Harmless trade war?

Harmless trade war?

That's how the Conservatives are spinning it and many are drinking the Kool Aid and ignoring the stress and strain we are putting on the rest of the World – especially China, where the Shanghai Composite is officially a bear market, down 20% for the year and almost 50% off it's 2015 highs. 2015 was another crisis we ignored in China – until we had a "flash crash" in August and a proper 10% correction in the beginning of 2016 – even as China was "recovering" a bit.

When people tell you that what happens to the second largest economy in the World doesn't effect the largest economy in the World, those people are idiots and you should never listen to anything they say to you – ever again. Jamie Dimon of JP Morgan, for his part, is doing his best to minimize the concerns of retail investors so he can keep dumping stocks on them:

"If you look at tariffs on $200 billion (worth of Chinese goods), and this may all get passed on to American consumers and they have to pay another $20 billion (on Chinese imports), it's a $20 trillion economy, so the actual economic effect is not dramatic," Dimon said.

"We can add tariffs to more things and the Chinese can retaliate in other ways and I don't think all that's good. It's not a devastating thing, it's not a war, it's a trade skirmish that can have negative economic effects."

Dimon is not going to say what happens in China has no effect but he's mimizing the impact and misleading traders by using the 10% figure that costs $20Bn but that 10% tariff escalates to 25% at the end of the year ($50Bn) and then Trump plans to double the number of goods that are taxed ($100Bn) so a smart reporter would ask Dimon – does $100Bn matter then?

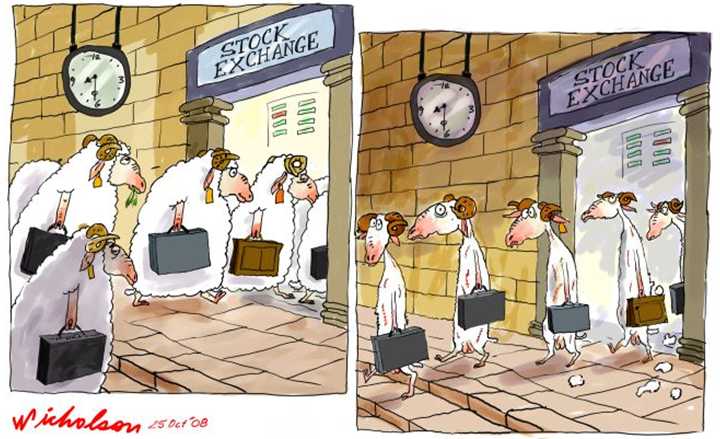

You can nod your head and agree with Dimon (after all, he's a rich guy, so he must know stuff and he would never lie to you, right?) because $20Bn is only 0.1% of our GDP, though that's still enough to knock growth down from 4% to 3.9%. $100Bn, on the other hand, is 0.5% of our entire GDP – it's really kind of hard to find any justifcation to minimize the impact of that other than – "Because I'm an investment banker and my wealthy clients need greater fools to sell their ridiculously over-priced equities too." Kind of like these bastards:

This is what "THEY" do to retail investors at the tail end of the rally, they herd all the sheeple into the markets at the WORST possible time, cranking up the propaganda machine and doing whatever it takes to pretty up the indexes to draw as many people as they can into the markets – providing fresh buyers so they can cash out of the stuff they bought when they were telling consumers to stay out of equities.

I guess your investing premise can be that tariffs (ie. taxes) amounting to 5% of our GDP won't impact the economy because…. well, I can't think of why because it's not my premise… or your premise could be that President Trump has lied to the American people 6,000 confirmed times in less than 2 years in office (millions of times before as well) so why should we believe he'll go through with anything he says so it will all work out in the end. If that makes you sleep better at night, that's great but the fact that there are people who believe that crap is exactly what keeps me up at night.

Wealthy Conservatives like Dimon love to tell you that you can learn to live without Chinese goods because the only Chinese goods in Dimon's house are Ming vases and silk pajamas but the average American, who is already struggling to make ends meet, is going to have a hard time avoiding Trump's 25% tax on most of the things they buy. Of course, that's exactly the point – Trump is taxing the poor in order to give tax cuts to rich people like Dimon, who has a net worth of $1.4Bn.

If anyone steals $1.4M from Jamie Dimon, make sure you use his quote above as 1% of his wealth is "not dramatic" enough to be a crime!

This is the problem when you have Billionaire setting US policy – they don't live in the same world as the rest of us so their concerns are NOT the concerns of the average citizen of even the average Millionaire. If you are a Millionaire, you are to Jamie Dimon and Donald Trump as much of a concern as a person with $1,000 is to you. That's what a Billionaire is – one thousand Millionaires – if you say "F the poor", well, you are the poor to them!

This is the problem when you have Billionaire setting US policy – they don't live in the same world as the rest of us so their concerns are NOT the concerns of the average citizen of even the average Millionaire. If you are a Millionaire, you are to Jamie Dimon and Donald Trump as much of a concern as a person with $1,000 is to you. That's what a Billionaire is – one thousand Millionaires – if you say "F the poor", well, you are the poor to them!

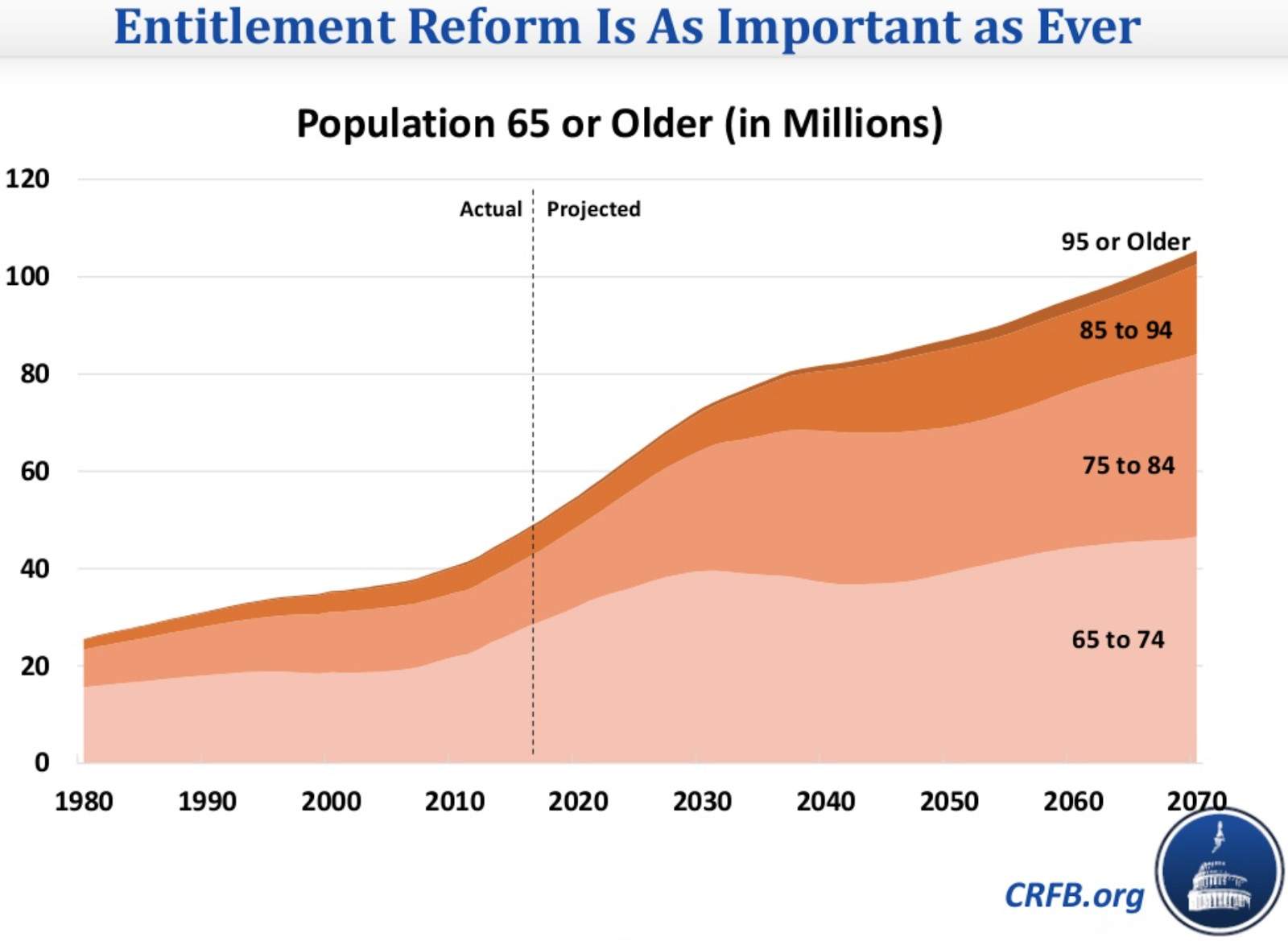

Speaking of F'ing the poor, as well as your parents if they are still living – Trump's tax cuts combined with lower than promised job gains has caused the Congressional Budget Office to accelerate the dates that Social Security (2022) and Medicare (2026) will run out of money by 3 years. Well SS won't "run out of money" as they have $2.8Tn in reserves but, once they go negative in 2022, they are now projected to be out of reserves by 2034.

I'll be 71 in 2034 so I guess all the money I put in over the last 40 years plus the money they will continue to collect for the next 16 years will be lost. We should all be pissed off that we now have to contribute to a fund that will never pay us back. The reason they are called "Entitlements" is because we are ENTITLED to the benefits – this was our money that was taken out of our paychecks and placed in a forced savings account "for our own good."

61M Americans, who worked and saved their whole lives, are currently collecting $952Bn a year but, in perspective, that's only $15,606 per person but the Trump Administration is going after that money and each year they cut is another Trillion Dollars they can give out to their friends and family.

61M Americans, who worked and saved their whole lives, are currently collecting $952Bn a year but, in perspective, that's only $15,606 per person but the Trump Administration is going after that money and each year they cut is another Trillion Dollars they can give out to their friends and family.

Consider the average American who made the average salary of $6,000/yr back in the 50s and 60s, $20,000/yr in the 70s and 80s and $40,000/yr in the 90s and 00s and is now retired. In each 20 years they made $120,000, $400,000 and $800,000 so the 12% SS tax (half you, half the company) would have been $14,400, $48,000 and $96,000 but $14,400 saved at just 3.5% in 1960 would be worth $105,901 and $48,000 at 3.5% since 1980 would have been $177,000 and $96,000 at 3.5% since 2000 would have been $178,000 today.

So a total of $461,000 was contributed by the average American and, at 3.5% that's $16,135 in annual interest. See – ENTITLEMENT – they are only getting back the money they put in (and the government keeps the principal when they die) – albeit at a ridiculously low rate of return since wealthy people, who were not forced to save 10% of their earnings (it caps out at $100K), were able to invest in the market at 8% average returns, earning them (and yes, this is real math) $5,496,000 on the EXACT SAME SAVINGS.

That money has been STOLEN from the American people to benefit the Top 1% and, now that the piggy bank is empty and the Ponzi scheme is collapsing, the Top 1% are saying that YOU have a problem because the system is empty and they are reclassifying "entitlements" as if it's some kind of Socialist Agenda as opposed to a CONTRACT they Government made with you where you contribute 12% of your income and they will invest it wisely for you to make sure you have enough money to live on in your old age.

That money has been STOLEN from the American people to benefit the Top 1% and, now that the piggy bank is empty and the Ponzi scheme is collapsing, the Top 1% are saying that YOU have a problem because the system is empty and they are reclassifying "entitlements" as if it's some kind of Socialist Agenda as opposed to a CONTRACT they Government made with you where you contribute 12% of your income and they will invest it wisely for you to make sure you have enough money to live on in your old age.

Rembember, we're not even talking about what constitutes "enough money" as $15,000 a year isn't all that much to live on – even if you enjoy cat food. The entitlement payouts have never kept up with inflation – even the Fed's fake inflation numbers that minimize the Government's need to adjust the payouts. We're talking about the fact that money you could have saved yourself was taken from you and used by the Government (mostly Republican ones) to excuse cutting taxes to the Top 1% so they would have more and you would have less – in 2022.

Since 2022 seemed very far away at the time (and the date keeps moving closer) and since Americans are not known for thinking about the Future, this was an easy crime to commit as there wouldn't even be an investigation until the victims began to realize they have been robbed but now it's just 4 years until even Trump's base will notice there are no more checks coming or drastically reduced checks and there WILL be a reckoning but, sadly, it's far to late to really save the projected 105M people who will be turning 65 with NOTHING to retire on – NOTHING!

This country has an expiration date – and it's rapidly approaching. What's going on at the moment is the Top 1% are milking whatever wealth they can and they will be long gone before the collapse. Where will you be?