Thank you, Mr. President.

You can certainly fool at least some of the people all of the time as President Trump once again tries to fix the markets by tweeting out "Very productive conversations going on with China! Watch for some important announcements!" and that's all it seems to take to ramp the indexes up 1% in the Futures. Well, that and the coordinated cooperation of his fellow Oligarchs, who have their hands on the market switches, of course.

The above quote is from March but there are about 100 tweets from Trump telling us how great trade negotiations are going with China, going back over 18 months and EVERY TIME it somehow boosts the markets though, after 18 months of China talks, the market is lower now than it was when we started!

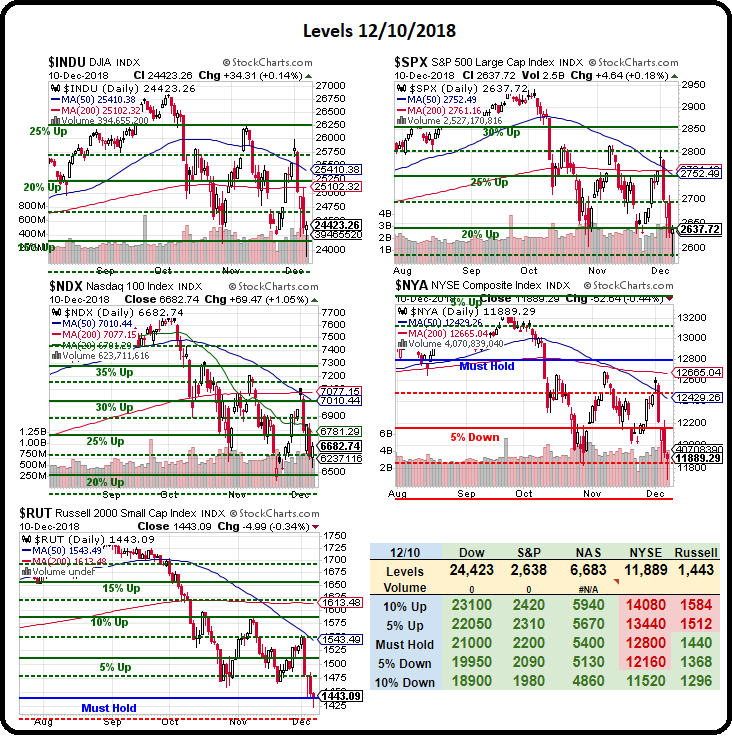

So let's keep any sort of bounce today in context as we have fallen from 2,950 on the S&P (/ES) to 2,650 (and a quick spike below) so, with a 300-point drop, we expect a 20% bounce (60) to 2,710 (weak) and 2,770 (strong) and, so far, all we have is a weak bounce off the spike low to 2,600 – not that impressive. Is Trump having trouble fooling even some of the people all of the time? We're back at the lows but the bounce lines are the same as they've been since October at:

- Dow 24,300 with a weak bounce at 24,800 and a strong bounce at 25,300

- S&P 2,640 with a weak bounce at 2,710 and a strong bounce at 2,780

- Nasdaq 6,870 with a weak bounce at 7,080 and a strong bounce at 7,230

- Russell 1,485 with a weak bounce at 1,530 and a strong bounce at 1,575

- NYSE 11,880 with a weak bounce at 12,150 and a strong bounce at 12,400

This is what's useful about the bounce lines from our 5% Rule™, this is the 3rd time we've bounced off the bottom and each time we failed to get confirmation (all green) we need to flip back to being bullish so we have, fortunately, kept our hedges on but also we haven't gotten more bearish as we failed to go all red – though we were there for a moment yesterday…

Keeping an eye on our bounce lines helps us make better trading decisions in a volatile market and, speaking of volatility, the VIX says don't count your chickens before they bounce as we're still up near the highs on the volatility index and this is after spending most of the year below 15.

We are, in fact, having telephone negotiations with China but you're not going to get a massive trade deal done in 90 days with a few phone calls. For one thing, the US is asking China to drop their 2025 Plan and that's the cornerstone of their current 10-year plan. This would be like China saying "How about you stop making America great?" This is China's big bet on the Future, they're not going to walk away from it – especially while it's working and the US harassment of Huawei is simply another attempt to threaten China by showing how we can mess with their tech companies at will.

Obviously, this is a non-starter but that's what happens when you put China Hawks in charge of Trade Negotiations and, despite Trump's enthusiasm over the phone call, China’s Commerce Ministry, in a brief statement, said the conversation—held Monday evening in the U.S., Tuesday morning in China—was meant to “push forward with next steps in a timetable and road map” for negotiations. So the call had nothing to do with actual trade negotiations, Trump is lying, what else is new?

I have said since the beginning, Trump has no interest in lifting the tariffs, which are simply a tax on middle-class Americans that completely offsets what little breaks his tax cuts actually gave them. If he were interested in solving the problem, he's put Kudlow, Ross and Mnuchin on it, not Lighthizer and Navarro. In fact, it actually says right in the Wall Street Journal:

Trump aides say that Mr. Trump sometimes tweets positive news about China talks to try to boost the stock market. Futures trading suggested a strong opening on the New York Stock Exchange.

Meanwhile, Chinese Foreign Minister Wang Yi said in remarks this morning that Beijing would firmly resist “acts of bullying that wantonly infringe upon the legitimate rights and interests of Chinese citizens” referring to the Huawei kidnapping and the only reason China isn't more upset about that is because they are confident Canada will fold and send the Founder's daughter back to China and not hand her over to the US, where it would be a great embarrassment if they fail to get her to "admit" her company spies on Americans.

We'll see how all this plays out but, meanwhile, we will watch the indexes to see if they bounce and, of course, next Wednesday the Fed makes their final rate decision of the year and, just this morning, our Core PPI came in at 0.3%, miles above the 0.1% expected and that's AFTER oil prices have come down considerably so the Fed MUST raise rates to stave off inflation – not usually a big plus for the markets.

We'll see how all this plays out but, meanwhile, we will watch the indexes to see if they bounce and, of course, next Wednesday the Fed makes their final rate decision of the year and, just this morning, our Core PPI came in at 0.3%, miles above the 0.1% expected and that's AFTER oil prices have come down considerably so the Fed MUST raise rates to stave off inflation – not usually a big plus for the markets.

We will see tomorrow whether or not the CPI confirms inflation heating up tomorrow and we also get Import and Export Prices on Thursday followed by Retail Sales and Industrial Production on Friday – so plenty of data to get us through the week and certainly nothing I'd bet on giving us a strong bounce – Santa or no Santa.

Look for rejections at our weak bounce lines for signs that the selling is far from over!