Wheeeeeee!

Wheeeeeee!

This is exciting, isn't it? We had our Live Trading Webinar yesterday and our last Trade Idea was a long on Gasoline (/RB) at $1.82 with a planned double down at $1.80 for a hold into the weekend if we had to but already we're up $1,000 this morning (and done there) and that, added to our quick trades on the Nasdaq (/NQ) and the Russell (/RTY) Futures during the webinar put us well over the $2,000 profit mark on our Futures Trades, which is just where we want to be with 2 hours' of "hard" work.

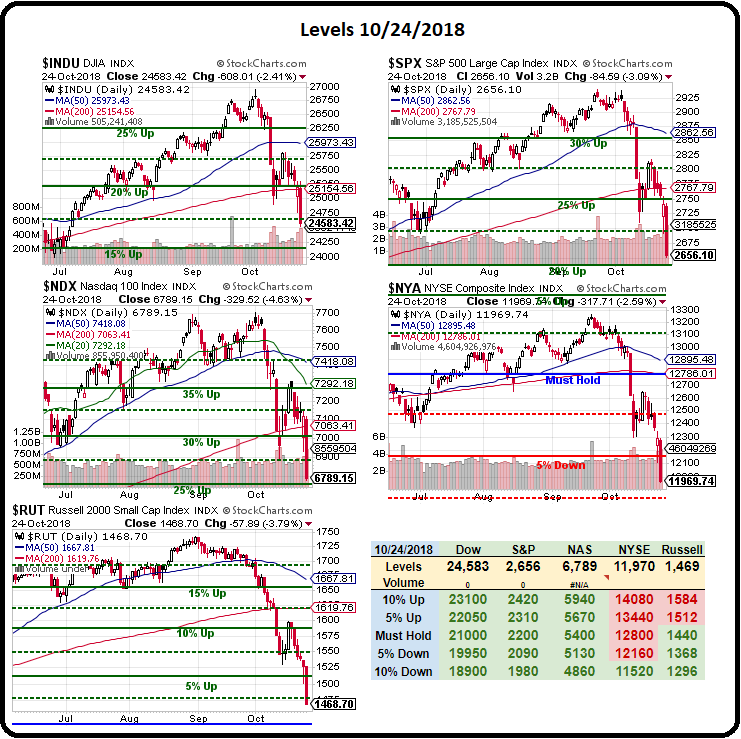

The indexes were far too scary to trade overnight and, even this morning, I'm less than enthusiastic about the "rally" that's lifting the Dow (/YM) back to 24,800 because that's still 2,200 points (8%) down from 27,000 which means it is only a weak bounce (20% of the 10% drop) and we're not going to be impressed by anything less than getting back over the 25,300 mark, which is still 500 points away.

These are the same bounce lines we predicted we'd need yesterday morning after completing the 10% correction – we just weren't expecting to complete it yesterday and we didn't quite get to 24,300 (the 10% drop from 27,000) but we never quite got to 27,000 either – so fair is fair I suppose…

Actually, I'm not expecting us to bounce back to the strong lines and, as I said last night on Money Talk (where we announced our portfolio adjustments and DID manage to add the MJ trade we discussed yesterday morning), I think we're going to fail our lines and fall another 10%. To that end, we added a Russell Ultra-Short (TZA) hedge to our Money Talk Portfolio in yesterday's review and, in our Live Member Chat Room, we added an additional Nasdaq Ultra-Short (SQQQ) to our Short-Term Portfolio at 10:40 am:

In the STP, we have 80 naked short SQQQ March $14 calls at $1.25, now $2.13 with SQQQ at $13.65. I'm still iffy about covering but let's not take too much risk so let's pick up 80 of the June $12 ($3.30)/17 ($2) bull call spreads at $1.30 ($10,400) as they are well in the money and only lose if the market is going up nicely 8 months from now in which case our longs will be up $250,000 so we won't be worried about losing $10,400, right?

Overall, it adds about $30,000 of insurance (the upside potential) as well as letting the short SQQQs ride for $17,000 we gain if they expire worthless.

Using our bounce lines, we knew that a failure at 7,080 (weak bounce line) on the Nasdaq Futures (/NQ) was a sign of DOOM!!! that indicated we were about to complete our FIRST 10% correction to 6,930 and the Nasdaq fell all the way to 6,785, which was a very nice $6,000 per contract gain on our Futures shorts for the day – a nice hedge if you know how to look for them!

Also, as I noted in the morning report – watching the Dow (/YM) and Russell (/RTY) Futures would let us know whether to go long the Russell at 1,530 or short the Dow at 25,300. Needless to say the Dow won and fell below 24,600 for a 700-point drop that paid $3,500 per short contract – another nice hedge to tide us over during the downturn...

The Futures are wonderful for making quick adjustments to your portfolio's weighting – they are a tool every trader should have in their toolbox but it takes PRACTICE to get good at trading them so I suggest you start now – and don't wait for the next emergency to attempt your first trade!

We've weighted ourselves back to bearish and we're going to be very skeptical of even weak bounces at this point and we can re-short the indexes if those weak bounces begin to fail. Only making AND HOLDING strong bounces by tomorrow will convince us not to remain short into the coming weekend and, looking over the Dow components and their earnings so far – I'm not at all convinced that they shouldn't be down another 10% and AAPL hasn't even had its 10% correction yet ($207) and woe be unto the Nasdaq if it does.

We've certainly managed to turn the United States of America into a 3rd World Nation complete with tremendous wealth gaps, tin-pot dictators, social unrest, political assassination attempts and massive robbing of the Government piggy-bank leading to tremendous levels of debt – why should it surprise you that the market follows the rest of the World down into a 20% correction? If this keeps up – we'll be lucky if that's all we lose…