And we're back! (for now)

Keep in mind, of course that 2,710 is only the WEAK bounce line on the S&P and we need to clear AND HOLD all the bounce lines before the market is back in a truly bullish mode. While the 5% Rule™ protects us from jumping in and chasing false bottoms – after such a huge fall it's frustrating to sit on the sidelines while stocks recover.

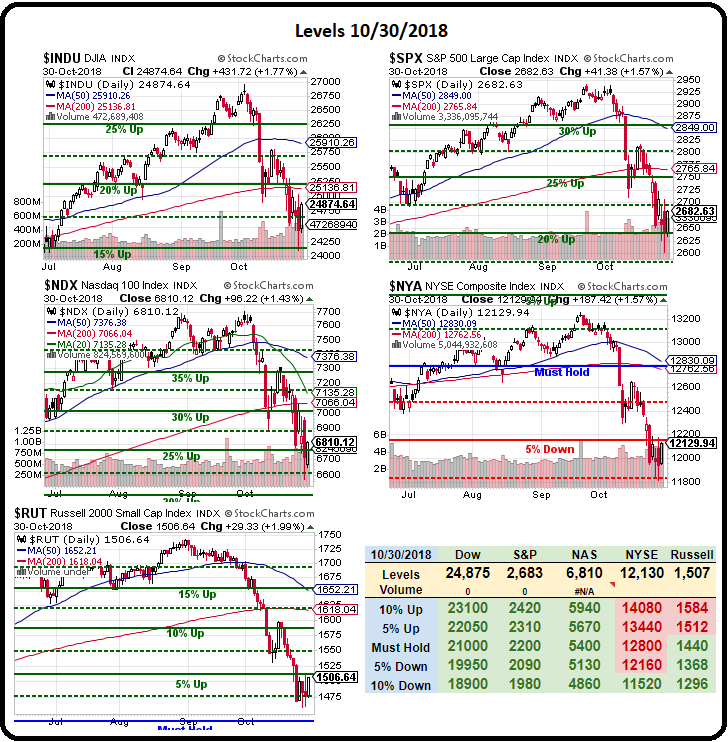

Our predicted bounce lines are:

- Dow 24,300 with a weak bounce at 24,800 and a strong bounce at 25,300

- S&P 2,640 with a weak bounce at 2,710 and a strong bounce at 2,780

- Nasdaq 6,870 with a weak bounce at 7,080 and a strong bounce at 7,230

- Russell 1,485 with a weak bounce at 1,530 and a strong bounce at 1,575

- NYSE 11,880 with a weak bounce at 12,150 and a strong bounce at 12,400

After yesterday's strong rally, we're already back above all our -10% lines except the Russell, which actually fell from 1,750 to 1,450, which was 20% so bounces from a 300-point drop are 60 points so 1,510 (where we are now) is weak and 1,570 is strong so really, on the Russell, that 1,575 line – is the more important number to clear which means, logically, if you are going to back a bullish horse, /RTY may be the way to go.

Meanwhile, before we go reaching for the stars, we should at least see if the S&P can get over it's weak bounce line at 2,710 and the NYSE 12,150 (they are bopth around there this morning) and whether they turn black or red this morning will likely determine the direction of the market. As noted in the title, however, it's the last day of the month and all the stops will be pulled out by the powers that be (the Banksters, not the Government) to engineer a not-so-terrible finish to the month.

As I noted yesterday, China, Europe and the US have all taken measures to boost the markets so of course we're hitting our weak bounce lines and the strong bounce lines won't be surprising but will we hold those? Sadly, that's a question we'll have to answer in November but, for today, expect more of the same from yesterday and a HUGE disappointment if we don't. Although stocks rallied yesterday, bonds did not and we should be watching them for bounces as well.

It's not complicated, 155 to 135 on the 30-year is a 20-point drop to 20% of that drop (4 points) is a weak bounce and 40% is a strong bounce (8 points) so the recovery begins at 143 and you can see how the bond index bounced off that line on the way down, which indicates it's likely to be harsh resistance on the way back up as well. Keep in mind though that these slightly better bond rates (lower interest now is good for long-term bondholders) is very much due to the Dollar's current strength, as it's up almost 10% over the summer and that's very unlikely to continue – unless the rest of the World is really collapsing – which wouldn't be good either.

In fact, if we call 89 the bottom (where it consolidated, not where it spiked down to) early this year than 97.9 is the actual 10% line to the upside and we don't need to get there to cacluate the pullbacks, which would be 20% of 8.9 (1.78) for the weak retracement, so 96.1 and then another 1.8 down for a strong retrace at 94.3 and we can see there was good consolidation there on the way up, which indicates that's likely to hold up well on any pullback.

So we expect to see 96.1 again and a pullback in the Dollar is a boost for the indexes as well as commodities. Silver (/SI) is getting interesting again at $14.30, having never really had the same rally as gold in October. You can play the Futures bullish over the $14.30 line with very tight stops below ($50 per penny per contract!) but you can also play our 2017 Stock of the Year, Wheaton Precious Metals (WPM), which is back in our buy zone at $16.50.

Earnings are on Nov 14th and silver is much lower than it was last November ($17) and last quarter averaged $15.25, falling from Q2's $16.50 so estimates are for WPM to make just 0.10/share vs 0.15 least year and 0.16 last quarter but, for the year, they are still on track to make 0.52/share vs 0.63 last year so -20% and WPM was in the low $20s last year so $16.50 may be a bit oversold – especially considering they are a contract streamer and not a miner so, going forward, they stand to reap a huge benefit from rising silver prices as well as a new production deal on their Stillwater project. As a new trade, I'd go with:

- Sell 10 WPM 2021 $15 puts for $2.10 ($2,100)

- Buy 20 WPM 2021 $15 calls for $3.85 ($7,700)

- Sell 20 WPM 2021 $20 calls for $2.05 (4,100)

The net of that spread is $1,500 and it pays $10,000 if WPM is over $20 in Jan, 2021 and that would be a gain of $8,500 (566%) and the put sale obligates you to buy 1,000 shares if WPM is below $15 for $15 so worst case is owning 1,000 shares for a net of $16.50 ($16,500), which is the current price. I'ts a very margin-efficient trade as only $1,340 of ordinary margin is tied up on the short puts.

Like our 2017 Trade of the Year, it's very possible you'll be able to cash in very early if the stock rockets back up, we took ours off the table in the summer rally and re-entered a position when the stock fell back in August though our portfolio spreads are more aggressive, like our Money Talk Portfolio's adjustment from 10/25, which is now:

| Short Put | 2021 15-JAN 17.50 PUT [WPM @ $16.58 $0.00] | -10 | 10/25/2018 | (807) | $-3,200 | $3.20 | $0.10 | $3.30 | $0.12 | $-100 | -3.1% | $-3,300 | ||

| Long Call | 2021 15-JAN 15.00 CALL [WPM @ $16.58 $0.00] | 25 | 10/25/2018 | (807) | $10,000 | $4.00 | $-0.05 | $3.95 | – | $-125 | -1.3% | $9,875 | ||

| Short Call | 2021 15-JAN 22.50 CALL [WPM @ $16.58 $0.00] | -25 | 10/25/2018 | (807) | $-4,250 | $1.70 | $-0.19 | $1.51 | $-0.06 | $475 | 11.2% | $-3,775 |

Also interesting in Commodity Land this morning will be oil, which is testing $66 this morning and $65 on WTIC (/CL) is $75 on Brent (/BZ) and that surely will be bouncy off a fall from $77, which is right about 15% so a $12 fall and we'll call them $2.50 bounces (since oil loves the 0.50 lines) all the way back to $67.50 (weak) and $70 (strong) with the Thankgiving catalyst just around the corner so we'll look for an opportunity to go long on /CL if it dips lower on inventories – and it will if the EIA (10:30) confirms last night's API, which showed yet another 5.7M barrel build in crude, which makes 27Mb of gains over the last 6 weeks!

Gasoline, interestingly, had a draw of 3.5Mb so there's no reason that should be at $1.79, it's merely following /CL lower but also should be bouncy off the 0.26 (12%) fall from $2.15 – just 4 weeks ago! I'd call 0.26 the 0.21 (10%) fall from $2.15 with a 20% (of the 0.21) overshoot so I don't need to wait for EIA to tell me that Gasoline Futures (/RB) are a good long gamble here above the $1.79 line, with very tight stops below. Below that, however, could turn ugly as the next support is $1.70 which would be a $3,780 per contract drop so – TIGHT STOPS BELOW THE LINE!

Rembember, both of these plays premise on a Dollar pullback so watch that 97 line on /DX and pay attention to API at 10:30 – there could be wild swings around that and, otherwise, let's watch those bounce lines and see what sticks!