Is this guy delusional or what?

Is this guy delusional or what?

The Republicans got trounced in the House but kept the Senate and Trump calls it a "Big Victory" though I do have no doubt that his friend Putin did congratulate him – so maybe that part is true. So far, the markets seem very happy with a split Congress and we're back to the 7,100 line on the Nasdaq but that's only our weak bounce line (7,080) and we're still waiting for the Nasdaq and the Russell to confirm strong bounces and, of course, the others need to hold theirs for two consecutive days or we'll have to reset the clock on them as well. Our bounce lines are:

- Dow 24,300 with a weak bounce at 24,800 and a strong bounce at 25,300

- S&P 2,640 with a weak bounce at 2,710 and a strong bounce at 2,780

- Nasdaq 6,870 with a weak bounce at 7,080 and a strong bounce at 7,230

- Russell 1,485 with a weak bounce at 1,530 and a strong bounce at 1,575

- NYSE 11,880 with a weak bounce at 12,150 and a strong bounce at 12,400

As you can see from our Big Chart, We are still below the 200-day moving averages on all but the Dow and the Dow is a very silly index that it's best to ignore. The Dollar is helping things along this morning by dropping half a point and we're down 1% since Monday, which means the things priced in Dollars, like stocks and commodities, have to rise 1% just to stay even.

So it's no surprise that, this morning, we've got a big reversal on Gasoline (/RB), back to $1.70 but that's still shy of where we went long at $1.72 last week (down $880 per contract). With Oil inventories at 7:30, it's too tough to call and yesterday's API Report showed yet another massive build in oil, with 7.8M barrels piling up in inventories against a 1.2Mb draw in Gasoline and a 3.6Mb draw in distillates so net +3Mb is NOT GOOD for the energy sector but it's hard to say if it's due to weak demand or robust drilling in the US.

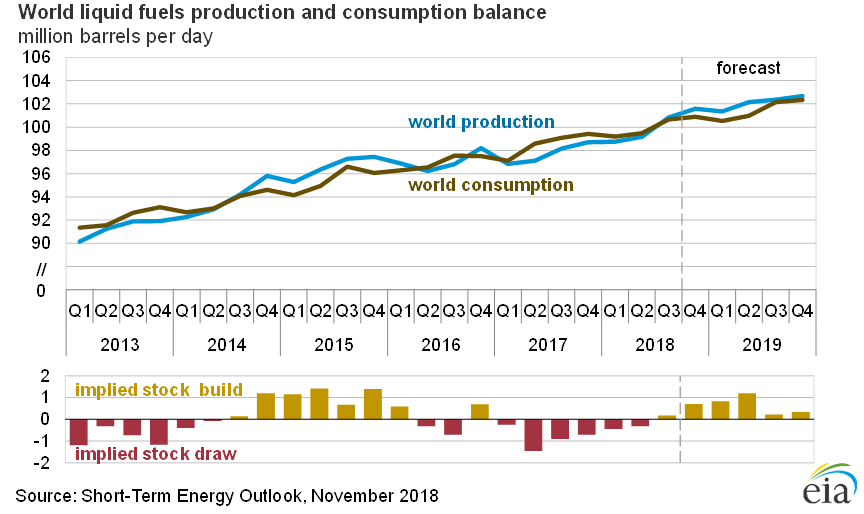

Overall, at the moment, Global Production of oil exceeds the Global Supply and that's forecast to continue into the 3rd quarter of next year so get used to these weekly builds – they are not going away and, looking at this EIA chart, we're only at the begginning of a full year of a huge build in inventores.

Overall, at the moment, Global Production of oil exceeds the Global Supply and that's forecast to continue into the 3rd quarter of next year so get used to these weekly builds – they are not going away and, looking at this EIA chart, we're only at the begginning of a full year of a huge build in inventores.

Keep this next chart in mind before going bullish on oil as it shows you what happened to the price of oil in 2014 and 2015 – the last time we put together a string of 6 consecutive quarters of builds in oil stockpiles:

That's from $100 to $30 and there's really not much of a reason we should be over $50 now. Only the upcoming Thankgiving holidays gives the bulls real hope this month but, after that, where's the catalyst going to come from? Unless the Iran situation escalates into a war that disrupts production – we may have a lot further to slide in Oil (/CL) and Gasoline (/RB).

As to the market, who knows how it will react to the election but that's all based on speculation until the Dems actually take office in January. Meanwhile, we're waiting on tomorrow's Fed Statement and it's possible they put off raising rates until December – but I doubt it.

We'll likely re-test recent lows after that.