Hooray!

Whatever happened to "hooray"? Apparently people used to chant it all the time. We should bring that back. Apparently we're bringing back NAFTA as Canada signs on over the weekend and that is rocketing the markets much, much higher than when we used to have NAFTA, which Trump called a terrible trade deal and now we have a new NAFTA, which is the same as the old NAFTA but now it's called the US-Mexico-Canada Agreement because Trump hates anything that had to do with Democrats and because Republicans are about as creative with naming things as a demented parrot.

The fact that USMCA was already the US Minority Contractors Association and now Trump has subsumed the name and ruined their Google ranking, plunging the association into web obscurity is just a bonus for those who want to make America white great again. The bill is a little better for US dairy farmers but, in typical GOP doublespeak BS, the 2.6M vehicle restriction is miles above (40%) what we currently import – that's not a restriction – it's an invitation for growth!

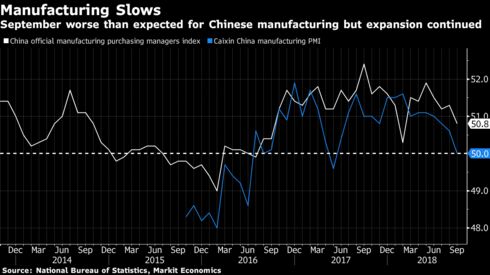

Meanwhile, China is not fixed but because we made deals with Canada and Mexico, people hope we can work something out with China as well. China's PMI dropped to 50.8 in September – that's barely expanding and the lowest since 2016 and missed the 51.2 expected by leading economorons by a wide margin. New Orders fell to 48, which is contracting – also for the first time since 2016.

Meanwhile, China is not fixed but because we made deals with Canada and Mexico, people hope we can work something out with China as well. China's PMI dropped to 50.8 in September – that's barely expanding and the lowest since 2016 and missed the 51.2 expected by leading economorons by a wide margin. New Orders fell to 48, which is contracting – also for the first time since 2016.

“The further slowdown in China’s official manufacturing PMI in September reflects the intensifying impact of the U.S.-China trade war on China’s manufacturing export sector,” said Rajiv Biswas, APAC chief economist at IHS Markit in Singapore. “The near-term outlook for the Chinese manufacturing export sector remains weak, albeit the Chinese government may apply some further stimulus measures to support growth.”

That worsening follows on from a slowdown in industrial profit growth in August. Private companies fared worse than state-owned enterprises, but discrepancies in that data suggest that the picture for Chinese manufacturers may be worse than officially-reported growth rates show. The official PMI report also indicates rising unemployment in the manufacturing sector. Analysts also expect China’s central bank will continue topping up liquidity in the financial system to support economic growth.

Congratulations are in order this morning for Elon Musk, who will not be going to jail (so far) and "just" has to pay the SEC $20M and step down as Chairman but he gets to remain CEO, which has sent the stock flying higher as the faithful celebrate the return of the man who's lost over $10Bn of investor cash and is still struggling to make 250,000 cars a year (yes, that's all 5,000 cars a week is – even if they can keep that up).

TLSA is bouncing right back towards $310 this morning in pre-market trading and we'll be thrilled to get a chance to short them again if they go higher. I'm not going to get back into why TLSA sucks – you can read last week's reports for those details or Value Walk's article from Friday that compares Tesla to Enron and Valeant – just before they collapsed.

Meanwhile Tesla continues to downsize its SolarCity division while a civil securities fraud case accusing Musk of using Tesla to bail out his (and his family’s) interests there proceeds; earlier this year Zero Hedge included an excellent summary of the suit by Twitter user @TeslaCharts in this story about SolarCity’s latest retrenchment, which will undoubtedly help fuel that fraud case, as will this later story describing how Tesla sales people have no idea when the solar tiles or PowerWalls used to justify that merger will ever be available. (Remember that when Musk was promoting that merger he used fake solar tiles on a fake house at a movie studio… How appropriate!)

Finally, Tesla is increasingly besieged by a wide variety of lawsuits for securities fraud, labor discrimination, worker safety, union-busting, sudden acceleration and lemon law violations, and new ones appear on a regular basis. This SEC settlement will put a lot of teeth into lawsuits by the shorts caused by Musk's manipulation of the stock – which he just pled guilty to. We're still short on TSLA stock but our shorts pay us below $420 in January from back when TSLA was over $360 – we'd by happy to buy more of those!

In other good news for our portfolios, GE finally has a new CEO and any change is a good change at GE and that stock is also jumping 15% this morning – back to $13. We're not out of the woods yet but our Jan 2021 target for GE is only $15 (we have the $10/15 bull call spreads with short $15 puts) and we're finally back on track – if we can hold $13.

We were just discussing GE last week when one of our Members asked what was wrong with GE as they tumbled lower and lower – this time right after we had doubled down in our Long-Term Portfolio. My response from the Live Member Chat Room was:

GE/Jabob – Sadly true.

The 2021 $10/15 bull call spread we rolled to last week at $2.15 (80) is now $1.90 ($15,200) and the 30 short 2021 $15 puts we sold for $3.50 are now $4.25 ($12,750). Clearly entering into the $40,000 spread for net $2,450 with only an upside potential of $37,650 (1,535%) is far too scary to take a chance on a shaky company like GE, right?

Our net on the new spread was $6,700 so our upside was only $43,300 (646%) but we already lost about $13,000 on the initial positions so we're in for about $20K on the $40K spread but, as a new trade – it's still kid of exciting!

They "only" made $800M last Q and project $8Bn for the full year which would be a p/e of 11.5 on a $98Bn valuation at $11.25.

Unfortunately, there's no quick way to know if traders know something or if the fundamentals will win out over time – you need time for that and, in between, there's nothing that stops traders from panicking out of positions.

It's hard to be a Fundamental Trader as you have to learn to ignore the PRICE of stocks and concentrate on their VALUE and the two can be very, very different at times. What's the "value" of TSLA when it goes up and down 15% in two days and up and down $135 (40%) in a month? The answer is "none of the above" as the VALUE of TSLA is based on how many cars it can make at what margins over time compared to their peers and Musk has purposely attempted to obscure that valuation by adding all sorts of other projects to the mix but, overall – until he shows actual sales of batters, roofs, tunnels or rockets – Tesla is an electric car company and should be valued as such.

You can trade GE or TSLA for whatever price you want – that doesn't change its VALUE which, in TSLA's case – is barely $150 – even giving Musk the benefit of the doubt on his various projects over the next 5 years. $150/share would still be a very large $25Bn market cap – very, very generous for a company with $14Bn in sales and $3Bn in losses over the past 4 quarters. Keep in mind that $25Bn is about HALF of what the stock is trading for now – RIDICULOUS!

Meanwhile, the markets have jumped up in PRICE but it remains to be seen whether or not the new NAFTA deal actually adds VALUE to the market but, on the whole, nothing has changed and we're very likely to be using the same successful shorting lines we used last week.