At the end of this week, we'll have gone a month without a Government.

At the end of this week, we'll have gone a month without a Government.

That's kind of dangerous as people may begin to realize they don't need a Government. Well, rich people don't need a Government – poor people are screwed… Federal workers are screwed as they didn't get paychecks on Friday, despite 420,000 of them being considered "essential" and working without pay. When you go to work you spend money on gas, tolls, lunch, day care – it's not like the Government is just asking people to work for free – they are essentially forcing people to dig into their own pockets to support Trump's madness.

Not only that but missing bill payments due to not getting paid will impact the Federal Workers' credit ratings – damaging them and their families for years to come. #TrumpDontCare

Meanwhile, nothing is getting done and that's slowing US commerce down and we're talking a month – that's 10% of the year and we're not going to be back to 100% right after the shutdown ends as there must be piles and piles of backlogged things sitting on the desks of the 380,000 furloughed workers as well. Already the Wall Street Journal has estimated that this shutdown will bring GDP growth for Q1 down to 2.2% from 3.1% for all of 2018 – another month and we'll be below 1.5% but it will give Trump an excuse for failing to deliver on his GDP promises – and he needs an excuse because nothing Trump has done has really helped the economy anyway.

We're right in the middle of Flu Season and 30 people are dead and 9,000 people are hospitalized but money to the CDC's Influenza Program (our front-line defense against a national outbreak) has been cut off and that means we have no coordinated program to track and identify flu strains, which is how doctors get guidlines for treatment and how vaccine makers are able to prepare batches of antibiotics to contain the outbreaks. In other words, not only are people going to die during Trump's little temper tantrum, but this could lay the groudwork for a massive outbreak – the kind that usually doesn't happen in a first world nation.

We're right in the middle of Flu Season and 30 people are dead and 9,000 people are hospitalized but money to the CDC's Influenza Program (our front-line defense against a national outbreak) has been cut off and that means we have no coordinated program to track and identify flu strains, which is how doctors get guidlines for treatment and how vaccine makers are able to prepare batches of antibiotics to contain the outbreaks. In other words, not only are people going to die during Trump's little temper tantrum, but this could lay the groudwork for a massive outbreak – the kind that usually doesn't happen in a first world nation.

The last time the Government shut down was Oct 1st, 2013 and it only lasted 16 days – not a huge effect on flu season. This shutdown is happening near the peak of the season, it's like pulling back your firefighters just when the fire is getting more intense – bad plan! That's just one of the many, tiny things the Government does for us that no one seems to notice along with feeding, clothing and sheltering the poor – who will also soon be dying in record numbers as soon as we get a cold snap.

Trump WANTS them to die! Trump NEEDS them to die! Because Trump knows the Democrats care about poor people and sick people and Trump doesn't – and that gives him a huge negotiating advantage as he holds our citizens hostage in order to extort $5.7Bn as a downpayment on a $30Bn wall that he's already made sure rich people and corporations won't have to pay for. If this were the plot of a movie you would say the villain is unrealistically evil, right?

Trump WANTS them to die! Trump NEEDS them to die! Because Trump knows the Democrats care about poor people and sick people and Trump doesn't – and that gives him a huge negotiating advantage as he holds our citizens hostage in order to extort $5.7Bn as a downpayment on a $30Bn wall that he's already made sure rich people and corporations won't have to pay for. If this were the plot of a movie you would say the villain is unrealistically evil, right?

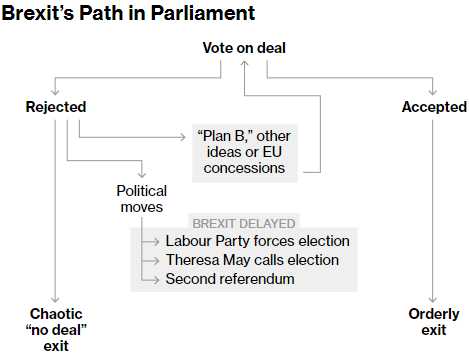

Meanwhile, the Trade War marches on and now China has derailed applications by Visa (V) and Mastercard (MA) to process Renminbi payments – effectively locking them out o fthe Chinese markets. Over in Europe, the Brexit vote is supposed to be decided tomorrow and it's widely expected that May's compromise with the EU will be rejected and, if she can't swing enough votes her way (she'll get 3 tries) – it's very possible she will be removed from office, which will set everything back just 11 weeks from the drop dead date, when the UK leaves the EU without a working agreement (ie – total chaos).

Labour leader Jeremy Corbyn indicated his party would stage a no-confidence vote in the Government within days of May’s deal being defeated in Parliament on Tuesday. If a confidence vote failed, he’d be under pressure to back a second Brexit referendum, which would open deep divisions in the Labour Party, many of whose supporters backed leaving the EU in 2016. Corbyn said he’d rather get a negotiated deal to avoid a no-deal Brexit, which would be “catastrophic” for industry and trade. “We will do everything we can to prevent a no-deal exit.”

Amazingly, the crux of the conflict within Britain is over something people in the US thought was resolved decades ago – Nothern Ireland! The main objection Parliamant has is to guarantees May has offered the EU to make sure a new physical border doesn’t emerge between Northern Ireland, which is part of the U.K., and the Republic of Ireland, which remains in the EU. Critics say the pledges — which constitute what’s known as the "backstop" — risk binding the U.K. to EU rules forever.

Amazingly, the crux of the conflict within Britain is over something people in the US thought was resolved decades ago – Nothern Ireland! The main objection Parliamant has is to guarantees May has offered the EU to make sure a new physical border doesn’t emerge between Northern Ireland, which is part of the U.K., and the Republic of Ireland, which remains in the EU. Critics say the pledges — which constitute what’s known as the "backstop" — risk binding the U.K. to EU rules forever.

They argue that May caved in to the EU and betrayed the electorate’s call to regain sovereignty, while treating Northern Ireland differently from the rest of the country. Though May survived a Conservative Party challenge to her leadership on Dec 12th, there’s still opposition on all sides: pro-Brexit hardliners in her party, other Conservatives who are pro-EU, the Northern Irish party that’s been propping up the government as well as the opposition from Corbyn's Labour Party.

EU leaders have repeatedly said that the withdrawal agreement cannot be changed. The EU may send a letter offering reassurances about the backstop ahead of the vote in the British Parliament, but neither side thinks this will be enough to swing the result. European officials are probably waiting to see the scale of the likely defeat on Tuesday before deciding how to respond. The next EU summit is scheduled for March 21-22, though an emergency meeting could be called earlier.

May hasn’t said what she will do if she loses tomorrow, but she would have to come back to Parliament by Jan 21st with a "Plan B." Her Cabinet is divided on what that should be. The opposition Labour Party has said it will try to trigger a general election, though it’s not clear it will have enough support to bring down the Government (yes, they get to do that in England!). May could put the deal back to Parliament again, with or without some tweaks. Or the Cabinet could decide to adopt a new approach to Brexit, in an attempt to win a majority. That would almost certainly mean trying to keep closer ties with the EU Bloc. Other scenarios: May could call an election, or lawmakers could try to trigger a re-run of the June 2016 Brexit referendum.

In other words, total chaos in Europe is very likely and investors are not generally fond of total chaos – especially when the US is also shut down and Asia is issuing report after report that indicate a slowing economy.

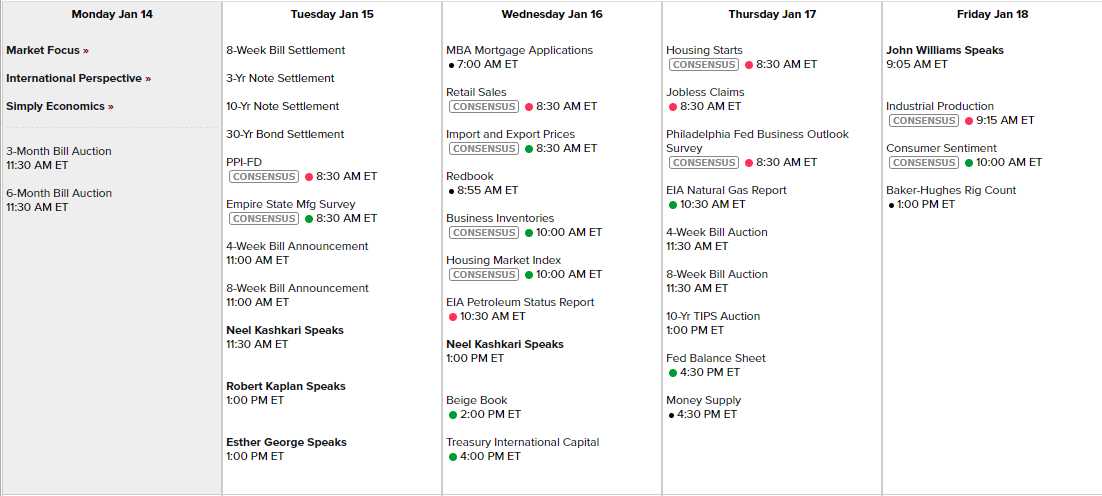

Meanwhile, our own economy may be slowing or it may not be slowing – there's no way to tell with all our Government data shut down but we have 4 Fed speakers this week and some of the data may come in – very hard to say. We also have the start of earnings season but Citigroup (C) already missed on revenues to get us off to a poor start this morning.

Needless to say, be careful out there!