Wow, what a comeback!

Wow, what a comeback!

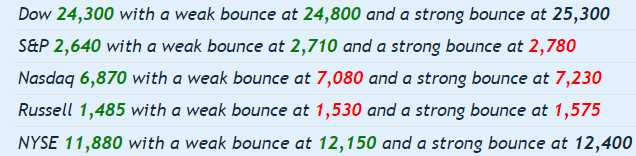

Fed Chair Jay Powell said some words and the market jumped up over 2%, adding $2Tn to the global market cap in a matter of minutes. He should say those words every day, right? Actually, he didn't have to say anything as the Dow (/YM) began rising from 24,900 (already up from 24,800 at 5am) at 11am to 24,950 at noon – before the text of Powell's speech had even been released and, by 12:05, we were already up around 25,200 and we continued on to a high of 25,370 at the close, up 600 points for the day (2.4%).

The market's exuberance hinged essentially on a single sentence from Powell's speech:

"Interest rates are still low by historical standards, and they remain just below the broad range of estimates of the level that would be neutral for the economy–that is, neither speeding up nor slowing down growth. "

Rather than focusing on "still low by historical standards" the media chose to focus on the much vaguer "just below the broad range of estimates" which shows a complete lack of understanding of what a range is – whether intentional or otherwise. Fortunately, we know exactly what range Powell is talking about as it's the Fed's famous "Dot Plot" that shows exactly what the range for rate expections is among the 12 Fed Governors.

As you can see from the chart of Sept 26th, the RANGE of the expectations is from 2.25%-2.5% at the end of 2018 (we're at 2.125% now) but the RANGE next year is between 2.25% and 3.75% and, by 2020 – there is only one outlying dot that shows 2.25% while the middle of the range is about 3.25% – that's 4 quarter-point hikes from now.

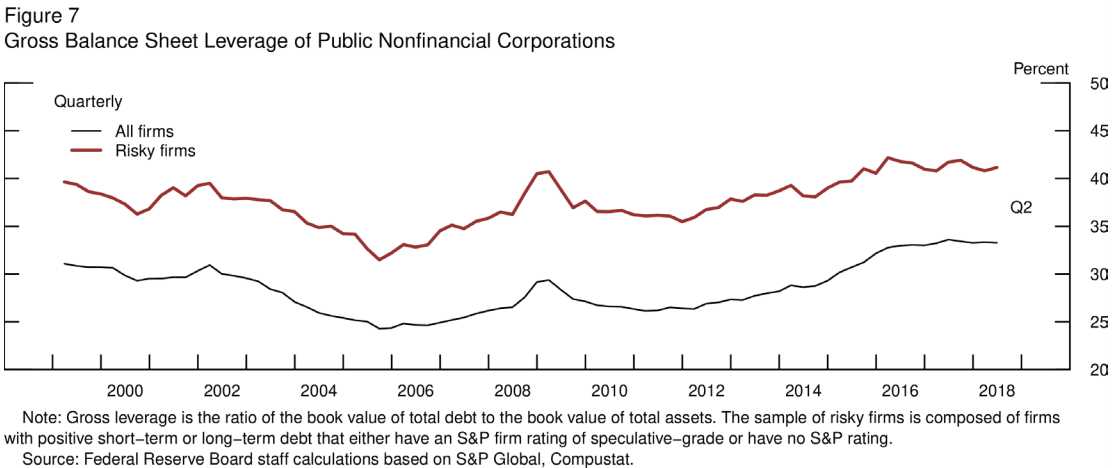

Also, not at all covered by the media – Powell also had slides (as well as 14 other pages of text) and he was also concerned about the massive increase in Corporate Debt, now well above the economic collapse levels of 2009 and matching the post-crash levels of 2002. The difference was, in 2002 and 2009 the Fed was able to LOWER rates significantly to reduce the stress of outstanding Corporate Debt but, without a good deal of tightening now, the next time corporations need a rate bailout – the Fed's hands will be tied and defaults will skyrocket and the economy will collapse unless the Government steps in with a cash bailout. How is that healthy?

You can plant a lawn in Las Vegas and, if you water it every day, it will do fine and look healthy and grow strong but, like low interest rates – it's all artificial and, no matter how "healthy" the grass looks in these artificial conditions, as soon as you stop watering it the lawn will turn brown and die because it's entire existence was based on ARTIFICIAL STIMULUS that couldn't be maintained indefinitely.

Corporate America is running on low rates and tax cuts – take either of those things away and the market drops 10-20% from here. Since, for some reason, maintaining a record-high market is the only thing that matters in America, we're going to keep giving these "healthy" corporations low rates and tax cuts – even if it's to the detriment of Infrastructure Spending, Social Welfare or even those Entitlements that the citizens are ENTITLED to because they had 6.5% of their pay placed in a Government Savings Account for THEIR ENTIRE LIVES and another 6.5% was contributed by your employer to match it. It's YOUR MONEY – you are ENTITLED to it – THAT is why they call it an entitlement!

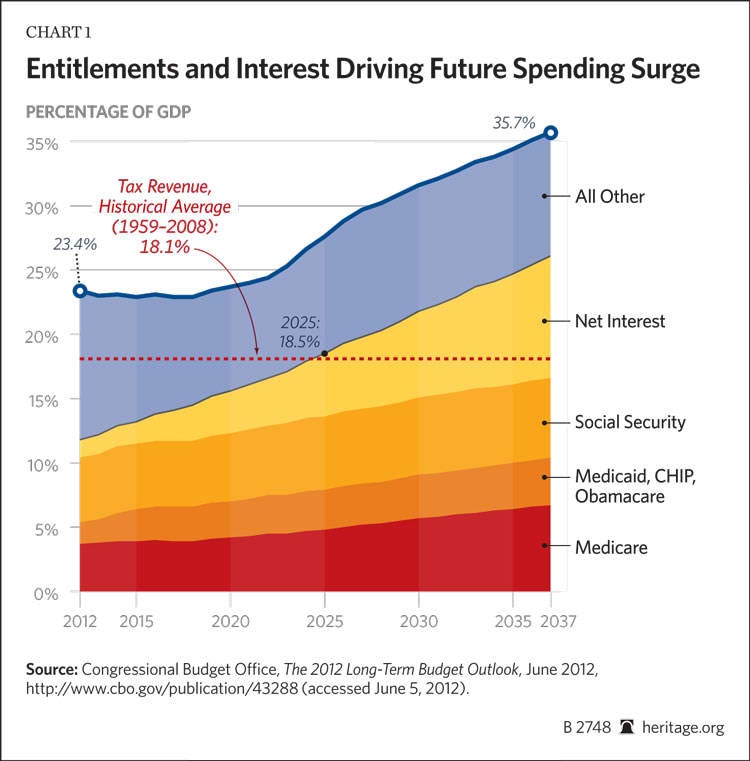

Entitlement spending is not the problem, the mismangement of the collected entitlement money was and is the problem but it's currently the scapegoat for the massive deficits that are simply caused by a REVENUE problem. As you can see from the chart on the right, Interest on Debt is our fastest-growing Government Expense while Entitlements, INCLUDING OBAMACARE, currently take up 12% of Government Spending and are projected to increase to 15% by 2037.

Entitlement spending is not the problem, the mismangement of the collected entitlement money was and is the problem but it's currently the scapegoat for the massive deficits that are simply caused by a REVENUE problem. As you can see from the chart on the right, Interest on Debt is our fastest-growing Government Expense while Entitlements, INCLUDING OBAMACARE, currently take up 12% of Government Spending and are projected to increase to 15% by 2037.

Is this hopeless? Is it unfixable? Or perhaps we could just raise taxes by 3% over the next 20 years to cover it? No, instead the plan is to gut benefits and, very simply, not pay you back the money you are ENTITLED to so that the Top 1% people and Corporations can continue to enjoy their tax cuts. You are, very simply, being robbed and shame on you if you don't realize it.

- I'm 55 and I started working in a deli when I was 13 but let's say I got my first job out of college at 22 and I only made $15,000 a year for my first 10 years. That's $150,000 and 12% of $150,000 is $18,000 that the Government collected. Even at just 4% interest, at the end of 1995 the Government should have had $25,000 in my account and that $25,000 growing for another 30 years becomes $81,084 (calculator here).

- In 1995, I'm earning let's say $30,000 a year and the government is pulling $3,600 a year so $36,000 for the decade and 4% interest is $50,279 by 2005 and banking that another 20 years until my retirement becomes $110,167.

- In 2005, I'm up to $40,000 a year and the government is taking $4,800 a year so $48,000 that decade at 4% interest is $67,039 by 2015 and 10 years from now that's $99,234 and I'll make and they will take another $48,000 assuming I've reached the peak of my carrer so another $67,039 by the end of 2025, when I'll be 62.

So that's $325,329 of MY MONEY that should be in MY retirement account after 40 years of work at a below-average salary. That works out to 8 years of my current salary – seems like a lot of money and 4% interest is very low and the money we cacluated was very low and STILL it's enough to cover. Keep in mind that, until recently, not that many people lived until 73 so hundreds of millions of people never got their full benefits and the Government kept and squandered that money too!

The GOP has been engaged in a 45-year plot to undermine your rights to your own money beginning in 1974, when the Nixon administration first started using the term "Entitlements" to describe your eventual payouts from a forced Government Savings Account that was collected from your own paycheck:

The first official use of “entitlements” in its current sense came during the Nixon Administration, when the 1974 budget act defined it as “payments to persons or governments who meet the requirements established by laws.” But it didn’t rise from the wonky mire until 1982, when, as John H. Makin and Norman J. Ornstein note, in their 1994 book, “Debt and Taxes,” President Reagan, who had always referred to government programs for the old, the sick, and the poor as the “Social Security net,” renamed them “entitlements,” in a speech to a Jaycee convention. The business press quickly followed suit. “Later in the year, other magazines also used the term,” Makin and Ornstein write. “Most of the publications put the word in quotes the first time it was used, indicating its novelty, but not thereafter.”

Thereafter is where we’ve been ever since. “Entitlements” went from nowhere to everywhere in record time. The Washington Post mentioned “entitlements” or “entitlement programs” in the same article as “Social Security” just five times in 1979. In 1982 it happened a hundred and eighteen times. During the nineteen-nineties, the number topped eight hundred. If the current rate holds steady for the rest of this decade, the Post will have racked up seventeen hundred by the end of 2019.

And the use of the word "Entitlement" has been expanded to include food stamps and wellfare and now Obmacare, which is merely a ploy by the Republicans to vilify your hard-earned savings and muddy the waters as if they were all part of some charity program. That's the kind of brain-washing techniques you need to use when you have spend 50 years robbing people and now you need them to go to debtor's prison to pay for your crimes.

You should be ashamed of yourself!