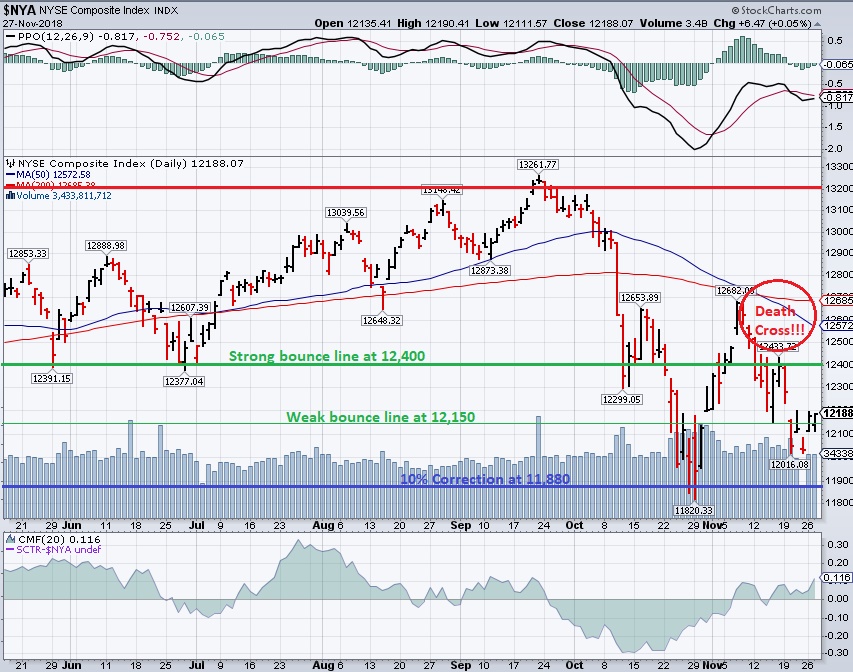

Well, we flipped the NYSE's weak bounce line green at 12,150.

Well, we flipped the NYSE's weak bounce line green at 12,150.

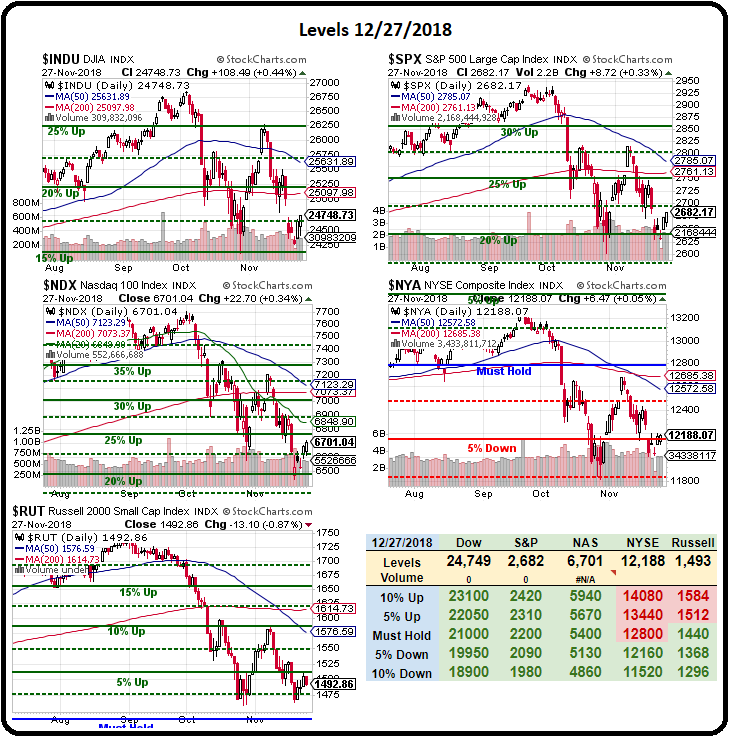

We also hit the weak bounce line (24,800) on the Dow (/YM) futures so all is well(ish) at the moment as the Trump administration made nice noises on trade yesterday – essentially negating Trump's morning tirade and that gave us the pop that we needed to get back over the hump so now we are waiting to see if either the S&P (/ES) can take back their weak bounce at 2,710, Nasdaq (/NQ) 7,080 or the Russell (/RTY) 1,530 and, if any of them do – then we can go long on the laggard with tight stops if those weak bounce lines fail again.

Unfortunately, as you can see from the NYSE chart, recent weakness has already caused a "death cross" to occur as the 50-day moving average fell below the 200-day moving average and we really won't be out of the woods again until that reverses and that will take a couple of months above the 200 dma so, until we cross back over those lines – this market will still have a tendency to trend lower well into Q1 of 2019.

And it's not just the NYSE, the Russell has already crossed and the Nasdaq will cross early next week and the S&P will cross within two weeks and the Dow MIGHT avoid a death cross, but only if it gets back over 25,000 and stays there. This morning, the /YM Futures are at 24,900 with a 160-point gain on the Dow overnight so it could possibly happen and the best bullish Futures bet at the moment is going to be going long on the Russell (/RTY) above the 1,500 line which will be confirmed by Nasdaq (/NQ) 6,750 and S&P (/ES) 2,700 so as long as all 4 of the indexes are over those lines, you can stay bullish on /RTY.

And it's not just the NYSE, the Russell has already crossed and the Nasdaq will cross early next week and the S&P will cross within two weeks and the Dow MIGHT avoid a death cross, but only if it gets back over 25,000 and stays there. This morning, the /YM Futures are at 24,900 with a 160-point gain on the Dow overnight so it could possibly happen and the best bullish Futures bet at the moment is going to be going long on the Russell (/RTY) above the 1,500 line which will be confirmed by Nasdaq (/NQ) 6,750 and S&P (/ES) 2,700 so as long as all 4 of the indexes are over those lines, you can stay bullish on /RTY.

The big, positive spin for the World markets this morning is that Trump and Xi are scheduled to meet over the weekend at the G20 conference so, hopefully, there will be a resolution of some sort. Also to be resolved is Brexit, which seems to be staggering forward without actually collapsing and then we have the Fed Minutes tomorrow and Fed Speak where the Financial Press Cheerleaders are dying to get some kind of quote they can spin positively to encourage the dips to come back and buy.

There was no help yesterday evening from Chicago Fed's Charlie Evans, who said he supports the Central Bank pressing forward with short-term rate rises. With the economy doing well and likely to turn in a growth performance above 3% this year, “it’s time to get back toward something that’s more normal.” KC's Esther George and Atlanta's Raphael Bostic were also on the panel and none of them supported the Presient's demand for a longer period of lower rates – because it's silly – especially from a guy who keeps talking about how strong the economy is and how low unemployment is.

Richard Clarida is the Fed's Vice-Chairman and he said the Fed would keep raising short-term interest rates gradually, a hint that another rate increase is coming in December. “Raising rates too quickly could unnecessarily shorten the economic expansion, while moving too slowly could result in rising inflation and inflation expectations down the road that could be costly to reverse, as well as potentially pose financial stability risks,” Mr. Clarida said at a banking conference.

Now, keep in mind that 4 Fed Speakers talked about raising rates and the market still went higher so what is there that will discourage them from actually raising rates at next week's meeting? Traders are simply delusional if they think that's not going to happen – almost as delusional as the ones who think Trump and Xi will suddenly hammer out an agreement over dinner on Saturday.

Now, keep in mind that 4 Fed Speakers talked about raising rates and the market still went higher so what is there that will discourage them from actually raising rates at next week's meeting? Traders are simply delusional if they think that's not going to happen – almost as delusional as the ones who think Trump and Xi will suddenly hammer out an agreement over dinner on Saturday.

Meanwhile, President Trump told The Washington Post on Tuesday that he's "not even a little bit happy" with his appointment Jerome Powell as chair of the Federal Reserve. Trump told the Post, "So far, I'm not even a little bit happy with my selection of Jay," who he appointed earlier this year. The president told the newspaper that he thinks the U.S. central bank is "way off-base with what they're doing."

If Trump shakes people's confidence in the Fed by attacking the Chairman, that can have some very serious repercussions for the Global Markets as the Fed depends very much on the confidence of others, using words more often than rates to steer the Global Markets when they need to. Powell will speak later at the NY Economic Club at noon and we can use those bullish lines as bearish lines if things don't go as well as traders are hoping.

Either way, it will be an interesting day and we have a Live Trading Webinar at 1pm, EST – so join us there!