Are the dip buyers still out there?

Are the dip buyers still out there?

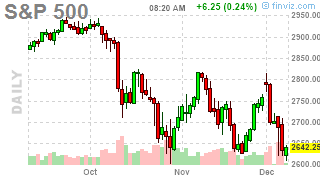

That's not entirely clear anymore as we're testing a triple bottom on the S&P since late October and 2,950 to 2,650 is 300 points down and 2,800 is right in the middle and that's where we kept failing – not a very bullish sign and this dip has been faster than the first two so, if the bounce is weaker than the first two – that's a bearish pattern we'll be able to hang our hats on.

Trade talks with China did not improve over the weekend with Lighthizer saying March 1st would be a "hard deadline" while Navarro says "China's predatory days are over" – and those are our chief negotiators! China is demanding that Canada release the daughter of Huawei's Founder and is treatening "further actions" against the US if the issue is not resolved and this is what happnes when people pretend to negotiate a trade deal but are actually only interested in sabotaging it so Trump can keep taxing (oh, sorry, tariffing) Americans on things they used to buy under free trade agreements.

Speaking of Trump – things have not been going well in Trump Land and that adds to the market uncertainty so I would take any move up this morning with a huge grain of salt. Very simply, for the S&P, the 300-point drop leads to a 60-point weak bounce so that's the goal for today and failing that (we will fail that) then it's more likely we'll have to keep an eye on the floor tomorrow to see if that holds.

Meanwhile, both China and Japan had poor economic data over the weekend and riots continue in France for the 4th week with 136,000 people marching on Satuday leading to 2,000 arrests while Retail Sales are down $1Bn for the month and restaurant sales are down as much as 50% as people choose to stay home rather than navigate Paris' burning streets.

Meanwhile, both China and Japan had poor economic data over the weekend and riots continue in France for the 4th week with 136,000 people marching on Satuday leading to 2,000 arrests while Retail Sales are down $1Bn for the month and restaurant sales are down as much as 50% as people choose to stay home rather than navigate Paris' burning streets.

If you wonder why you don't hear much about the Paris protests in the US – it's because the Yellow Vest Protests are about economic inequality and the Capitalists that own the media like to pretend there is no such thing so they certainly aren't going to give the Bottom 90% in the US the idea that they could actually object to being ground down by an unjust system that favors those on top to their detriment.

Rather than subsiding, the Yellow Vest Protests have spilled over to Belgium this weekend. In the US, they try to convince you that this protest is about gas taxes but that was only the spark that started the fire – this has been a long time coming – and not just in France. Macron is going to make a public announcement this week in hopes of calming things down and, of course, Trump is goading him for being weak while trying to convince his base these protests are over the Paris climate accords and not about calling Oligarchs like himself into account.

The Paris Agreement isn’t working out so well for Paris. Protests and riots all over France. People do not want to pay large sums of money, much to third world countries (that are questionably run), in order to maybe protect the environment. Chanting “We Want Trump!” Love France.

None of this is true, of course, but when has that ever stoped the President from making things worse? Per Wikipedia, who have facts and citations:

Motivated by rising fuel prices, the high cost of living and claims that a disproportionate burden of the government's tax reforms were falling on the working and middle classes[24][25][26](especially those in rural and peri-urbanareas),[6][27] protesters have called for reductions in fuel taxes, the reintroduction of the solidarity tax on wealth, the raising of the minimum wage, and the resignation of the President of France, Emmanuel Macron.

In other worrds, they are essentially protesting Trump's agenda and yes, the fuel tax was a part of the Paris accord to discourage driving but the tax was disproportionately affecting the poor as a person in the Top 1% who makes 100 times the average income, drives just one car so the tax is, in effect, nothing to them while, for those making 1/100th as much – a huge burden. A flat tax is a very unfair way to address Global Warming.

So there are many issues dragging down the market this morning but the good news is that we're finally pricing in the issues investors have been ignoring all summer long. There's really nothing "new" here – Trade spat with China, Trump is a crook, Global Warming will kill us all… same old, same old, on the whole so why worry about it now?

This is, as I said last week, a CORRECTION, which means the market is CORRECTING towards a CORRECT price in relation to the true value of the stocks – that's nothing to be afraid of – unless you were unrealistically bullish.