2,480.

That's the weak bounce line we've been talking about on the S&P all quarter and that's the line we're playing with this morning as the markets digest China's Caixin Manufacturing Index, which fell to a declining 49.7 in December, the first time China has shown contraction since May of 2017.

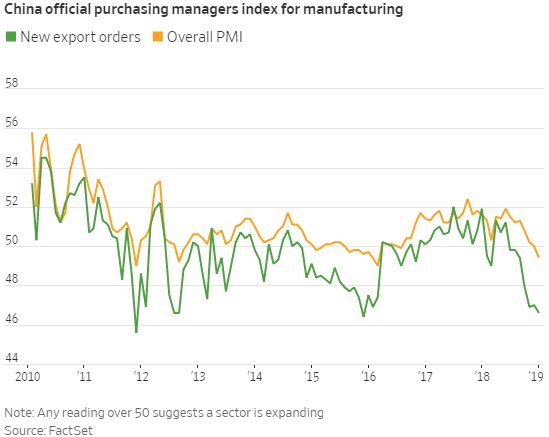

Still, the theme follows through from last quarter that we are all suffering from self-inflicted wounds as the ongoing trade war has sent New Export Orders plunging to their lowest levels since Q4 of 2011, when we didn't have a trade war and things turned around sharply from there so it's hard to say what happens next – but it is certain this negativity can all be unwound very quickly, IF our President pursues a rational course of action (see, now you are worried again!).

That is a theme I notice when pundits are discussing US policy these days – noithing is off the table – we are an insane super-power that could nuke North Korea or strike a trade deal with North Korea or annex North Korea or Sanction North Korea or push North and South Korea together – it's all on the table because no one knows what the F our foreign policy is – even from minute to minute.

That kind of madness internally means the markets can be moved on any sort of insane rumor because ANYTHING is possible. "Trump Declares War on Apple" is not a headline you would ignore because it MIGHT be true and, unfortunately, modern trading algorithms are trained to respond to headline news – on the assumption that thing that make the headlines of mainstream media are likely to be true. This is no longer the case as the MSM also doesn't know if something is too insane for Donald Trump or not.

That kind of madness internally means the markets can be moved on any sort of insane rumor because ANYTHING is possible. "Trump Declares War on Apple" is not a headline you would ignore because it MIGHT be true and, unfortunately, modern trading algorithms are trained to respond to headline news – on the assumption that thing that make the headlines of mainstream media are likely to be true. This is no longer the case as the MSM also doesn't know if something is too insane for Donald Trump or not.

Back in China, President Xi seems to be taking a harder line against Trump this week as well as talking about taking back Taiwan by force – something that would have been unthinkable but, now that Trump has given Russia a hall pass for Crimea, there's no reason for China to think he'll suddenly grow a spine over Taiwan – especially with all of his top Generals either having resigned or come out openly against Trump's policies.

Xi may be using Trump as a convenient fall guy to blame any economic hardships that may befall China as the Government attempts to reign in their own stimulus and debt issues. Meanwhile, Trump's pal and slighly less crazy dictator, Kim Jung Un warned Trump that his patience with the US is wearing thin and North Korea will go back on the warpath if the US does not lift sanctions – as Trump promised they would last June.

“I am willing to sit with the U.S. president any time in the future and will strive to produce outcomes that would be welcomed by the international community. However, if the United States does not deliver its promise and misjudge our people’s patience, making unilateral demands to continue sanctions and put pressure on us, we will have no choice but to seek a new path to protect the country’s independence, interests and peace on the Korean Peninsula,” Kim said.

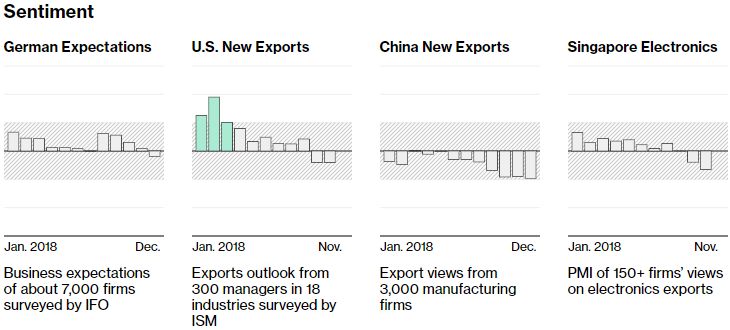

South Korea also had a big drop in Exports in December, down 1.2% vs up 2.5% predcicted by leading economorons but that is nothing compared to China's 13.9% drop and our own Regional Manufacturing Indexes were ALL in contraction last monhty – Trump's Trade War is single-handedly destroying the Global Economy. Global Sentiment is down sharply and, so far, other than Trump's positive tweets – there's no concrete evidence that these trade issues are being resolved.

South Korea is the first country to release trade date for the New Year and, if other countries look as dire – we may be re-testing those market lows. Don't forget Europe has the same POTENTIAL issues through a messy Brexit, which hasn't even happened yet but could give us a whole new round of bad news beginning in Q2. Housing in Australia is dropping the most since the 1980s, worse than 2008 and those loans kick back to the Asian banks as well.

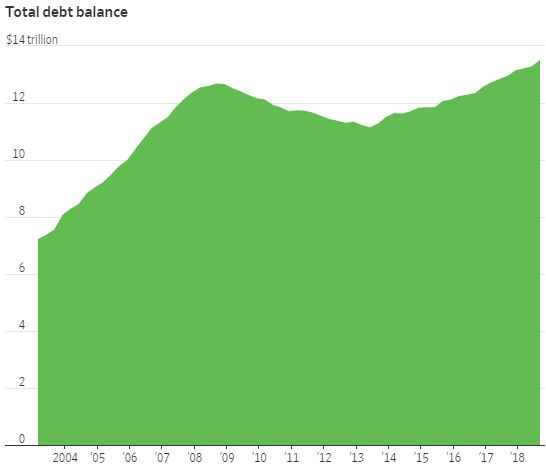

In the US, things are not so bad but a big warning indicator is the nearly $14Tn in non-mortgage debt, which is about $1Tn more than where we toppped out in early 2008, when we were also pushing a rally too far just ahead of a major economic collapse – so try not to be too complacent, okay?

In the US, things are not so bad but a big warning indicator is the nearly $14Tn in non-mortgage debt, which is about $1Tn more than where we toppped out in early 2008, when we were also pushing a rally too far just ahead of a major economic collapse – so try not to be too complacent, okay?

Our Government is also hitting all-time highs on Debt, including debt to GDP (110% and growing) and that can become a problem if people stop buying short-term bonds at 2% as the interest on $21Tn at 2% is $420Bn but at 3% it adds $210Bn, which would boost our current debt by 20% so each 1% increase in interest rates adds 20% to our annual debt.

Since Trump's new tax plan has dropped Corporate Tax Collections down to $300Bn, it's up to us citizens to fund the other $3.7Tn the Government needs to operate so I guess it must be time to give more tax cuts to the rich – as that does seem to be the GOP solution to everything, right?

Credit-card loan losses are rising from a year earlier despite the low unemployment rate. The average share of card balances that eight of the largest credit-card issuers wrote off as a loss increased to 3.16% in the third quarter, compared with 3.03% a year ago and 2.59% two years ago, according to Fitch Ratings. Lenders are pulling back in certain areas, lowering credit limits for subprime consumers and tightening auto-loan underwriting, which can lead to pullbacks in spending and this is how a slowdown begins to snowball into a recession very quickly.

Student loans also are a particular concern. There is more than $1.5 trillion of outstanding student-loan debt, and some 92% of it is owed to the federal government, according to MeasureOne. Many federal-loan borrowers are postponing or making smaller payments on their loans than originally required despite the economic rebound. “If borrowers can’t pay down their student-loan debt now, in a time of relative economic prosperity, what will happen during the next economic downturn?,” John Anglim, a credit analyst at S&P Global Ratings, wrote in a recent report.

Let's not forget what a volatile start we had to 2018 and that was coming in off a relatively calm 2017 but the indexes have ended 2018 already bucking like wild broncos with this morning's Futures down 400 points on the Dow (which is nothing as China was down 2.5%) back at 23,000 but, as I said, it's the S&P 500 (/ES) at the weak bounce line of 2,480 we need to keep our eye on – losing that level (now 2,466) would be a VERY BAD sign – especially with the weekend just 2 sessions away.

Let's not forget what a volatile start we had to 2018 and that was coming in off a relatively calm 2017 but the indexes have ended 2018 already bucking like wild broncos with this morning's Futures down 400 points on the Dow (which is nothing as China was down 2.5%) back at 23,000 but, as I said, it's the S&P 500 (/ES) at the weak bounce line of 2,480 we need to keep our eye on – losing that level (now 2,466) would be a VERY BAD sign – especially with the weekend just 2 sessions away.

Fundamentally, nothing has changed and there's plenty of stocks we'd love to buy but Technicals are also a Fundamental factor we have to take into account so we're going to be sidelined while we wait to see how this thing resolves itself.

As I've said, these are very much self-inflicted wounds, including the ongoing Government Shutdown, so they can be quickly undone but they can also cascade into a much larger failure if we don't do something about it soon.