Move along folks, nothing to see here.

Move along folks, nothing to see here.

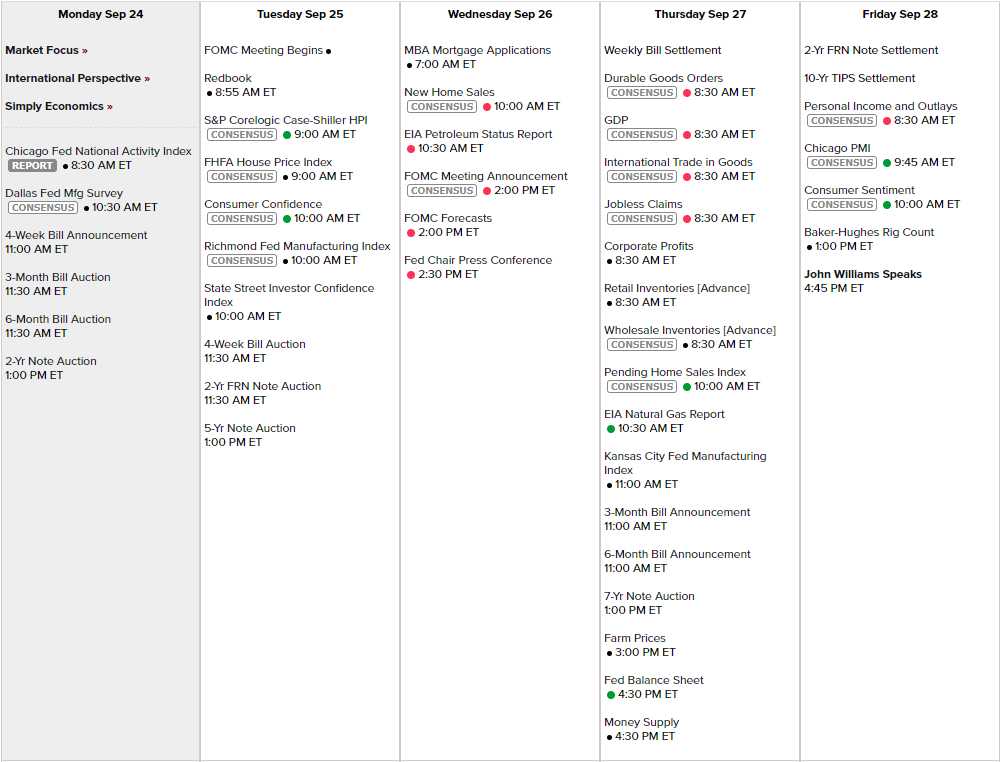

Despite a run of bad news over the weekend, so far, the market indexes seem unphased by negative news reports. Of course it is the last week of the quarter and windows need to be dressed so we'll see what happens when October rolls in, along with Q3 earnings, when we may begin to see some companies begin to choke on higher wages and trade concerns. As noted in the Wall Street Journal, Industrial and Material stocks are in their own private bear market yet no one is taking it seriously at all.

“There’s a number of money managers who’ve been hesitant to be involved with the [companies] that are going to be potentially affected by the tariffs, whether they’ll be able to export fewer goods or be buying less from China,” said Mark Grant, managing director and chief global strategist at B. Riley FBR Inc.

As I noted last week, China's Shanghai Composite is down 20% for the year and would likely have been down more today as China withdrew from trade negotiations over the weekend but that market is closed today for a holiday. THESE ARE THE SAME KIND OF THINGS PEOPLE IGNORED IN 2007/8!

Analysts caution that while investors have been pricing the risk of a trade war into shares of manufacturers, mining firms, home builders and others, they mostly have ignored the glaring risks associated with major tech companies, such as potential punitive measures that could affect Apple’s manufacturing in China or cost increases that could hurt Amazon’s e-commerce sales. That puts the S&P 500’s narrow leadership at risk of a sharp pullback if trade tensions reach a boiling point, similar to the swift correction that stocks suffered in February on worries about a potential pickup in inflation.

Analysts caution that while investors have been pricing the risk of a trade war into shares of manufacturers, mining firms, home builders and others, they mostly have ignored the glaring risks associated with major tech companies, such as potential punitive measures that could affect Apple’s manufacturing in China or cost increases that could hurt Amazon’s e-commerce sales. That puts the S&P 500’s narrow leadership at risk of a sharp pullback if trade tensions reach a boiling point, similar to the swift correction that stocks suffered in February on worries about a potential pickup in inflation.

Last night, China cancelled this week's trade negotiations with the Trump Administration and no further talks are scheduled as the US insisted on moving forward with $200Bn in additional tariffs that take effect today. That makes it very doubtful there will be any resolution before the election as China has no reason not to wait and see if they will have more a more reasonable Government to deal with in 45 days.

Meanwhile, in other news that's hurting the United States, Trump's unprovoked sanctions on Iran based on long-disproved Israeli intelligence reports is causing oil prices to rise and OPEC just had a meeting over the weekend where they did not agree to increase supply to cover Trump's self-inflicted shortage. That sent the price of Brent Crude (/BZ) back over $80 for the first time since 2014, when it was on the way down from $120.

Doubling the price of oil is indeed making things GREAT again for some of Trump's biggest donors but don't worry, you get to donate every time you go to a gas station as Gasoline is already averaging 30% more than it was last year but still hovering around just $3/gallon so a long way to go to get back to the $4-5 range – so we have that to look forward to as yet another way Trump manages to transfer money from the poor to the rich.

Of course it's all nonsense and the truth is that without production issues in Venezuela (-1.5Mb/d) and sanctions on Iran (-2Mb/d) and OPEC's production cuts (-1Mb/d) the World would be drowning in oil as demand has been cutting back while total production capacity has increased and the escalation of a trade war between the US and China – even if it does not spread to other countries – will put further curbs on the demand for oil as 1/3 of all oil demand is trade-related.

These are the last gasps of a dying commodity and, no matter how much money the oil barrons pay Trump and his family to create false crises along the way – the day's of $80 oil (Brent) are over and we're very happy to short NYMEX Oil (/CL) again below the $72.50 mark, with tight stops above and Gasoline (/RB) at the $2.05 line, also with tight stops above. They can scare people into anything – especially early in the monthly contract cycle (we just started trading November) but there are already 308,000 FAKE contracts in November to deliver 308Mb to Cushing, OK by Nov 30th – a facility that can only handle 50M real barrels a month.

|

Click for

Chart |

Current Session | Prior Day | Opt's | ||||||||

| Open | High | Low | Last | Time | Set | Chg | Vol | Set | Op Int | ||

| Nov'18 | 71.14 | 72.39 | 71.14 | 72.23 |

09:21 Sep 24 |

– |

1.09 | 166691 |

– |

433907 | Call Put |

| Dec'18 | 70.75 | 71.89 | 70.68 | 71.71 |

09:21 Sep 24 |

– |

0.96 | 37540 |

– |

308728 | Call Put |

| Jan'19 | 70.36 | 71.55 | 70.36 | 71.31 |

09:21 Sep 24 |

– |

0.95 | 13590 |

– |

168201 | Call Put |

| Feb'19 | 70.39 | 71.20 | 70.36 | 70.98 |

09:21 Sep 24 |

– |

0.59 | 7448 |

– |

94939 | Call Put |

| Mar'19 | 70.00 | 70.96 | 70.00 | 70.75 |

09:21 Sep 24 |

– |

0.75 | 6725 |

– |

147986 | Call Put |

The US produces 11Mb/d and we import 4Mb/d via pipeline from Canada and Mexico and there are 2 other ports where oil comes into the country to provide for our 600Mb monthly consumption. 11 x 30 is 300Mb and 4 x 30 is 120Mb and 433,907 FAKE contracts at the NYMEX is 434Mb if we round up by 93,000 so that's 854Mb of oil less 600M we actually use is 254M barrels of completely and utterly FAKE demand being pushed at the NYMEX for no purpose other than to rip you off at the gas pumps.

Notice how the front month is far more expensive than longer months – they KNOW oil is going down over time but, as long as they can screw you out of $5 every time 200M Americans fill up their cars – it's a nice $360Bn annual scam.

The more fake "crises" they can dredge up, the more likely you are not to think about what's really causing these prices to climb and the more they can get away with. And it's not just oil – the Trade Wars will be an excuse for many companies to raise their prices, forcing the consumers to pay for Trump's "tariffs" a second time. I know the market trades like none of this matters but disposable income is being squeezed from all sides and something has got to give.

Be careful out there!