracts, you can pick up a long contract, like the Dec 2022's, which are trading at $57.52, more than $10 below the current contracts so you can lock in your own oil for delivery in 4 years for $57.52 while fearlessly shorting the front-month contracts because, if they move up against you, you can simply do what all the NYMEX traders do, which is to roll your front-month and, 48 months from now, if oil is still at $70, you'll have a $12.50 spread times 1,000 barrels for a $12,500 per contract gain.

| Dec'22 |

– |

– |

– |

57.12 * |

07:52 Sep 14 |

– |

– |

– |

57.42 | 8840 | Call Put |

If oil drops, we assume the front month will have a more drastic move down than the longer months so you can pick up the short-term money and cash in or wait for the next bounce and do it again. That's all it takes to lock in the price of all the gas and oil your family is likely to use in the next 4 years while allowing you to make some short-term money speculating along the way. That's how we force those FAKE!!! bastards at the NYMEX to pay us for their BS con game – so it's satisfying as well…

Meanwhile, our Central Banksters may not see a need to hike rates but Russia's Central Bank just did, raising their key interest rate to 7.5%, the first rate hike since 2014, when rates were as high as 17% at the peak. “Changes in external conditions observed since the previous meeting of the board of directors have significantly increased proinflationary risks,” the Central Bank said in a statement, noting that the ruble’s exchange rate has weakened since the start of the year. The Ruble is down more than 14% against the Dollar so far this year, although it rose 0.7% in response to the rate hike.

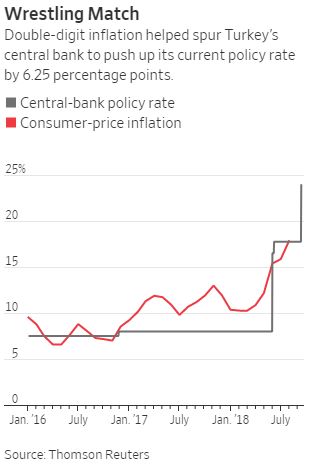

Turkey raised rates sharply yesterday, from 17.5% to 24% as that country looks to reign in the inflation that our own Fed can't seem to find and signs of, despite the fact that home prices are rising and fuel prices are rising and auto prices are rising and education costs are rising and medical costs are rising (in fact, the Administration has been very vocal on that point) yet, somehow, officially in the US – there is no inflation. Dictatorships are more honest with their people than the US Government – sad.

Turkey raised rates sharply yesterday, from 17.5% to 24% as that country looks to reign in the inflation that our own Fed can't seem to find and signs of, despite the fact that home prices are rising and fuel prices are rising and auto prices are rising and education costs are rising and medical costs are rising (in fact, the Administration has been very vocal on that point) yet, somehow, officially in the US – there is no inflation. Dictatorships are more honest with their people than the US Government – sad.

We have lots of data this morning with China's Retail Sales along with ours as well as Industrial Production for both countries while China will give us Fixed-Asset Investments and the US will have Consumer Sentiment and Retail Inventories. I have no idea when China comes out but we just (8:30) got retail sales and they sucked at 0.1% while Import Prices for 2018 (so far) have blasted up 3.7% – what inflation?

Running an economy based on false information is what led to the collapse of 2008. All the reports ignored the facts back in 2007 as well and we got glowing reports from the Banking and Real Estate sectors and none of the official Government Reports picked up on the myriad of underlying problems that were flasing massive warning signs for those who were willing to pay attention (while being ridiculed by the bulls for being a worry-wart). As I've said many times, I got tired of banging the drup and warning people to be more cautious in 2007/8 so I'll error on the side of annoying you in 2018/19 to make sure the next drop doesn't catch you overly bullish.

Leading Economorons had forecast Retail Sales to be up 0.5% so it's "just" an 80% miss – which is pretty good for these guys yet they'll ask them for targets again next month as well. Last month, Industrial Production was up 0.1% and this month they predict 0.4%, so we'll see how that goes but Michigan Sentiment (10am) should be strong as the other consumer surveys have been strong so far.

So it's wait and see into the weekend but I like the S&P (/ES) Futures short at 2,915 with tight stops above as a play on the data so far.

Have a great weekend,

– Phil