Wheeeeeee!!!

Wheeeeeee!!!

So much fun to trade a volatile market. Already this morning (7:30) we picked a quick $1,000+ trading the Futures in our Live Member Chat Room and that's always a nice way to start the day but we stopped out Gasoline (/RB) with just over $200 per contract on a 15-minute trade and Oil (/CL) contributed $110 per contract and the indexes were good for a quict $150-250 each between 7:17 and 7:34.

Now we're looking for a pullback and our 7:17 entries were:

Well, we're re-testing Wednesday's lows so hopefully a little bounce here at 24,600 (/YM), 2,650 (/ES), 6,750 (/NQ) and 1,470 (/RTY) so I'd go long the laggard here but very tight stops below.

Also /CL over the $66.50 line and /RB $1.785 are both fun longs for a Friday.

Watch the Dollar though, we don't want to see it over 96.50 and VIX under 22 would be nice too!

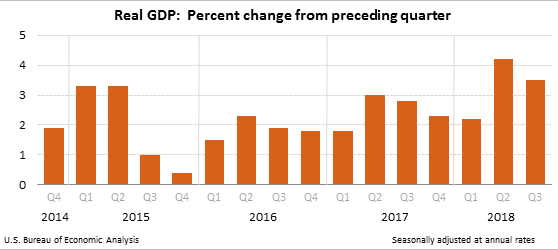

We've got GDP at 8:30 and last quarter was 4.2% and this quarter we'll be lucky to see 3.3% and it's likely to be downhill from here but the question is – has the drop to 3.3% been realistically priced into the market and, sadly, I don't think it has. Certainly any print below 3% would cause a new wave of panic and over 3.5% will be relief – so that's the zone we're keeping our eye on.

Google (GOOGL) and Amazon (AMZN) disappointed on earnings last night with AMZN dropping 10% pre-market. Netflix (NFLX) is down too, mostly because it's got a 100x p/e ratio and people are starting to realize how stupid that is and that does not bode well for other Nasdaq high-fliers, who may actually be held to realistic standards as they report, which can lead to that next 10% corection we've been warning you about (Nadsaq (/NQ) 5,940 should be the bottom but, hopefully 6,400 holds).

Notice in the weekly chart, yesterday's bounce meant nothing and, if we close down today, we're looking at a very ugly, accelerating downward pattern and, if we fail Wednesday's lows today, it will mark the 3rd time in a row dip buyers have been burned and that's how many times it takes them to learn their lesson and that will cause us to lose retail support on the next leg down so make sure you are very well-hedged into the weekend!

That means those longs we were playing for this morning were just technical bounces – it's not our conviction at all…

We don't know for sure which way GDP will break us but, as I noted yesterday, we took advantage of the bounce and filled out our hedges and now we're back to being a bit more bearish on the market as I think it's more likely we go 10% down than 10% up and 10% up only puts us back to where we were. 10% down, however, begins to make for some interesting bargains!

We don't know for sure which way GDP will break us but, as I noted yesterday, we took advantage of the bounce and filled out our hedges and now we're back to being a bit more bearish on the market as I think it's more likely we go 10% down than 10% up and 10% up only puts us back to where we were. 10% down, however, begins to make for some interesting bargains!

We were talking about good books on valuation yesterday and I said the bible on the subject is Benjamin Graham's "The Intelligent Investor" – these are a few quotes from his work. Value investors like us LOVE a good downturn – it's when we go shopping! In fact, just yesterday we sent out a Top Trade Alert on International Paper (IP) as it tested the $40 line:

Since you can sell the 2021 $40 puts for $5.50 – let's sell 10 of those in the LTP for $5,500 and let's also pick up 15 of the 2021 $40 ($7.50)/47.50 ($4) bull call spreads for $3.50 ($5,250) so we have a $250 net credit on the $11,250 spread ($11,500 upside potential) and my real intention is to sell calls when they come back. The Jan $50 calls are 0.35 but the $45s are $1.60 so let's say we pick up $1.50 per Q x 8 qs on 5 contracts is $6,000 more while we wait.

Since our Long-Term Portfolio is closing in on $1M, this is just an initial entry so we don't mind if goes lower and we can buy more but here our worst case is owning 1,000 shares (from an assignment of the short puts) at net $39.75 while a move up to just $47.50 (very low in their range) will return $11,500, which is 46 TIMES the initial $250 credit and the short puts use $3,179 of ordinary margin – so it's a very margin-efficient trade as well.

That's what makes it a Top Trade, we look for VALUE stocks that are very low in their range and then pick option spreads that have a very high probability of success AND good leverage to the upside. We wrapped up our review of 2017 just last month (you have to give the trades time to work!) and we finished 2017 with 54 winners and 9 losers but we still love most of our losers – they just need more time to cook…

8:30 Update: GDP came in right on the line at 3.5% so in the high end of our expected range but not really high enough to get the market excited as it's still down 0.7% (17%) from last quarter and the signs are not pointing up at the moment. One bullish note this morning is the Fed's Kaplan saying "I’m very sensitive to not being rigid or pre-determined about the pace [of rate hikes]." Kaplan is not a voting member but it's a crack in the Fed's recent narrative of constant rate hikes no matter what.

8:30 Update: GDP came in right on the line at 3.5% so in the high end of our expected range but not really high enough to get the market excited as it's still down 0.7% (17%) from last quarter and the signs are not pointing up at the moment. One bullish note this morning is the Fed's Kaplan saying "I’m very sensitive to not being rigid or pre-determined about the pace [of rate hikes]." Kaplan is not a voting member but it's a crack in the Fed's recent narrative of constant rate hikes no matter what.

So our bullish lines are back in play but very tight stops below them!

Personal Savings went down $55Bn (5%) in Q3 – a sign consumers may be getting tapped out by the non-existent inflation the Fed doesn't see. Another thing that bothers me about the GDP, and this is wonky but Gross Private Domestic Investments have been a major driver to the GDP recently and that's been driven by Intellectual Property Products, which have been inflated by changes in the Tax Code so a lot of these bonus gains recently are simply accounting changes – that makes me nervous.

Defense spending has also been huge all year long, up 4.6%, which is a huge driver in the economy. Despite Trump's tariffs, imports are down and exports are up while Gross Domestic Income is only up 1.6% – falling behind inflation and indicating that NOTHING is trickling down to the bottom 90% under Trump's tax plan. Another thing that REALLY bothers me is that Inventories were so far up they added 2.07% to the GDP and I never like the assumption that rising inventories are a good thing – sometimes they are a sign that things are not selling…

Defense spending has also been huge all year long, up 4.6%, which is a huge driver in the economy. Despite Trump's tariffs, imports are down and exports are up while Gross Domestic Income is only up 1.6% – falling behind inflation and indicating that NOTHING is trickling down to the bottom 90% under Trump's tax plan. Another thing that REALLY bothers me is that Inventories were so far up they added 2.07% to the GDP and I never like the assumption that rising inventories are a good thing – sometimes they are a sign that things are not selling…

Commenting on the report, Bloomberg economist Carl Riccadonna observed the following:

"The composition of growth in the third quarter has some important implications. The economy has reverted back to the `same old' model of consumers accounting for most of the growth. Supply-siders will be disappointed to see business fixed investment essentially stalling out after a robust first half. As a result, the implication is that the surge in growth is not the onset of the economy evolving toward a new speed limit; rather, the frothiness in the second and third quarters really does appear to be largely due to a sugar high from tax cuts. Unfortunately this is not sustainable barring tax cuts 2.0."

So nothing to get me off my bearish stance into the weekend. We're still watching the same bounce lines we laid out earlier in the week but even yesterday's mega-bounce failed to get us there and I don't see any hope of a repeat of this today so we're heading into the weekend very well-hedged and waiting to see what happens next – though another big leg down is very likely – so be don't just be careful – BE PREPARED!

Have a great weekend,

– Phil